European Commercial Real Estate’s Returns Show a Slowdown

European CRE returns deteriorated in Q3, according to MSCI.

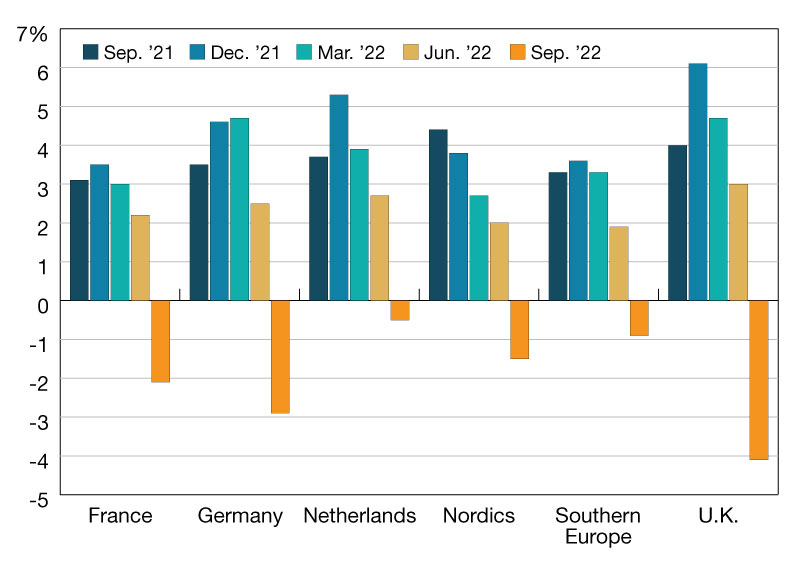

Returns sank across countries

European commercial real estate’s returns deteriorated in the third quarter, posting the worst performance since the 2008 global financial crisis, according to the MSCI Europe Quarterly Property Index. The results indicate that a widespread slowdown in Europe’s commercial-property market is underway.

Rising interest rates and slowing economic growth meant total returns sank to -2.2 percent at the end of September, down from 2.5 percent in June. This was the largest quarterly shift in the index’s history and was the worst total return since December 2008, when the figure was -6.4 percent.

Capital values across Europe have been impacted by rising yields; yields had previously sunk to record lows in response to more than a decade of exceptionally loose European monetary policy. Climbing yields were the major drag on the index, and the impact on the total return was the worst since the inception of the index.

The yield impact was felt most keenly in industrial properties. Industrial was the worst-performing sector in the three months to September, a reversal from the previous period, when it was the best-performing. Industrial returned -3.9 percent in the third quarter, compared to -1.7 percent for offices, -0.5 percent for retail and -0.7 percent for residential.

Positive fundamentals in the occupier market meant industrial rents rose by 1.9 percent on the quarter and more than 8 percent on the year, however. Such fundamentals are one reason why acquisitions of European industrial property in the first nine months of 2022 rose 70 percent against the 2017-2021 average, according to MSCI data.

At a country level, the U.K. was the quarter’s worst performer: Total returns were -4.1 percent, largely due to the sharp correction in the U.K. industrial sector. Total returns were -2.9 percent for Germany and -2.1 percent for France.

You must be logged in to post a comment.