FEBRUARY ISSUE: Mortgage Bankers Roundtable

How much will the mortgage market change in 2015?

Things are looking up. The economy and real estate markets seem to be well on their way to recovery, and lenders are expecting higher loan volumes. But this could also be a year of volatility for the commercial property financing market due to the treacherous geopolitical situation. CPE interviews mortgage bankers and an intermediary about the outlook for 2015. Participating in the interview are Willy Walker, chairman, president & CEO of Walker & Dunlop; William Ross, president of NorthMarq Capital; David Rifkind, principal & managing director of George Smith Partners; and David Casden, senior vice president, and Daniel Wolins, managing director of Hunt Mortgage Group.

CPE: What is your expectation for 2015?

Ross: NorthMarq Capital had a record production volume of $13 billion in 2014. We see a strong 2015, with volume expectations above $15 billion. The wave of CMBS financing is beginning to appear, and NorthMarq Capital is on target to capture this sea of refinancing in 2015 to 2017. With current rates in the market in the 3 percent to 4 percent range, many borrowers should be able to take advantage of this environment and refinance their loans much earlier than the maturity schedule might suggest.

Wolins: For 2015, Hunt Mortgage Group expects to do non-GSE lending of $500 million to $1 billion. The non-GSE lending platforms were begun in fourth quarter 2014, so the firm is still in the ramp-off phase, with first closings in first quarter 2015.

Rifkind: 2014 showed a marked increase in our volume at George Smith Partners, and we expect a steady and moderate increase in 2015. General market activity is positive. We survey our originators and we monitor our pipeline. Coming out of 2014 into 2015, it’s a very robust pipeline, so we are very optimistic about 2015.

CPE: Have all of the commercial property sectors recovered?

Walker: If you look at multi-family, we are at occupancy levels we have not seen in 13 years, and we are experiencing the tightest supply in over a decade. Multi-family is the only asset class where there is a significant amount of new construction coming online. There are very few places where there is so much multi-family construction that it is going to have significant impacts on the markets anytime soon. In pretty much all the other asset classes, you have had for all practical purposes no new development over the last five to seven years. So as the economy continues to gain steam, with no new product delivered over that period of time and the economy continuing to grow, all the other asset classes are poised to do quite well.

Walker: If you look at multi-family, we are at occupancy levels we have not seen in 13 years, and we are experiencing the tightest supply in over a decade. Multi-family is the only asset class where there is a significant amount of new construction coming online. There are very few places where there is so much multi-family construction that it is going to have significant impacts on the markets anytime soon. In pretty much all the other asset classes, you have had for all practical purposes no new development over the last five to seven years. So as the economy continues to gain steam, with no new product delivered over that period of time and the economy continuing to grow, all the other asset classes are poised to do quite well.

Ross: I think all the general property types have seen a strong recovery in this cycle. Certainly, multi-family has recovered, but most of the property types have seen some growth, and clearly lodging has seen a nice surge in its performance. Construction in retail has been constrained over the past few years, and occupancy levels are stronger in most markets as a result. The one area of value-add is still suburban office.

Wolins: They have all recovered nicely and pretty steadily over the past 24 months. Office vacancies are broadly decreasing, and office and retail rates continue to grow in solid markets. There are still soft markets, and the property lending structure must be in place for those types of assets. Low-quality regional malls are still an asset class that has struggled and will probably continue to do so into the new year and beyond.

Wolins: They have all recovered nicely and pretty steadily over the past 24 months. Office vacancies are broadly decreasing, and office and retail rates continue to grow in solid markets. There are still soft markets, and the property lending structure must be in place for those types of assets. Low-quality regional malls are still an asset class that has struggled and will probably continue to do so into the new year and beyond.

Rifkind: I think there is still some more recovery and stabilization to be experienced outside of the top 25 MSAs, going into the secondary and tertiary markets. There is so much competition for primary markets, and lenders have a lot of money to lend. That money is seeping its way into the secondary and tertiary markets. We will see more activity and availability of financing in those markets than we have seen in the past several years.

CPE: Is 2015 the year that the long-term Treasury interest rates will increase?

Walker: I am hard-pressed to think that things in Europe or Asia will snap back to the point where the demand for U.S. Treasuries falls off significantly.

The real question will be how much of a flattening of the yield curve will we see in 2015. It’s pretty clear the Fed will try and raise short-term rates, and most of the economists polled say that rates will go up anywhere between 25 and 50 basis points sometime in September. If the Fed sticks to the timeline, the question would be what happens to long-term rates as the Fed continues to buy 10-year paper. My tummy tells me you will see a flattening of the yield curve, where short-term rates start to move up while the long-term rates move up not as quickly as the Fed would like. The flattening of the yield curve makes it extremely attractive for borrowers to go long term and fixed rate with their borrowing, rather than short term and variable rate.

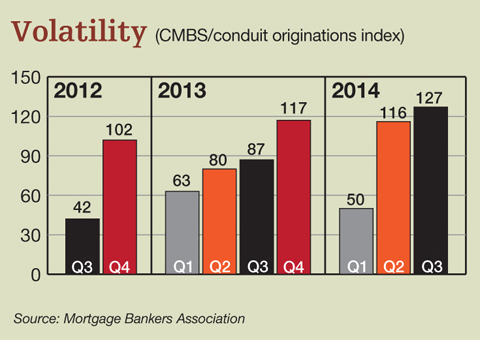

Rifkind: I think what will mark 2015 is not so much that rates will be higher but that we will be in a more volatile marketplace. Certainly, the mind shift to higher interest rates is part of it, as well as geopolitical factors—fears of deflation in Europe and slowdown in Asia and India. A lot of anxiety is out there; that anxiety is already translating into greater volatility in the interest-rate market.

Rifkind: I think what will mark 2015 is not so much that rates will be higher but that we will be in a more volatile marketplace. Certainly, the mind shift to higher interest rates is part of it, as well as geopolitical factors—fears of deflation in Europe and slowdown in Asia and India. A lot of anxiety is out there; that anxiety is already translating into greater volatility in the interest-rate market.

Casden: I expect long-term Treasury yields will trade higher over the course of 2015 on the expectations the Fed will begin to raise short-term interest rates over the course of the year. This along with improving market fundamentals and higher GDP growth should bode well for the greater stock indexes, as investors will look to add more risk into their portfolio, causing a sell-off in Treasuries. I expect the 10-year Treasury yield to trade slightly north of 3 percent after Dec. 31, while the 30-year U.S. Treasury will hover around 3.65 percent.

CPE: The wave of loan maturities begins in 2015. Do you expect it to contribute substantially to loan volume for your company?

Ross: We think the wave of CMBS maturities in 2015-2017 will have a substantial effect on our production. We are thinking it might increase volume by 20 percent going forward. We are just beginning to see the wave crest and expect it to really start to impact us during the second half of 2015.

Walker: 2014 is a truly trough year as it relates to CRE refinancing volume. Our third-quarter data reflects the fact that we’ve seen a pickup in activity, and there is just a massive amount of maturities out there that need to be refinanced. We are in a very low-interest-rate environment now, where the vast majority of paper that needs to be refinanced is getting refinanced with first-trust mortgages because interest rates are so much lower than they were when most of these loans were put out 10 years ago. … When you have that 200 to 250 basis points built in there, every loan is going to size right now. If you have a 10-year rate that is going to move up significantly, it will be a little more difficult (to refinance).

Rifkind: When we started talking about the maturity wave, we were thinking in terms of loans that were potentially underwater that would have challenges being refinanced. That is just not an issue anymore. It is true that eight, nine, 10 years ago, there was a great deal of origination activity. We are coming up on those maturities now, and we are going to start seeing those loans coming into the market for refinance. I would not call that a wave; I would call that a healthy, normal market.

Rifkind: When we started talking about the maturity wave, we were thinking in terms of loans that were potentially underwater that would have challenges being refinanced. That is just not an issue anymore. It is true that eight, nine, 10 years ago, there was a great deal of origination activity. We are coming up on those maturities now, and we are going to start seeing those loans coming into the market for refinance. I would not call that a wave; I would call that a healthy, normal market.

Wolins: Aggressive loans that were written 10 years ago will require that sponsors come up with additional cash. … Troubled loans will most likely find a home, as the general CMBS market really heated up in ’14. We are going to pick our spots and be more aggressive with assets and markets we see as long-term performers.

CPE: Do you expect investor demand for CMBS bonds to continue to be as strong in 2015 as it has been these past few years, or will it weaken in 2015?

Rifkind: Sure, why not? What has changed? CMBS as an alternative to anything else in fixed income absolutely has its place.

Casden: Demand for CMBS will continue to strengthen over the course of 2015, driving new-issue spreads tighter up and down the credit stack. Triple-A 10-year spreads should hit the swaps-plus-70-basis-point level before year-end. I do, however, caution that with the increase in loan competition for commercial real estate loans, the expectations for even looser credit underwriting standards by CMBS issuers will be rampant, which may cause investors to push back on spreads at various points throughout the year. Overall, though, by year-end I think we will be tighter than where we were to end 2014.

Walker: Anytime you talk about CMBS, you cannot forget the fact that CMBS is highly volatile. When things are going well, the CMBS market works perfectly and provides a huge amount of liquidity for borrowers, and provides investors with great access to fixed-income instruments that look like they have a very attractive return. But that market comes and goes on a daily basis. So any kind of dislocation from a global standpoint, any kind of geopolitical risk, can have a big impact on the CMBS market. If you have a similar period of time (as 2004-2007) in which the 10-year sits in a tight band and does not vary dramatically from day to day and quarter to quarter, that allows CMBS issuers to go out to originate, underwrite and sell huge amounts of CMBS loans.

Walker: Anytime you talk about CMBS, you cannot forget the fact that CMBS is highly volatile. When things are going well, the CMBS market works perfectly and provides a huge amount of liquidity for borrowers, and provides investors with great access to fixed-income instruments that look like they have a very attractive return. But that market comes and goes on a daily basis. So any kind of dislocation from a global standpoint, any kind of geopolitical risk, can have a big impact on the CMBS market. If you have a similar period of time (as 2004-2007) in which the 10-year sits in a tight band and does not vary dramatically from day to day and quarter to quarter, that allows CMBS issuers to go out to originate, underwrite and sell huge amounts of CMBS loans.

CPE: In a rising-rate environment, will alternative investment vehicles be paying more? Will they be competing with CMBS returns?

Rifkind: Ultimately, that will have an effect, but we haven’t seen it yet. We don’t know what form higher interest rates will take. It depends on the shape of the yield curve, too. You are right, but that is just one of many possible scenarios that can affect CMBS. If we start to see cracks in the fundamentals of commercial real estate, if we start seeing credit concerns, that would change. I think 2015 will see ascent and stability of most commercial markets in North America, so I think that bodes very well for investor confidence for CMBS bonds.

You must be logged in to post a comment.