Equity Commonwealth to Sell Hoboken Office Asset for Tidy Sum

Equity Commonwealth will sell the 13-story tower to Mack-Cali Realty Corp.

By Barbra Murray, Contributing Editor

New York—Talk about a profit. Equity Commonwealth will soon sell 111 River St. in Hoboken, N.J., for nearly $100 million more than it paid for the office tower in 2009. The office REIT recently agreed to trade the 565,000-square-foot property for $235 million in a transaction with Mack-Cali Realty Corp.

The deal is part of a larger plan. Early last year, Equity Commonwealth announced that it would sell roughly $3 billion of real estate in an effort to rationalize its portfolio, improve operations and maximize shareholder value. The REIT has since actively pursued its strategy, completing a whopping $2 billion in dispositions in 2015. And Equity Commonwealth hasn’t exactly been taking a loss on its sales transactions.

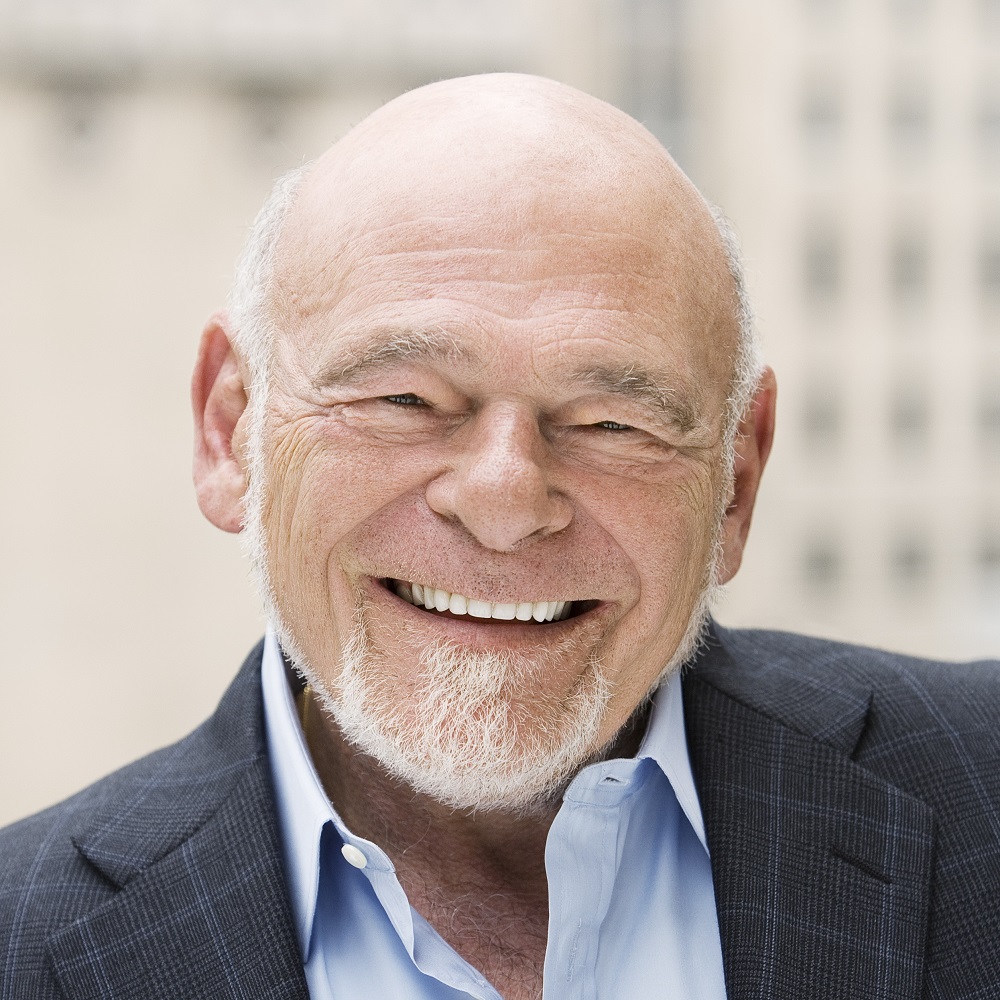

“I would say to you that, every single asset that we have disposed of, we would not have bought at the price somebody paid us—that’s the ultimate definition of whether you are a buyer or a seller,” Sam Zell, chairman of Equity Commonwealth, said during the company’s fourth quarter 2015 earnings conference call in February. It appears the 111 River transaction is no exception.

Once commonly known as Waterfront Corporate Center I, 111 River first opened its doors in 2002, with global publisher John Wiley & Sons Inc. having pre-leased 400,000 square feet in a move that effectively kicked off developer SJP Properties’ construction of the 13-story tower.

In 2004, SJP parted with the asset, selling it to JP Morgan Investment Management for $180 million. Five years later, during a less friendly real estate cycle, JP Morgan sold the building in a $145 million transaction to HRPT Properties Trust, which later changed its name to CommonWealth REIT before becoming Equity Commonwealth in 2014. And here we are, with lead tenant John Wiley having renewed its lease for occupancy at 111 River until March 2033, and Equity Commonwealth planning to hand over the property to Mack-Cali for nearly a quarter-billion dollars.

For Mack-Cali, which focuses on waterfront and transit-based office and luxury multifamily assets, the acquisition of the Class A office building will mark the REIT’s entrée into Hoboken and leave it with the distinction of being the owner of approximately 25 percent of the Class A office space in the Hudson River Waterfront submarket.

The 111 River transaction is on track to close in June, pending customary closing conditions and consents required under the property’s fixed-term operating ground lease, which is due to expire in 2098.

The party in the real estate market continues but, of course, it won’t last forever. “I, again, reiterate that I don’t think the real estate market of the United States can avoid the impact of what’s going on around the world,” Zell said during the earnings call. “Personally, I think that we are in the early stages of a mild recession and if we’re not, I think we’re going to be in another three or four months.”

You must be logged in to post a comment.