Heavy Supply Continues to Compress Self Storage Rents

Although metros on the West maintained rent growth, on a national level, street-rate rents have dropped 4.8 percent over the past 12 months.

By Evelyn Jozsa

New deliveries continued to put pressure on self-storage rents in September. On a year-over-year basis, street-rate rents have fallen by 4.8 percent for 10×10 non-climate-controlled and 3.5 percent for 10×10 climate-controlled units. Due to great demand and limited development options, metros on the West, such as Las Vegas (6.3 percent) and the Inland Empire (1.9 percent) continued to have the highest year-over-year rent growth.

High levels of existing inventory and heavy new supply are still hindering growth in Texas, rents in Austin and Dallas were down 6.5 and 6.6 percent, where existing inventory per capita is about 50 percent greater than the national average of 6 square feet. As of September, the highest asking rents for the average 10×10 non-climate-controlled unit were recorded in San Francisco ($194), Los Angeles ($183) and San Jose ($186).

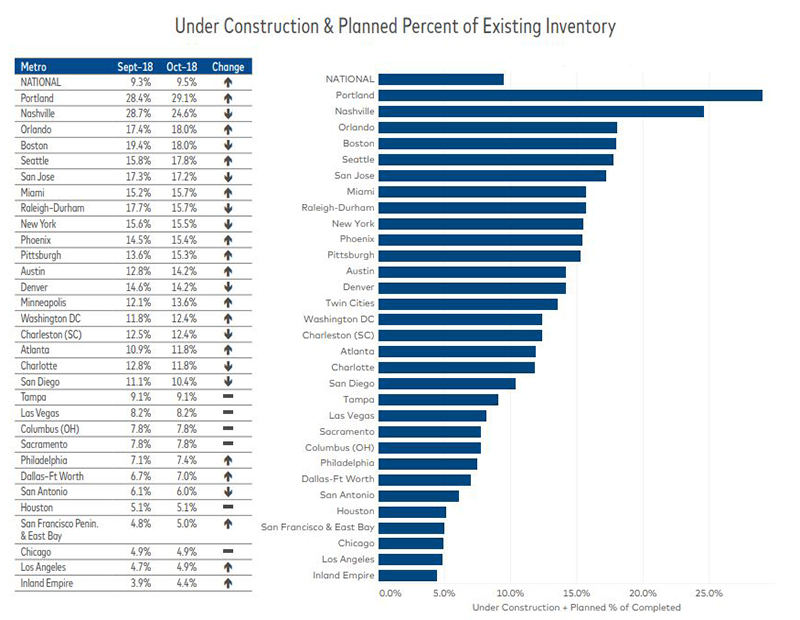

Nationwide, units under construction and in the planning stages account for 9.5 percent, which shows a 20-basis-point increase over the previous month. New construction was still heaviest in markets targeted by Millennials. Portland and Nashville were at the top, as planned and under construction projects represented 29.1 and 24.6 percent of existing inventory. The new supply pipeline has remained limited in retiree destinations like Tampa and Las Vegas. Nevertheless, states such as Nevada, Florida, Texas and Washington, remain among the most targeted destinations due to the 2017 tax law changes.

You must be logged in to post a comment.