Global Infrastructure Returns Rebound as Contracted Assets Provided Underpin

At the end of March, the MSCI index’s total comprised an income return of 4.9 percent.

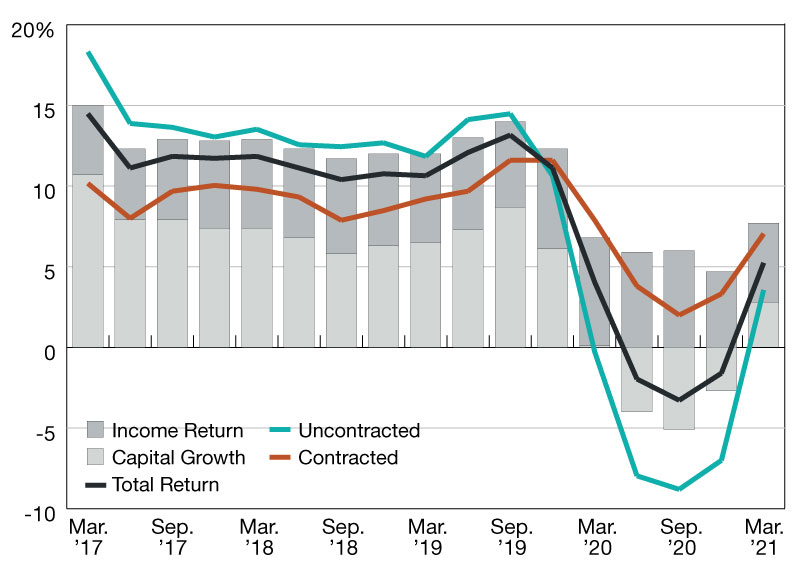

Annual Total Return by Asset Type

The MSCI Global Quarterly Private Infrastructure Index returned 7.7 percent for the 12 months ended Mar. 31—the index’s highest annual return since December 2019 and a continuation of the recovery that took place since returns bottomed at 0.6 percent at the end of September.

While capital growth did dip into negative territory during 2020, a relatively stable income return ensured the index’s total return remained positive throughout. At the end of March, the index’s total return comprised an income return of 4.9 percent and a capital growth of 2.8 percent.

Contracted assets—those bound by regulation or subject to long-term contracts—outperformed uncontracted assets since the onset of the COVID-19 pandemic. For the year through March, contracted infrastructure assets returned 9.2 percent compared to 6.3 percent for uncontracted assets.

Since 2008, an increasing percentage of the index’s weight has been allocated to lower risk, contracted assets. As a percentage of enterprise value, the index’s weight in contracted assets has grown from 30.6 percent at 2008Q1 to 56.1 percent at 2021Q1.

MSCI is a leading provider of critical decision support tools and services for the global investment community. With over 45 years of expertise in research, data and technology, we power better investment decisions by enabling clients to understand and analyze key drivers of risk and return and confidently build more effective portfolios. We create industry-leading research-enhanced solutions that clients use to gain insight into and improve transparency across the investment process.

You must be logged in to post a comment.