Economy Watch: Personal Income Up, But Consumers Still Glum

While consumers saw their incomes rise in October, their low optimism about the U.S. economy might mean less buying this holiday season.

By Dees Stribling, Contributing Editor

Some good news for retailers and the landlords they pay rent to: U.S. personal income increased $46.7 billion (0.3 percent) in September, according to estimates released on Monday by the Bureau of Economic Analysis. Disposable personal income, which is the money people have to spend after taxes and other such obligations, increased $37 billion, or 0.3 percent, and personal consumption expenditures (PCI) increased $61 billion, or 0.5 percent.

The increase in personal income in September primarily reflected increases in compensation of employees, according to the bureau, as well as business proprietors’ income. The BEA also reported that its PCE price index increased 0.2 percent for the month. Excluding food and energy, the PCE price index increased only 0.1 percent. So income is up, while inflation is still fairly tame.

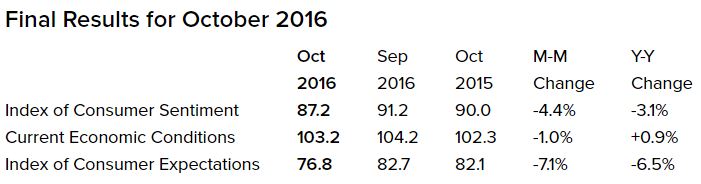

Will consumers use a bit of this rising income to buy things over the holiday season? Maybe. But they aren’t quite as optimistic now as recently, according to the final University of Michigan consumer sentiment index for October, which came in at 87.2 on Friday, down from the preliminary estimate of 87.9, and down from 91.2 in September.

In fact, the index slipped in October to the same low recorded last September and to the lowest level since October 2014. The October decline was due to less favorable prospects for the national economy, according to the university, with half of all consumers anticipating an economic downturn sometime in the next five years for the first time in two years.

You must be logged in to post a comment.