Emerging Property Types Garner More NOI Growth

A new wave of focused REITs is outpacing the slowing growth of the larger sectors.

By David Dent

Over the last 15 years, REITs have focused on primary property types such as Office, Apartments, Retail and Industrial. REIT management teams developed deep expertise in their respective property types and largely focused portfolio strategy around particular metro areas and property qualities. Throughout the Great Recession, executives focused on portfolio rationalization, asset management and refinancing debt as interest rates decreased.

Over the last 15 years, REITs have focused on primary property types such as Office, Apartments, Retail and Industrial. REIT management teams developed deep expertise in their respective property types and largely focused portfolio strategy around particular metro areas and property qualities. Throughout the Great Recession, executives focused on portfolio rationalization, asset management and refinancing debt as interest rates decreased.

But beneath the headlines around the broadest property types, a new wave of focused REITs is outpacing the slowing growth of the larger sectors. There are a growing number of REITs that manage smaller but attractive property types such as Data Centers and Infrastructure. While these property types require more specialized design and management than some of the broader categories, demand for new property continues to grow and is reflected in rising NOI for these emerging property sectors.

Though real estate fundamentals are healthy across most property types, a narrower subset of REITs are garnering an outsized portion of total NOI growth among U.S. equity REITs. In 2016, equity REITs reported combined NOI growth of 7 percent. While most property types grew by low single-digit percentages, NOI surged for Data Centers (+27 percent), Infrastructure (+15 percent), Health Care (+12 percent) and Self Storage (+17 percent). In 2016, NOI grew 16 percent across this high-performing subset of property types while all other equity REITs witnessed modest combined NOI growth of 3 percent. Data Centers, Infrastructure, Health care and Self Storage represent about 30 percent of total equity REIT NOI but garnered over 60 percent of total NOI growth last year, evidencing particular momentum in these categories.

An interesting sidebar to the structure of the REIT industry over the last 15 years is the slow disappearance of the Diversified REIT, which might own a variety of property types. Over time, REITs have generally focused on a specific property type for a number of strategic and tactical reasons. But as rent growth slows in the larger sectors, we might begin to see REITs invest more in both direct ownership of new property types as well as whole REIT acquisitions by larger property groups.

With over 200 REITs now publicly-traded in the United States, there are many interesting combinations to consider. In each major property type there are a few very large REITs with another dozen or so mid-cap REITs, in addition to several dozen small cap owners. Strategy teams at major REITs are likely identifying smaller REITs to buy or emulate in order to boost NOI growth. We might soon witness a new wave of more diversified approaches to REIT portfolio construction to capture emerging opportunities.

Net Acquisitions Fall Back to Earth

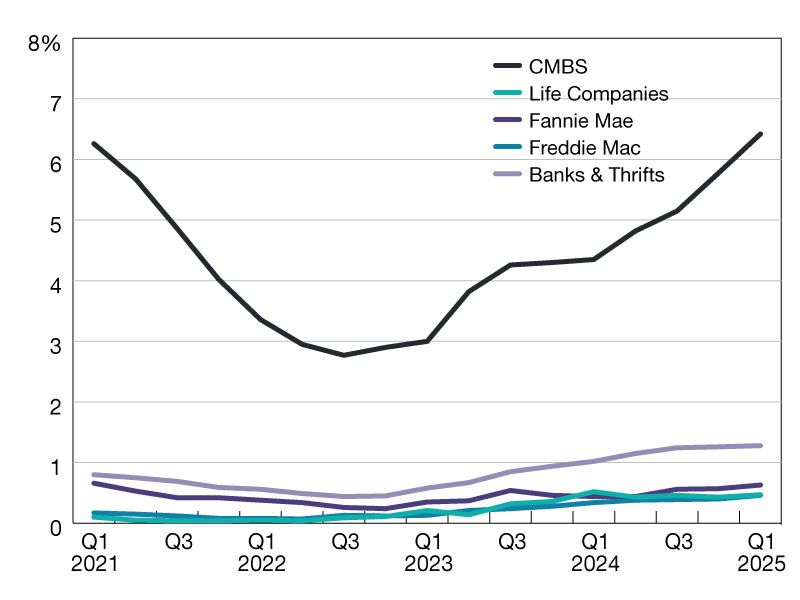

Rising interest rates and tightening loan underwriting terms are slowing commercial real estate transaction activity. In the second half of 2016, interest rates increased approximately 1.0 percent. In addition, the Federal Reserve’s Senior Loan Officer Opinion Survey reports that throughout 2016 credit officers raised underwriting standards for commercial real estate loans, both construction and permanent. Also, the Fed survey reveals decreasing demand for commercial real estate loans as potential buyers move to the sidelines in the wake of higher rates and credit standards.

Net acquisitions by U.S. equity REITs continue to fall in a trend that began 18 months ago. In 2016, net acquisitions totaled just $11 billion, down 80 percent from 2015 when REITs added $57 billion in net acquisitions. For Q4 2016, net acquisitions were slightly positive but now down to levels not seen since 2009 when REITs were net property sellers in the wake of the Great Recession. Major property types are now net sellers, with Apartments selling $8 billion in 2016, while Office and Industrial disposed of an additional $10 billion. Health Care continues to lead property types with $7 billion in net acquisitions in 2016, but this is down over 60 percent compared to 2015’s net acquisitions of $20 billion. In 2016, net acquisitions grew for a small set of emerging property types that are witnessing strong fundamental momentum: Data Centers, Infrastructure, Self Storage and Single Family Homes all increased their net acquisitions from 2015 to 2016, though these property sectors are relatively small.

The slowdown in net acquisitions in 2016 has an approximate corollary in the transaction slowdown witnessed in 2012 and 2013. In summer 2012, interest rates touched record lows and then began to drift approximately 1.0 percent higher through the end of 2013; in the wake of this back-up in rates, transaction activity dropped approximately 30 percent. During 2012 and 2013 the Fed reported that credit standards for commercial real estate loans were easing, in contrast to the tightening trend that began in 2016. The present shrinking availability of credit on attractive terms might account for why transaction volumes have plummeted more dramatically over the last several quarters; it is also true that the real estate recovery in general has matured and now offers fewer attractive acquisitions.

It is worthwhile noting that 2014 transaction volume boomed again once interest rates began falling in the wake of additional quantitative easing plans implemented by the European Central Bank and Bank of Japan. However, 2017 begins with a stock market rally and hawkish comments by central bankers so it currently seems unlikely that commercial real estate transactions will soon get much of a tailwind from the credit markets.

You must be logged in to post a comment.