How Trade Shifts Impact Port Real Estate

Delayed leasing decisions are complicating the outlook for investors, but at least one specialty facility will benefit.

Two days after threatening to impose a flat 50 percent tariff on imports from the European Union, President Donald Trump on Sunday announced he would postpone the tariff’s implementation until July 9—marking the latest twist in a trade policy saga whose effects have already begun to ripple through the supply chain.

The volatility introduced by tariff negotiations and rapid policy shifts in the past two months has weighed on industrial property markets in port areas, disrupting leasing patterns and complicating the outlook for investors.

The massive “Liberation Day” tariffs announced on April 2 tempered industrial demand nationwide as many tenants—especially those selling goods produced in China—delayed leasing decisions amid the uncertainty. For example, Prologis, the largest industrial REIT, reported a roughly 20 percent dip in leasing activity across its portfolio in the first two weeks of April.

But a week after unveiling the tariffs, Trump announced he was suspending most of the highest, “reciprocal” tariff rates for 90 days. And then on May 8, the trade war cooled further with a 90-day reduction of tariffs on Chinese imports from 145 percent to 30 percent following negotiations in Geneva.

Danny Reaume, who co-leads JLL’s Southern California national 3PL Practice Group, observed a “large uptick” in leasing inquiries from cross-border third-party logistics companies in the wake of the U.S.–China reprieve.

Those companies had essentially gone silent after the April 2 tariffs, he said. “It’s two-fold—they need the space now, but also believe the 90-day reduction is a strong signal both China and the U.S. will work through a mutually agreeable tariff solution long term,” Reaume noted to Commercial Property Executive.

The temporary trade truce has prompted companies to push inventory into the U.S. ahead of the three-month deadline, he added. In the near term, this could mean an earlier-than-usual peak season in advance of the holidays.

Property winners

One asset class that’s drawing strong interest in the trade turmoil is bonded warehouses, facilities where imported goods can be stored without immediate payments of tariffs, according to Andy Martin, co-founder & partner for Pacific IOS Ventures, which specializes in industrial outdoor storage facilities on the West Coast.

“We’re seeing an increase in demand from logistics tenants for bonded warehouses and outdoor storage, especially near West Coast ports,” he noted. “With the possibility that tariffs on Chinese imports can reach unprecedented heights, many tenants are choosing to ‘bond’ shipments, holding them in storage rather than releasing them into the supply chain.”

Tenants hope that releasing merchandise later can lead to major cost savings if tariffs come down in the future, but availability of bonded facilities is limited, Martin added.

READ ALSO: E-Commerce Drives Industrial Demand Growth

Reaume expects that demand for facilities within designed Foreign-Trade Zones will increase over the longer term. The heaviest users of FTZ facilities, such as automative, electronics and pharmaceuticals companies, will find these buildings more valuable if tariffs rise as they allow for better cash flow and inventory management for high-cost goods.

Sonnet Hui, vice president & managing director for Los Angeles at Project Management Advisors, flagged renewed focus on domestic manufacturing and increased interest in logistics infrastructure upgrades.

“Properties positioned to support these trends, whether through automation, regional distribution or last-mile logistics, stand to benefit,” she noted.

Divergent impact

Data from the Port of Los Angeles, the busiest U.S. port, reflects the whipsaw effect of trade policy fluctuations. The port handled 9.4 percent more container units in April than in the same month last year, an increase that the port’s Executive Director Gene Seroka attributed to importers pushing to bring in cargo ahead of tariffs.

However, he added that import volume was down more than 30 percent year-over-year in the first week of May, with 17 of the 80 or so sailings expected to arrive this month having been canceled. “The May volume drop is likely to be substantial when we close the books on this month, although it is really difficult to forecast right now,” he said at a news conference last week.

While the ultimate shape of the new trade regime is still being negotiated, significantly higher trade barriers are likely to remain. The series of delays and reversals following Liberation Day still leave the U.S. with an average effective tariff rate of 21.9 percent as of May 23, the highest rate since 1909, according to the Budget Lab at Yale.

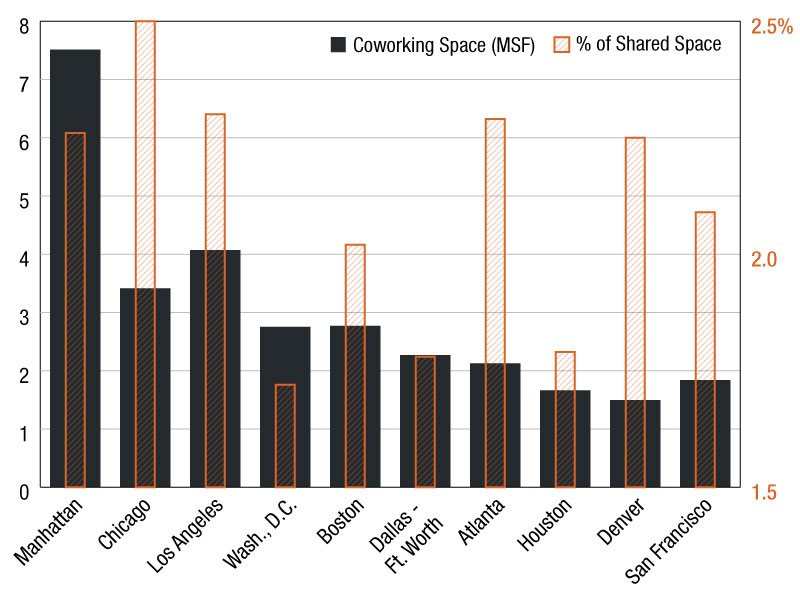

A tariff-driven reduction of international trade into and out of the U.S. would have an uneven impact on the country’s logistics property markets, since they vary widely in their exposure to global trade flows. The vast majority of imports and exports pass through just 10 markets, including the twin Ports of Los Angeles and Long Beach, Calif., through which a quarter of East Asian trade enters the U.S, according to CBRE.

The Greater New York trade hub, which includes the ports of New York and New Jersey, handles 17 percent of European imports. About a third of Mexican imports enter through the border crossing at Laredo, Texas, while Detroit is the main gateway for Canadian imports.

An important nuance is that Canadian and Mexican goods that are compliant with the U.S.-Mexico-Canada Agreement remain tariff-free, which amounts to an estimated 49 percent and 38 percent of imports by value from Mexico and Canada, respectively, according to the Budget Lab.

Most of the country’s logistics activity is sheltered from trade shocks, with roughly 75 percent of logistics real estate demand tied to regional distribution and local consumption rather than trade, according to a report last month by Prologis.

READ ALSO: CapRock Partners on Western Industrial Trends

“What we had anticipated in the industrial market is a soft 2025 where vacancies will be a little bit elevated” in a scenario without the Liberation Day tariffs, said Shubhra Jha, principal & head of investment strategy and research for Standard Real Estate, a real estate private equity firm.

“This would be a year of transition, where demand sort of starts to catch up with supply,” said Jha, before more solid fundamentals take hold in terms of rent growth and vacancy rates in 2026. “I think it still is our base-case scenario, except that maybe the trough gets a little bit deeper—but we expect the rebound in 2026 to be a lot stronger in that case.”

Jha pointed out that the country’s overhang of vacant big-box industrial space will take some time to work through, but leasing demand for smaller spaces has been “pretty active.”

Leasing demand remains healthy, although a short-term pause in rent growth is possible as tenants absorb higher costs and face uncertainty, according to Brian Malliet, founder, CEO & CIO of BKM Capital Partners, which acquires small- and mid-bay light industrial business parks.

“The long-term outlook for light industrial remains strong, supported by durable secular drivers such as e-commerce growth, supply chain decentralization and increased U.S. manufacturing investment.”

You must be logged in to post a comment.