Economy Watch: Multifamily Markets Softening

All four indexes of the NMHC's quarterly survey were below the breakeven level of 50, indicating that U.S. apartment market conditions are softening despite continued strong demand. New supply is finally catching up, and there seems to be more caution among buyers and lenders, noted NMHC Chief Economist Mark Obrinsky.

By Dees Stribling, Contributing Editor

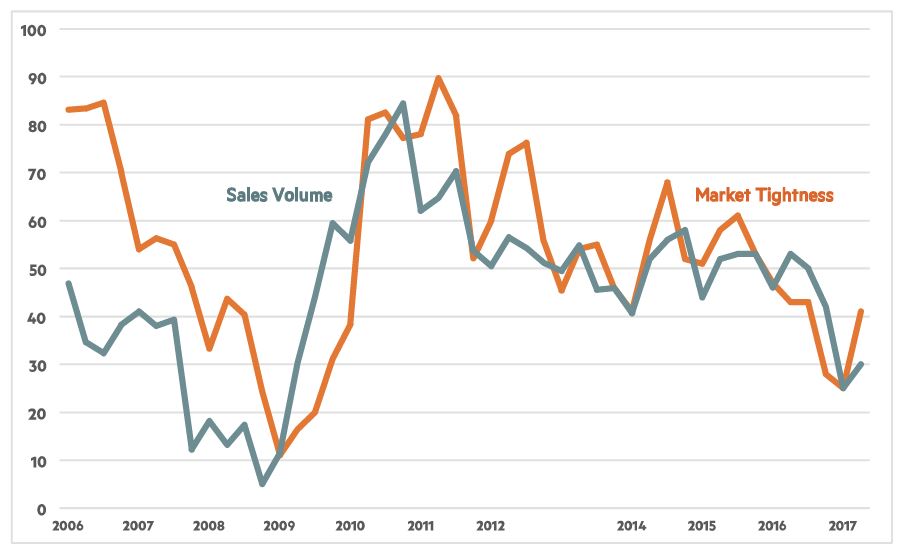

Despite moderate improvements during first-quarter 2017, all four indexes in the National Multifamily Housing Council’s quarterly survey remained below the breakeven level of 50, the organization reported on Thursday. Namely, Market Tightness (41), Sales Volume (30), Equity Financing (42) and Debt Financing (41) all point to continued softening conditions in U.S. apartment markets, even as demand for apartment residences remains strong.

After years of lagging behind the increase in apartment demand, new supply is finally coming online in sufficient quantity to alter the previous supply-demand imbalance, explained Mark Obrinsky, NMHC’s senior vice president of research and chief economist. In particular, the run-up in Class A supply in many urban core submarkets has led to increased concessions to maintain leasing activity.

The Market Tightness Index increased from 25 to 41 in the first quarter, as one-fifth of respondents (20 percent) reported tighter conditions than three months ago, up from 8 percent in January. Over one-third (38 percent) noted looser conditions. While that marks the sixth consecutive quarter of overall declining conditions, it does mark an uptick from the previous quarter.

“In the investment market, some of the weakness in property sales is seasonal, but respondents reported caution on the part of buyers as well as debt and equity capital sources, in particular in regard to construction lending,” Obrinsky said. “Increased uncertainty about the outlook for interest rates and cap rates also appears to be playing a role.”

You must be logged in to post a comment.