Financing Sources: Fewer Maturities, Slow Sales

Although CRE originations next year are expected to be marginally higher compared to this year--everything being equal--the latest data show that commercial real estate originations dropped in the third quarter.

The good news is that next year commercial real estate originations are expected to be marginally higher than they were this year–everything being equal, of course. The bad news is that they dropped in the third quarter.

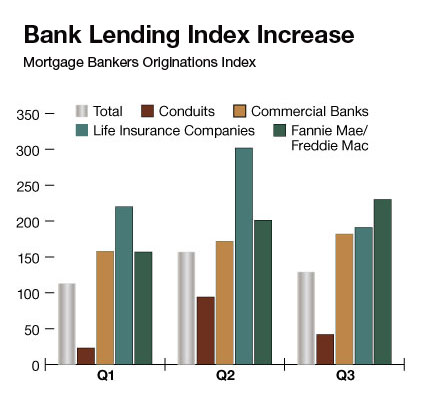

According to the Mortgage Bankers Association, originations were 17 percent lower than in the second quarter and 7 percent lower than in the same period a year ago.

“Low interest rates continue to make borrowing extremely attractive,” noted Jamie Woodwell, MBA vice president of commercial real estate research. He attributed the third quarter drop to a “moderate pace of commercial property sales transactions and a continued drop in the volume of commercial mortgages maturing.”

Among investor types, the dollar volume of loans originated by conduits for CMBS decreased by 55 percent from the second quarter. Loans for life insurance companies fell by 37 percent, while originations for commercial bank portfolios increased by 6 percent and for GSEs by 14 percent.

Compared to the third quarter of last year, originations in retail and office properties dropped the most. The MBA’s Quarterly Survey of Commercial/Multifamily Mortgage Bankers Originations showed that originations for retail properties fell by a whopping 35 percent in dollar volume, with office dropping by 24 percent. Multi-family originations increased by 30 percent over a year ago, while industrial and healthcare volume increased by 19 percent and hotel volume increased by 4 percent.

For a forecast on the finance market in 2013, turn to the Finance & Investment section of CPE‘s January 2013 issue.

You must be logged in to post a comment.