Economy Watch: Investors to Buy More US CRE in 2018

Eighty-eight percent of investors responding to CBRE Americas’ new Investor Intentions Survey said they plan to maintain or increase their spending this year.

By D.C. Stribling, Contributing Editor

Commercial real estate investors are more positive about American CRE going into 2018 than they were at the start of last year, according to the recently released CBRE Americas Investor Intentions Survey 2018, which involved about 300 investors who are focused on the Americas. Some of the reasons include a prolonged period of U.S. economic growth, as well as federal tax cuts and favorable regulatory changes.

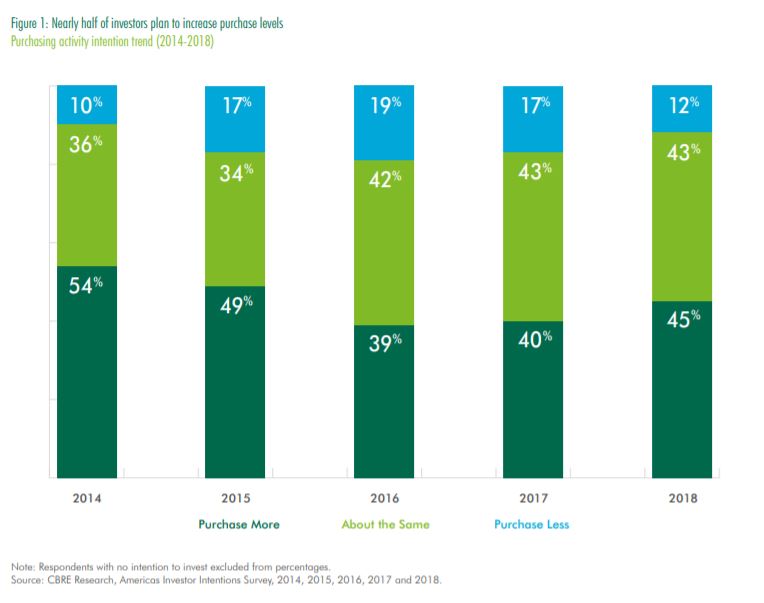

The survey found that the largest share (45 percent) of investors plan to increase their level of acquisitions in the Americas compared with last year. This pick-up in investor appetite represents a major shift from the downward or flat trend in the previous two annual surveys. All together, 88 percent of investors plan to either maintain or increase spending in 2018, up from 83 percent in 2017. Only 12 percent of investors plan to reduce their purchases in 2018, lower than the 17 percent in 2017.

Star Strategies

Among the five different asset strategies—core, good secondary, value-add, opportunistic and distressed—value-add remains the preferred strategy (34 percent), but it is down from 41 percent in 2017. Investor appetite for good secondary assets increased for the fourth consecutive year, as the supply of core assets is diminishing and investors broaden their search for yield, CBRE said.

Institutional investors (sovereign wealth funds, insurance companies and pension funds) are more interested in core assets than are other types of investors, with 33 percent indicating core as their preferred strategy, compared with 20 percent of overall investors.

U.S. gateway cities continue to command considerable investor interest. Los Angeles/Southern California is the top-ranked metro for property purchases, followed by Dallas/Ft. Worth and New York. As investors pursue good secondary assets, large upward shifts of investor interest brought Nashville, Portland and Tampa/St. Petersburg into the top 10.

Investors see a “global economic shock” that undermines occupier demand (30 percent) as the greatest potential threat in 2018, which is more than last year (22 percent). By contrast, investors are less worried about interest rates rising more quickly than expected this year (16 percent in 2018 vs. 21 percent in 2017).

You must be logged in to post a comment.