Economy Watch: Nonresidential Project Planning Up Slightly in February

The month's increase was the result of an 8.2 percent bump in institutional projects, while the commercial component contracted for the second month in a row, according to the latest Dodge Data & Analytics report.

By D.C. Stribling, Contributing Editor

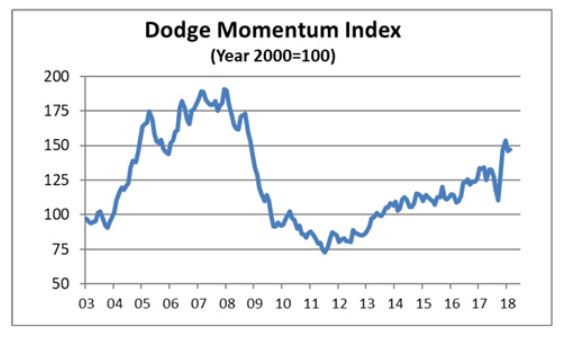

Dodge Data & Analytics Momentum Index increased 0.5 percent in February to 146.9 (2000 = 100) from a revised January reading of 146.2, the firm reported Wednesday. The index is a monthly measure of the initial report for nonresidential building projects in planning, which lead construction spending for nonresidential buildings by a full year.

The move higher in February was the result of an 8.2 percent increase in the institutional component, while the commercial component contracted 4.8 percent. The commercial component has declined for two consecutive months, Dodge reported.

While the decline shouldn’t lead to an outright decline in construction activity, it’s an additional sign that commercial building construction growth could ease in 2018 in response to rising vacancy rates for offices and warehouses. By contrast, institutional building construction continues to feed off the massive number of state and local bonds issued for schools and other institutional buildings over the past few election cycles.

In February, 16 projects each with a value of $100 million or more entered planning, Dodge said. For the institutional sector, the leading projects were the $450 million MSG Sphere Arena in Las Vegas and the $412 million St. Jude’s Children’s Hospital Research Center in Memphis. The leading commercial projects were the $280 million first phase of the Sentinel Data Center in Sterling, Va., and a $150 million mixed-use project in San Jose, Calif.

You must be logged in to post a comment.