Global Property Fund Returns Buoyed by Strong Industrial Performance

North America was the top performing region with a quarterly net return of 6.5 percent, according to MSCI's latest index.

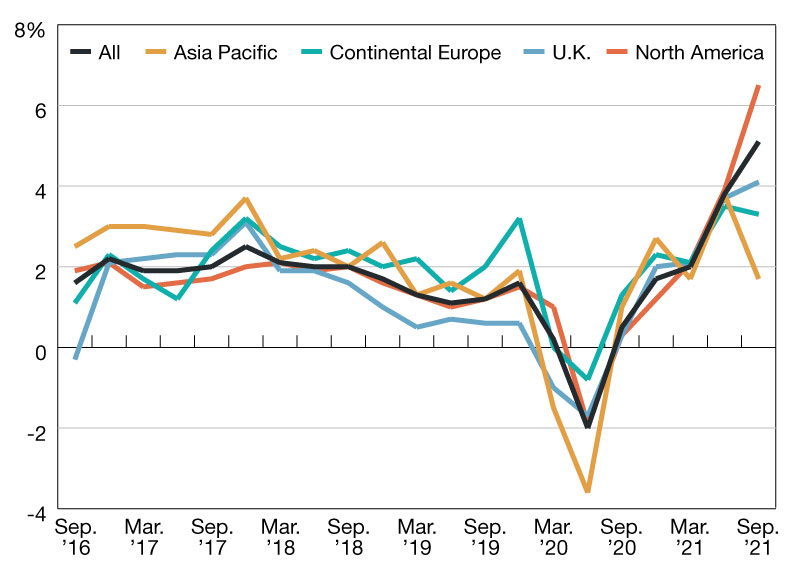

Quarterly Fund Return by Domicile

Global real estate funds recorded a net vehicle-level total return of 5.1 percent for the three months to the end of September 2021. The asset level total return for the same period was 4.6 percent, according to the MSCI Global Quarterly Property Fund Index which tracked the investment performance of 108 open-end real estate funds with a total gross asset value of $599 billion at Q3 2021.

North America was the top performing region with a quarterly net return of 6.5 percent and was the main driver of the index performance by virtue of its 64.4 percent capital value weight. At the same time, Asia Pacific domiciled property funds recorded a net return of 1.7 percent, which made it the lowest performing of the major regions. For the last several years, regional fund returns have been closely correlated but there was significant divergence across the different regions in the third quarter which is typical of market turning points.

Globally, industrial property remained the top performing real estate sector as a quarterly total return of 8.8 percent in Q3 marked the sector’s highest quarterly return since the inception of the MSCI Global Quarterly Property Funds Index and as a result opened a record high annual return spread of 23.5 percent over the retail sector.

By contrast, industrial assets held by APAC-based funds saw a correction in the third quarter as its quarterly total return dipped from 7.3 percent to 2.4 percent. As a result, the outperformance of industrial over retail for APAC funds have simmered since mid-2020 when its spread was higher than the global figure.

MSCI is a leading provider of critical decision support tools and services for the global investment community. With over 45 years of expertise in research, data and technology, we power better investment decisions by enabling clients to understand and analyze key drivers of risk and return and confidently build more effective portfolios. We create industry-leading research-enhanced solutions that clients use to gain insight into and improve transparency across the investment process.

You must be logged in to post a comment.