GSEs Increase Multifamily Loan Volume, Expand Initiatives

Why multifamily executives expect a strong finish for loan originations this year and continued demand beyond.

By Mallory Bulman

Multifamily executives expect a strong finish for loan originations this year and continued demand beyond, even if the pace of the sector’s growth moderates somewhat in 2017. That  scenario depends on plenty of capital to facilitate acquisition, development and refinancing.

scenario depends on plenty of capital to facilitate acquisition, development and refinancing.

During the first half of 2016, multifamily finance registered a perceptible shift. The government-sponsored enterprises’ share of multifamily finance slipped from 52 percent last year to 44 percent, according to Real Capital Analytics Inc. Meanwhile, regional and local banks boosted their share from 14 percent to 19 percent as national banks were growing their portion from 10 percent to 15 percent.

Whether this reflects a temporary dip or a long-term trend, multifamily stakeholders are counting on Fannie Mae and Freddie Mac to meet a diverse demand for transactions. “The markets have remained healthy,” said Steven Farnsworth, managing director of Walker & Dunlop’s origination team in New Orleans. “Obviously, there’s a lot going on in the global markets, with the election and things that are out of our control at this point, but based on the flow of deals in the marketplace, we feel that availability of capital looks good.”

As the market has expanded, the Federal Housing Finance Agency, the GSEs’ regulator, has been receptive to raising volume caps. In August, the FHFA increased each agency’s loan purchase limit from $35 billion to $36.5 billion. The FHFA cited a larger-than-expected volume of acquisitions, strong delivery of new multifamily inventory and the demand for refinancing. The regulator also reiterated its intention to review the cap quarterly and adjust it as needed.

GSE officials expect that the multifamily market’s strong performance will enable them to carry over this year’s high production volume into 2017.

“What I do expect to continue to expand is the refi preservation business.”

—David Leopold, Freddie Mac

“Our regulator has yet to release our scorecard and our volume cap for next year, but they are looking very closely at what those projections are, and I anticipate that they’ll make sure we have enough liquidity to provide and to see similar production levels in 2017 to what we saw this year,” said Hilary Provinse, senior vice president of customer engagement for Fannie Mae’s multifamily leadership team.

The GSEs have backed many of the biggest multifamily deals this year, such Strata Equity Group’s $720 million acquisition of a four-state, 24-property portfolio in October. Freddie Mac provided about $500 million worth of seven- and 10-year fixed- and floating-rate loans. CBRE Capital Markets’ debt and structured finance team, arranged the financing through the Freddie Mac Revolving Credit Facility.

Fannie Mae figured prominently in what may emerge as the year’s largest student housing transaction: the acquisition of a 14-asset, nationwide portfolio by an institutional joint venture comprising the Scion Group; GIC, Singapore’s sovereign wealth fund; and the Canada Pension Plan Investment Board.

“The biggest challenge in the transaction was the size of the portfolio,” Brendan Coleman, a Walker & Dunlop managing director who worked on the deal, told Multi-Housing News in July. “Assets were all over the country, some hadn’t come out of the ground yet and some were just finishing construction.”

To make the deal click, Walker & Dunlop arranged $672 million in financing through a Fannie Mae credit facility, which offers a combination of scale and flexibility. Designed for portfolios with cross-collateralized, cross-defaulted assets, the credit facility provides a minimum of $55 million, offers both fixed-rate and floating-rate terms, and is available for both stabilized properties and under-construction communities.

Meanwhile, Fannie Mae and Freddie Mac’s multifamily teams continue to roll out fresh initiatives and strengthen existing programs. “The GSEs do seem to be hedging their bets across all sectors, focusing on financing for green properties, affordable and tax-exempt loans, and small-balance lending,” said Farnsworth.

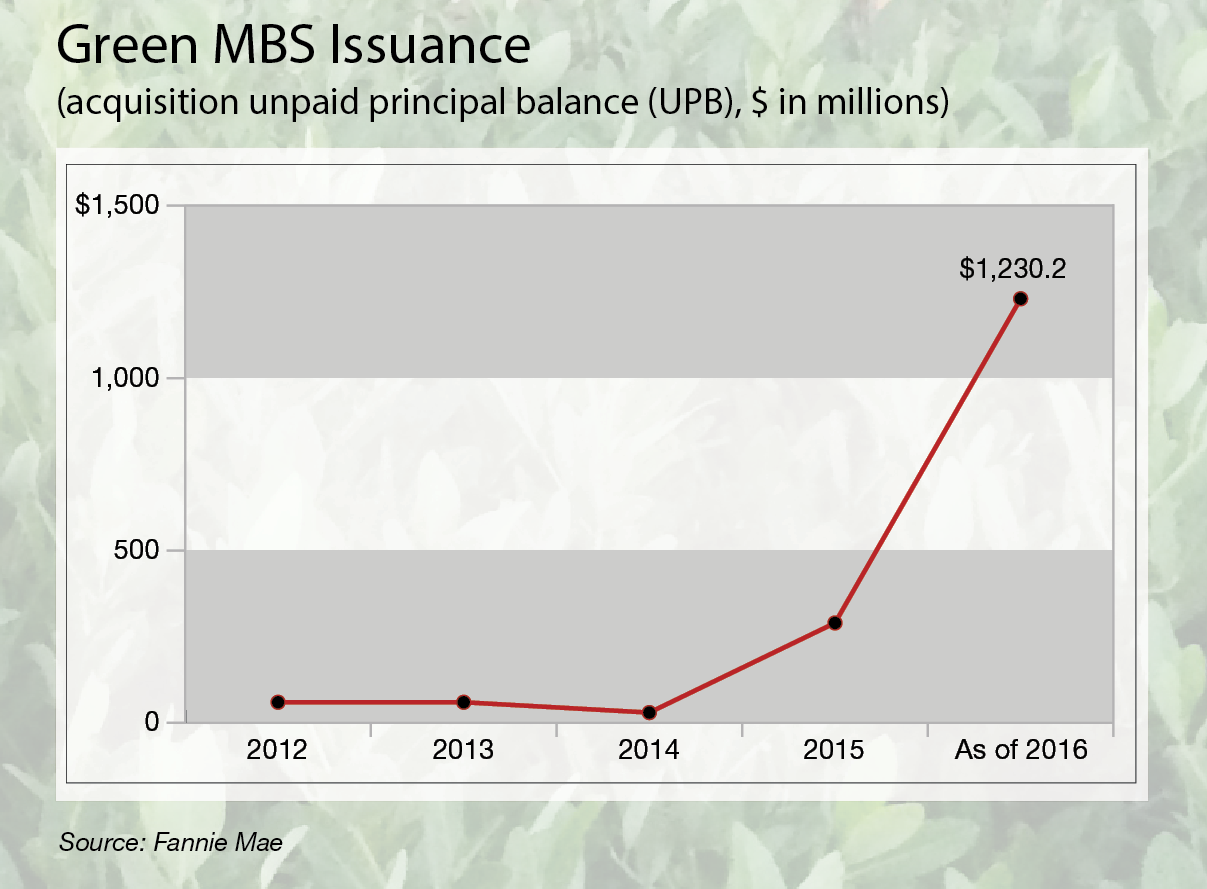

GSEs Go for Green

On the sustainability front, Freddie Mac’s Green Advantage and Fannie Mae’s Green Rewards offer multiple options to improve properties and achieve financing goals. A plus of the green programs is that a qualified property is exempt from the caps established by the FHFA. Farnsworth called that provision “a win-win for both operators and lenders.”

On the sustainability front, Freddie Mac’s Green Advantage and Fannie Mae’s Green Rewards offer multiple options to improve properties and achieve financing goals. A plus of the green programs is that a qualified property is exempt from the caps established by the FHFA. Farnsworth called that provision “a win-win for both operators and lenders.”

“The actual financing product really started to take off this year, and we’ve subsequently made exciting enhancements to it,” said Provinse.

To qualify for favorable interest rates and larger principal amounts from Freddie Mac’s Green Up program, properties must be able to reduce energy or water usage 15 percent. The loan targets older value-add properties that can benefit significantly from upgrades.

“We’re not targeting a property that was just built 10 years ago,” Cannon explained, “because you’re probably not going to get a lot of opportunity to spend money on the property and see the dramatic decreases in utility expenses.”

To qualify for green loans, prospective borrowers must submit the properties for an analysis that outlines options for energy or water savings. Freddie Mac subsidizes the cost of the analysis as high as $3,500 and Fannie Mae reimburses it entirely. Cannon maintains that the program has been well received.

“Based on the flow of deals in the marketplace, we feel that availability of capital looks good.”

—Steven Farnsworth, Walker & Dunlop

“We are not saying that (borrowers) have to do it,” Cannon explained. “It is something that if they sign a loan application with us, we will pay for the energy study and present the findings to the borrower. If they do want to do it, we’ll give them a lower interest rate.”

“Now that the market is understanding not only does it save me money on my property but you’re going to get a lower interest rate…there (are) lots of incremental changes and upgrades you can make to really drive that efficiency. We have seen a ton of interest; our pipeline is very large, and we anticipate that going into next year we’ll get a lot of momentum there, as well,” Provinse added.

ROAR for Affordability

The GSEs are also responding to the rising demand for affordable housing. Freddie Mac’s volume in the sector has roughly doubled in just the past two years, noted David Leopold, the GSE’s vice president of affordable production. “We’ve been focused on investments in the platform to drive improved execution and quicker turn times and a broader product.”

Fannie Mae has rolled out the Reduced Occupancy Affordable Rehab (ROAR) prod uct, which Provinse sums up as a construction loan to renovate an affordable property and a bridge to permanent debt.

“We feel generally really positive about what’s on the horizon for us next year and our ability to provide financing.”

—Hilary Provinse, Fannie Mae

For renovations of affordable properties, ROAR offers a flexible permanent loan as high as $120,000 per unit. The goal is to increase efficiency by eliminating the need for a construction loan or forward commitment. For acquisition and refinancing of value-add properties, Fannie Mae’s ROAR aims to make needed upgrades while keeping assets affordable.

Even as demand to bolster affordable housing stock looms, existing inventory is no less important. “What I do expect to continue to expand is the refi preservation business,” said Leopold. “That’s primarily driven by values and low interest rates. If you can refi in today’s interest rate, who wouldn’t want to? You’re seeing more trades and more (refinances), and I think that’s going to continue, certainly into 2017.”

Along those lines, Freddie Mac’s Capital Markets Execution program provided $255.9 million toward one of the largest affordable housing transactions of the year: Starwood Property Trust’s $563.5 million acquisition in June of an 8,498-unit Low Income Housing Tax Credit (LIHTC) portfolio in Florida.

The portfolio consists mainly of properties in Tampa and Orlando that were developed between 1995 and 2004. Arranged by HFF, the Freddie Mac financing covered 19 of the 31 communities that comprised the sale. HFF is servicing the loans through its Freddie Mac Program Plus Seller/Servicer program.

Gregg Shapiro, a managing director on HFF’s debt placement team, commented at the time that the Freddie Mac financing allowed Starwood to “not only achieve their targeted returns on investment but also to continue to invest in these communities and ensure that they provide high-quality afford-able housing long term.”

Thinking Small

“You’re not going to see the big institutions in the small-balance loan space.”

—John Cannon, Freddie Mac

While lenders have focused much of their attention on the demand in urban centers, another factor influencing GSE strategy is the migration of some apartment residents to less expensive suburbs. That trend is generating stepped-up interest in smaller communities, many of which are owned by smaller, modestly capitalized sponsors.

“We’re seeing more institutional ownership in multifamily real estate, but that’s certainly not the case in small-balance loans,” explained John Cannon, senior vice president of production & sales at Freddie Mac Multifamily. “It’s still smaller borrowers, proprietary partnerships. You’re not going to see the big institutions in the small-balance loan space.”

Freddie Mac started offering small-balance loans about two years ago, and by the end of 2016, it will have funded upward of 2,000 loans valued at $3 billion, Cannon estimates. “I think there was a need for a program that provides consistent liquidity to that space across the country,” he added. “In some markets, liquidity has not been as strong as it perhaps should have been.”

As a case in point, Hunt Mortgage Group closed in May on a $31.6 million multifamily portfolio deal, placing Freddie Mac Small Balance loans on 19 properties in metro Los Angeles. The facilities range in size from eight to 47 units, and loans vary from $750,000 to $4.1 million.

The complex transaction has one main sponsor but multiple ownership entities and partners. The borrowers required non-recourse financing, with an interest-only option and highly competitive rates. The rate was negotiated and priced below offerings from local and national lending institutions. All loans were non-recourse, with one-year of interest- only payments.

Demand for small-balance loans has been robust on the Fannie Mae side, as well, and the agency has implemented improvements in delegation and pricing that it says have spurred interest in the product. Provinse cited the flexibility of Fannie Mae’s step-down prepayment structure as another enticement. “We’re seeing our lenders’ pipelines shift to a much more even Fannie/Freddie mix of that small-balance business this year,” she reported.

Improvements to delegation enable lenders to underwrite and close loans without pre-approval, speeding up the process and enhancing the borrower’s confidence that the loan will be executed as planned.

As demand for small loans has ramped up, GSE executives say that the agencies have made a push to double down on efficiency and customer service. “The most important thing to us around small loans is really making sure that process goes as quickly as possible, making it easy for borrowers to work with our lenders to get that deal done,” Provinse explained.

While the peak of the multifamily market may still be ahead, GSE executives suggest that the pace of expansion is likely to slow in the not-too-distant future. “There will definitely be a leveling of the growth, but I do not think we’re going to see any decline,” said Leopold. “I think the market’s going to remain strong.”

Provinse also thinks growth is likely to moderate, likewise tempering the outlook by offering some context. As new projects reach completion and expand inventory, vacancy may tick up, but is unlikely to edge past 5.5 percent nationwide, she pointed out. That spells continued demand.

“We’ll see a little bit of rent growth, but I don’t think we anticipate rent growth to be like we have seen in prior years,” Provinse said. “Given that demand and the demographics, I think we feel generally really positive about what’s on the horizon for us next year and our ability to provide financing to meet those market demands.”

With the demand for financing as considerable as it is now, Fannie Mae and Freddie Mac executives promise a continued effort to tailor products to customer requirements and changing market conditions. “We’re constantly looking for ways to deliver our core products more efficiently, or tweak them to better meet borrowers’ needs,” Leopold said.

Cannon agreed. “This year, we’re concentrating more on significant process improvements and efficiencies, making it easier to do business with Freddie Mac. That’s been a huge focus of the organization in 2016, and I think that’s going to continue in 2017. … There’s a lot of tweaking of how one does business with Freddie, with the ultimate aim of making it easier, faster and more certain.”

Originally appearing in the November 2016 issue of CPE.

You must be logged in to post a comment.