Global Real Estate Returns at a High as Industrial Stormed Ahead

Global real estate recorded its highest annual return since 2008, according to the MSCI Global Quarterly Property Index.

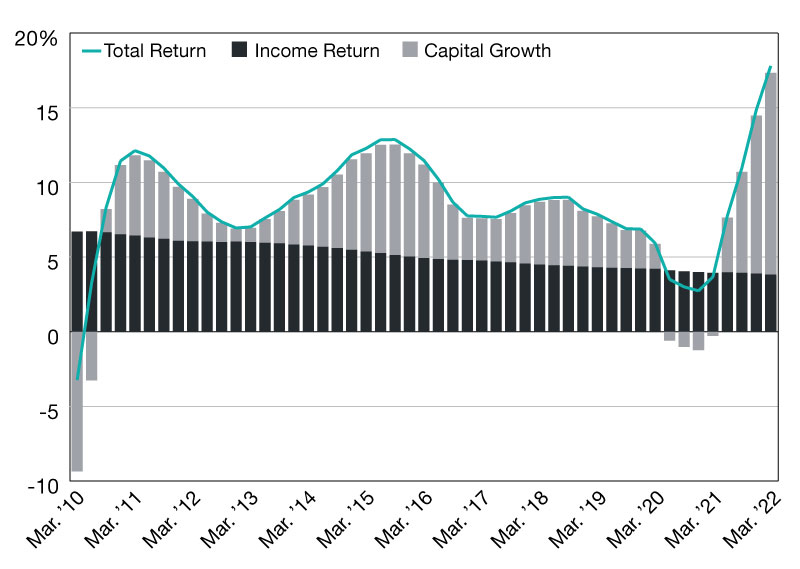

Total Return per Quarter; All Property

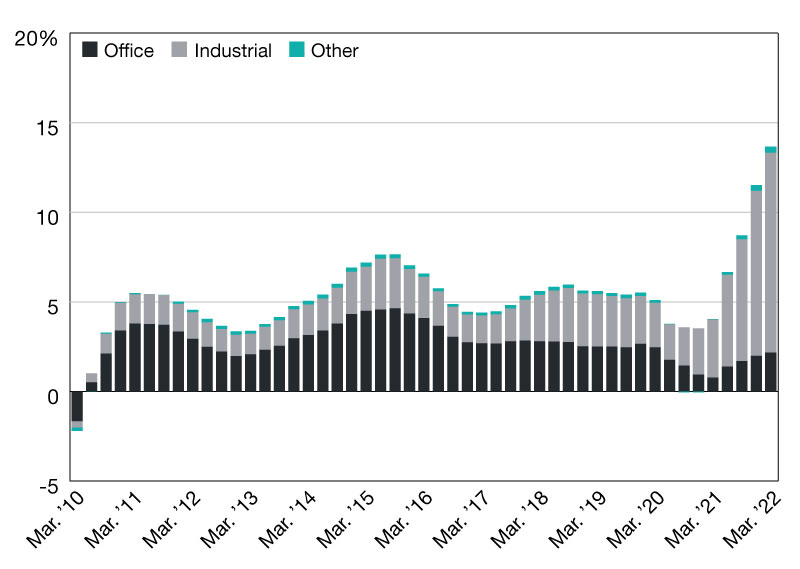

Sector Weighted Contribution to Annual Index Return

Global real estate recorded its highest annual return since 2008, during the first quarter of 2022.

This was according to the MSCI Global Quarterly Property Index where a quarterly total return of 4.4 percent boosted its annual return to 17.8 percent. This newly launched index tracked the performance of more than 20,000 properties from 391 quarterly-valued portfolios at the end of the first quarter.

The industrial property sector continued its stellar performance and an annual return of 35.4 percent contributed 11.2 percent of the index’s 17.8 percent aggregate return.

Residential property followed with a weighted contribution of 3.7 percent as a result of its annual return of 18.1 percent, its best 12-month performance since 2011.

The retail and office sectors contributed a combined 3.4 percent as their annual returns remained rooted in the high single digits. Such is the current spread in performance that the 25th percentile of Industrial return at 23.8 percent outstripped the 75th percentile of return for both retail (18.0 percent) and office (10.7 percent).

MSCI is a leading provider of critical decision support tools and services for the global investment community. With over 45 years of expertise in research, data and technology, we power better investment decisions by enabling clients to understand and analyze key drivers of risk and return and confidently build more effective portfolios. We create industry-leading research-enhanced solutions that clients use to gain insight into and improve transparency across the investment process.

You must be logged in to post a comment.