Healthcare REITs: Rapid Growth with Reasonable Leverage & Ample Liquidity

By Lori Marks, Associate Vice President & Analyst, Moody's Investors Service: Moody’s outlook for healthcare REITs remains stable, reflecting the companies’ sound financial profiles, which leave them well-prepared to weather potential challenges such as falling reimbursement rates and rising interest rates.

By Lori Marks, Associate Vice President & Analyst, Moody’s Investors Service

Moody’s outlook for healthcare REITs remains stable, reflecting the companies’ sound financial profiles, which leave them well-prepared to weather potential challenges such as falling reimbursement rates and rising interest rates.

Moody’s outlook for healthcare REITs remains stable, reflecting the companies’ sound financial profiles, which leave them well-prepared to weather potential challenges such as falling reimbursement rates and rising interest rates.

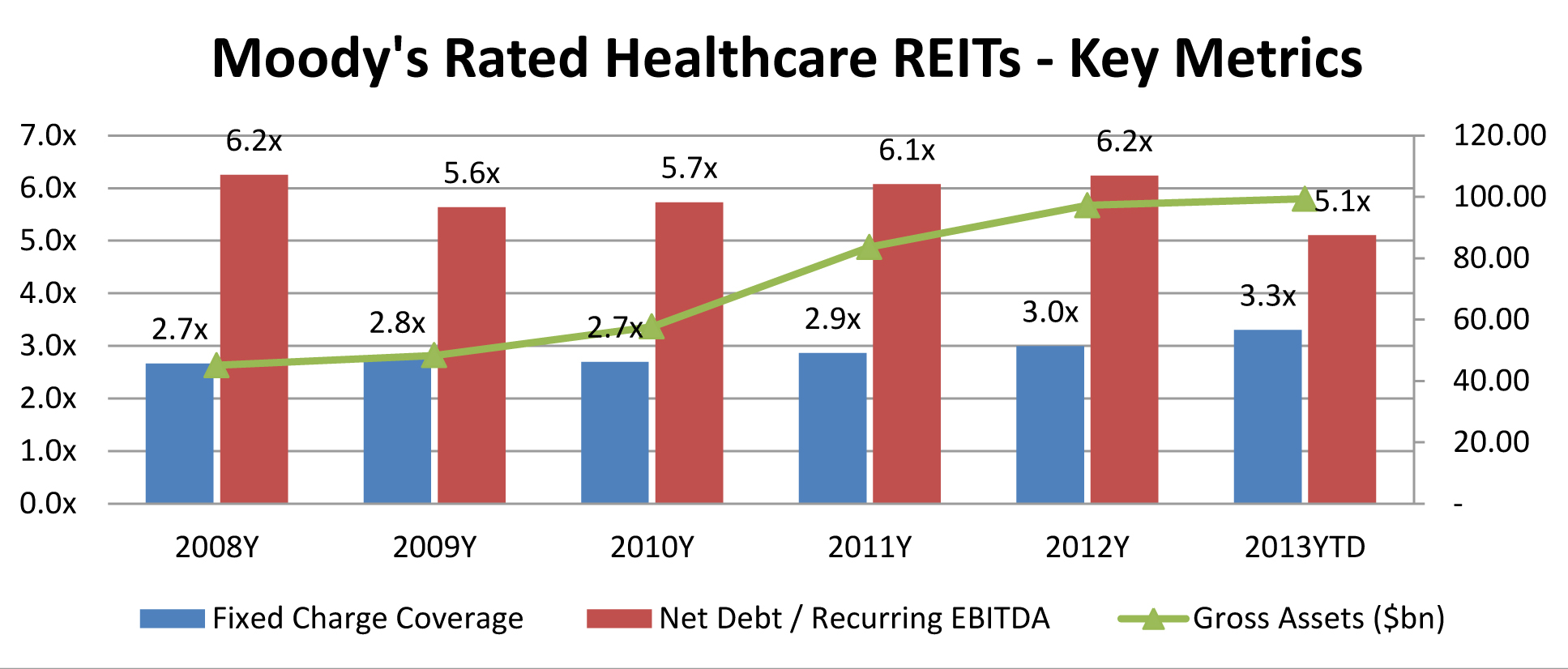

Thanks to their aggressive acquisition strategies, the healthcare REITs have grown substantially over the past few years. But they have funded their growth with a mix of common equity and long-term debt, which has enabled them to maintain reasonable leverage profiles and ample liquidity. The REITs have also strengthened their fixed charge coverage ratios by refinancing debt at historically low interest rates.

Source: SNL Financial; Company reports. Data represents aggregate for Alexandria Real Estate Equities, Inc., BioMed Realty Trust, Inc.; HCP, Inc.; Ventas Inc.; Health Care REIT, Inc., Healthcare Trust of America, Inc., Healthcare Realty Trust, Senior Housing Properties Trust, Medical Properties Trust, Inc., Omega Healthcare Investors, Inc., Aviv Healthcare Properties, Sabra Health Care REIT, Inc.

The healthcare REITs’ rapid, acquisition-fueled growth comes with execution and integration risks, but these companies have so far demonstrated an ability to effectively absorb assets into their growing platforms. Their increased size and diversification also reduces risk by decreasing the REITs’ exposure to any one type of tenant, geography, property sub-type or payor source. Their improved scale also lowers their capital costs.

The healthcare REITs have maintained reasonable leverage during this growth spurt considering their individual rating categories and portfolio profiles. Leverage, as measured by net debt/EBITDA, fluctuates considerably for these REITs, typically peaking after they close new investments and trending downward as the associated cash flow benefits are fully realized. But we have seen more consistency lately, with most REITs publicly committing to operate within a certain leverage range and adhering to these targets by issuing a predictable mix of common equity and debt as they continue to make acquisitions.

Notably, healthcare REITs with ratings below investment grade have maintained leverage as low as, or in certain instances lower than, their peers with investment grade ratings. The ratings of the below investment grade firms are constrained by their high exposure to asset classes that are dependent on government reimbursements, including skilled nursing, post-acute care, and hospitals. The lower leverage helps these REITs mitigate their reimbursement risk.

We have also seen a rise in the REIT’s fixed charge coverage ratios, as their increased size and diversification has lowered their capital costs, as has the low interest rate environment. The REITs have used their lower debt costs to help fund continued accretive growth and to refinance debt maturities at historically low rates, both of which have boosted fixed charge coverage ratios. Higher fixed charge coverage metrics will help to insulate the REITs’ cash flows from future headwinds that may arise, such as reimbursement cuts or rising interest rates.

You must be logged in to post a comment.