Economy Watch: GAO Finds Hightened Risk Among CRE Lenders

Changes in underwriting standards, property prices and other data suggest that credit and concentration risks have increased in bank CRE lending, according to a new GAO study.

By D.C. Stribling, Contributing Editor

Despite the recovery of the commercial real estate market since 2011, a new study released late last week by the Government Accountability Office says that risk in CRE lending by banks has increased over the past several years. Changes in CRE underwriting standards, property prices, and other data suggest that credit and concentration risks have increased in bank CRE lending.

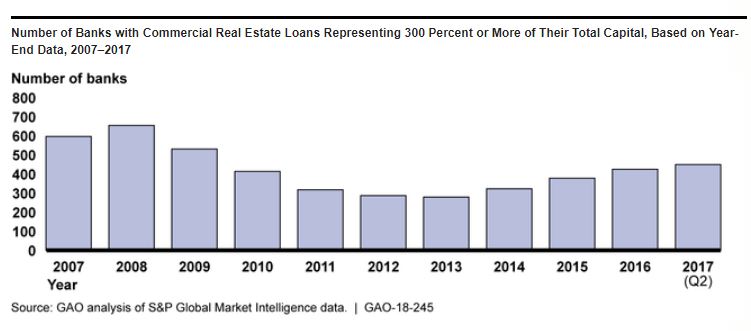

For example, the number of banks with relatively high CRE concentrations—which the GAO measures by the ratio of a bank’s CRE loans to its total capital—has been increasing. That has paralleled the trend of increasing commercial property prices and property valuations rising in recent years.

GAO’s predictive econometric models of CRE loan performance suggest that risk has increased based largely on the simultaneous increase in bank CRE lending and CRE prices over the last several years. The report is stresses, however, that the current risk profile for the sector is lower than it was just before and during the 2007 to 2009 financial crisis.

A GAO review of 54 bank examinations by the FDIC, Board of Governors of the Federal Reserve System, and Office of the Comptroller of the Currency from 2013 through 2016, found that 41 of the banks had relatively high CRE concentrations. In 26 of these 41 examinations, regulators did not find any risk management weaknesses.

In 15 of the 41 examinations, however, regulators found weaknesses in one or more of the bank’s risk management areas, such as board and management oversight, management information systems or underwriting. The regulators communicated their findings to the banks and directed them to correct their risk management weaknesses.

You must be logged in to post a comment.