Examining UK Real Estate’s Worst Quarter Since 2009

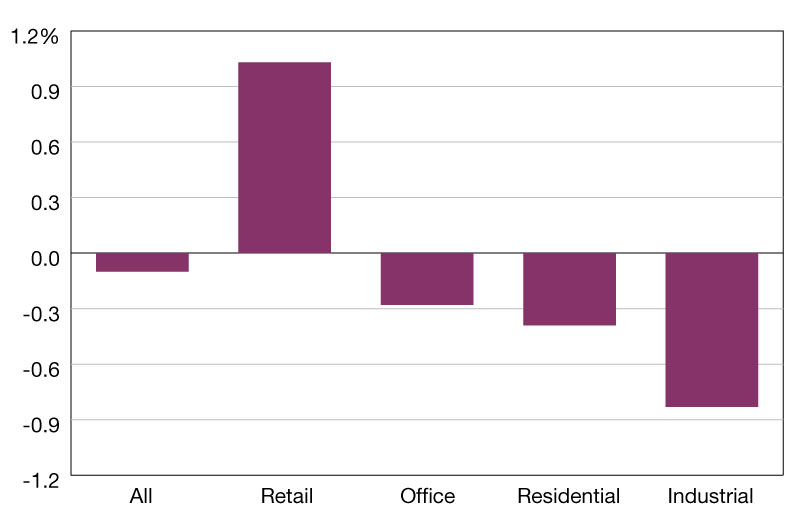

By the end of September, only the retail sector’s NOI yield offered a premium to the government-bond yield, while the yield on industrial property remained 80 bps lower than that of the 10-year U.K. government bond.

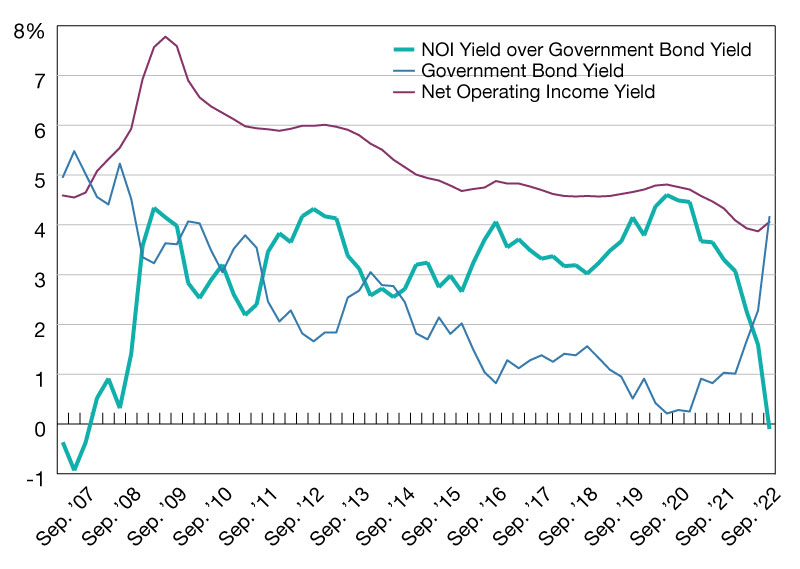

For first time since 2007, UK bonds yielded more than property

Weakening yields’ negative impact across sectors

Following its recent sharp rise, the 10-year U.K. government bond-yield has risen above the net-operating-income (NOI) yield of U.K. real estate for the first time since 2007. The evaporation of property’s yield premium — amid the recent deteriorating macroeconomic outlook and rising inflation and interest rates — weighed on performance to the extent that the MSCI UK Quarterly Property Index in the third quarter recorded its worst return since the second quarter of 2009.

In Q3, property yields rose by 20 basis points (bps) to 4.1 percent but remained below the previous low of 4.6 percent measured in Q2 2007. This was after the index’s NOI yield had reached a since-inception low in Q2, following a secular decline in the years since the end of the 2009 global financial crisis. By the end of September, only the retail sector’s NOI yield offered a premium to the government-bond yield, while the yield on industrial property remained 80 bps lower than that of the 10-year U.K. government bond.

As property yields start to drift up rather than compress, they pull property values down, rather than contribute to their growth. The all-property yield impact turned negative in the third quarter, after eight consecutive quarters of enhancing returns. This turnaround was most dramatic in industrial, where the sector experienced a double-digit swing into negative territory.

You must be logged in to post a comment.