Global Business Districts Rankings Shift

Western markets continue to lead in desirability, but Asian cities are narrowing the gap, according to a new report from EY and the Urban Land Institute.

A period of just three years has brought a notable change among global business districts, as noted in EY and the Urban Land Institute’s newly released 2020 Attractiveness of Global Business Districts Report. A comparison between the new study and the 2017 version reveals that while cities in the West remain at the forefront, Asian business districts are beginning to close the gap and the ability to attract talent has become even more significant.

READ ALSO: COVID-19 Creates CRE Opportunities for Latam Investors

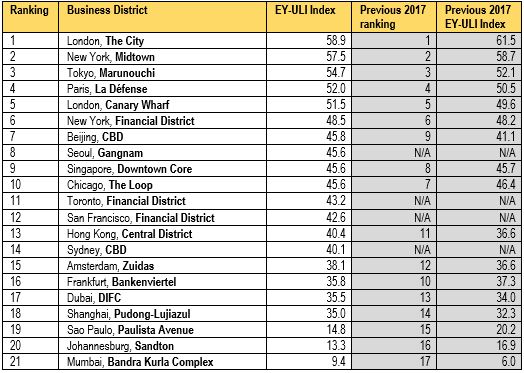

The Attractiveness report, commissioned by the Global Business Districts Innovation Club, assesses 21 GBDs and is based on a survey of 349 real estate professionals, public officials, academics and users around the world, as well as 22 interviews with global experts from the various business districts. In the three years since the last report, the leading GBDs on the EY-ULI Index have not changed; the City of London, Midtown in New York, Tokyo’s Marunouchi district, Paris’ La Défense and London’s Canary Wharf continue to hold the top five positions.

London, still buoyed by its status as a hub for corporate headquarters in Europe, scored 58.9 on the index and Canary Wharf came in at 51.5. “London features twice in the top five GBD ranking despite political concerns, particularly relating to Brexit,” Lisette van Doorn, CEO of ULI Europe, told Commercial Property Executive. “This is mainly due to the high concentration of service, financial and university activities but there have also been improvements to the urban environment, particularly around Canary Wharf.”

Midtown Manhattan, 57.5 on the Index, continues to benefit from a substantial density of Fortune Global 500 companies’ headquarters and a highly skilled labor pool. Marunouchi, also home to a bevy of Fortune Global 500 companies and highly skilled talent, scored 54.7. La Défense, which rose to 52 on the Index, held its position in the fourth spot with the assistance of its highly skilled population, high concentration of international headquarters and density of the regional transport infrastructure.

Competition brewing

While the top five spots on the Index remain unchanged from 2017, such may very well not be the case in the next EY-ULI Attractiveness survey. “One of the most remarkable outcomes of the report relates to the competition between business districts, which has significantly intensified with the range of the EY-ULI Index scores narrowing between the 21 GBDs since 2017,” van Doorn said. “The largest increases in the EY-ULI Index between 2017 and 2020 were by Asian business districts, with Beijing’s Central Business District leading the charge.”

Beijing rose from ninth place on the Index to seventh, with its score jumping from 41.1 to 45.8 due to its growing stock of office space, which now stands at roughly 46.3 million square feet and hosts eight Fortune Global 500 company headquarters, as well as its 9.1 million square feet of retail offerings. Tokyo’s Marunouchi GBD saw its score grow from 52.1 to 54.7 over the last three years.

The laws of attraction

The EY-ULI Index’s rankings are based on 46 indicators boiled down to five criteria: Ability to attract and retain talent; proximity to markets, customers and partners; quality of the urban environment; local and global influence; and adapted and innovative real estate supply. However, it’s the topic of talent that took center stage in the 2020 rankings, growing substantially in importance as a key to attractiveness. Success in reeling in and retaining talent, according to the report, centers on quality of life, health and well-being and the availability of a live/work/play environment.

The issue of the urban environment in the pursuit of tenants and talent also increased in importance from 2017. “We saw that global awareness of environmental issues has grown drastically amongst those surveyed and interviewed and the call for action on environmental stewardship is growing stronger,” noted van Doorn.

EY and ULI, conducted the survey before COVID-19 spread across the globe. However, looking ahead, the report serves as a roadmap of sorts for the best way for GBDs to move forward. As van Doorn concluded, “The challenge in the future will be how global business districts emerge out of lockdown due to the COVID-19 crisis and how business districts will adjust to a ‘new normal’ combining health, safety and well-being with a concentration of talent and global leading businesses.”

You must be logged in to post a comment.