Future Footprints: Spotlight on Space Needs

In the office sector, reduced footprints seem to be the new normal. Occupants aim for an environment that promotes collaboration, efficiency and cost savings. While there is a good deal of truth to that generalization, recent research suggests that occupants are taking a nuanced view of these evolving trends.

In the office sector, reduced footprints seem to be the new normal. Occupants aim for an environment that promotes collaboration, efficiency and cost savings. While there is a good deal of truth to that generalization, recent research suggests that occupants are taking a nuanced view of these evolving trends.

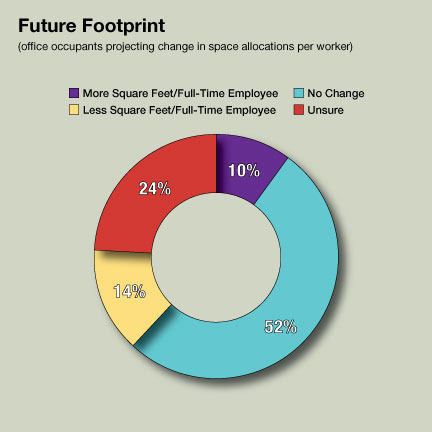

In a survey of 1,261 office users conducted in March and April by BOMA International and Kingsley Associates, a majority of respondents–52 percent–said that they do not anticipate any change in the space allocated to employees in the next year (see chart below). Only 14 percent expect to reduce space allocations, while 10 percent plan to increase the amount of space per employee. Nearly a quarter told researchers that they are unsure of their plans. The United States accounted for 85 percent of respondents in the study; Canada, New Zealand and South Africa made up the remainder.

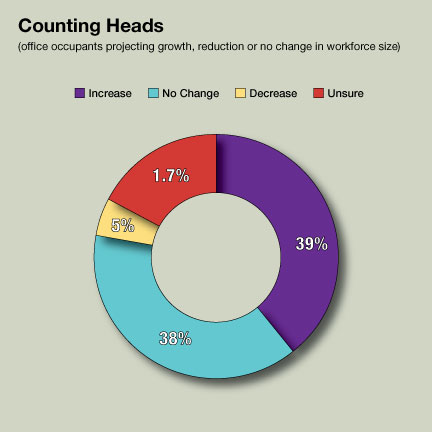

On the related topic of headcount, the BOMA International/Kingsley survey found that a large majority of office users–77 percent–either expect to increase their number of employees or maintain the same headcount in the next year. As the chart below shows, only 8 percent plan to shrink their workforce. Planned expansions, predicted by 39 percent of tenants, indicate an upbeat outlook for their business and for the economy at large. The results also suggest that those growing companies will have to decide whether to backfill unused space, accommodate new hires by making more efficient use of the current location or move to a larger space.

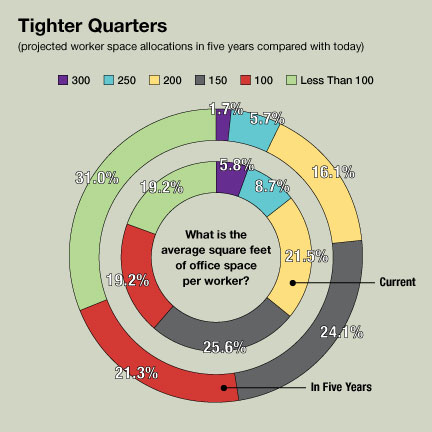

Occupant strategies are also influenced by the footprint assigned to each worker. A recent survey of corporate users by CoreNet Global confirms the trend toward reduced space allocations. Over the next five years, the number of participants allocating less than 100 square feet per worker will rise from 19 percent to 31 percent. Meanwhile, large-scale space allocations are on the wane. Today, 8.7 percent of respondents provide about 250 square feet per employee on average; by 2018, only 5.7 percent will.

An even sharper cutback is in store at firms that provide around 300 square feet for each worker. During the next five years, that group will shrink from 5.8 percent to just 1.7 percent. At the same time, the findings suggest an intriguing nuance to the trends of shrinking footprints. About one-quarter of firms told CoreNet Global that they provide 150 square feet per employee. According to CoreNet Global, that percentage will be nearly the same five years from now.

For more on this topic, read “What Tenants Want” in the September issue of CPE.

You must be logged in to post a comment.