Higher-Value Assets Outperform Others in Same Country

Using MSCI global real estate dataset, we find evidence that higher-value assets have been more likely to outperform other assets in the same country and sector than lower-priced assets.

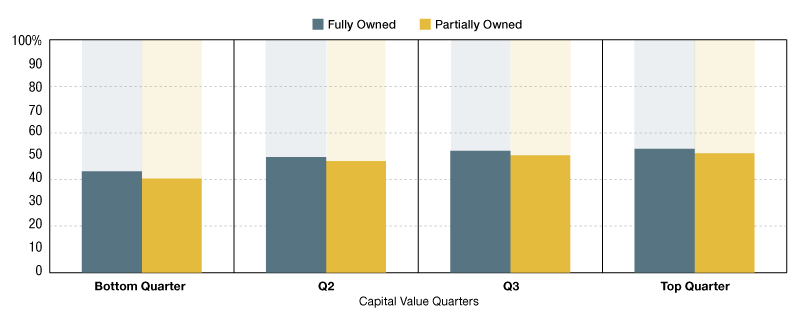

probability of outperforming other assets in same country and sector; 2001-2016

Some real estate investors assume that higher-value (big ticket) real estate assets outperform lower-value assets, partly because there are fewer of them and they are harder to buy. But is this just speculation? Using MSCI global real estate dataset, we find evidence that higher-value assets have been more likely to outperform other assets in the same country and sector than lower-priced assets.

But has there been a systematic difference in performance across capital value bands at a global level? To answer this question, we used 487,152 annual return observations from 87,723 assets across 24 national markets over a 16-year period in the retail, office and industrial sectors. The analysis controls for difference in location and property type by comparing assets only within in the same country and sector.

The exhibit shows that higher-value assets have historically had a higher chance than lower-value assets of outperforming other assets in the same country and sector. For instance, a fully owned asset in the top capital value quarter for its sector and country had a 53.2 percent chance of outperforming its country and sector peers overall, compared with 43.5 percent for a fully owned asset in the bottom quarter.

In addition, part ownership slightly reduced the chances of outperformance, though this effect appeared to be relatively small compared with the impact of asset size. To illustrate, a part-owned asset in the top capital value quarter still had a higher chance of outperforming than a fully owned asset in the first or second quarters.

You must be logged in to post a comment.