Economy Watch: Fitch Report Optimistic About CRE

In its first annual U.S. Equity REITs Handbook, Fitch predicts continued positive property-level fundamentals across most asset classes in 2017. Industrial REITs and office REITs with properties in technology-focused markets should perform particularly well.

By Dees Stribling, Contributing Editor

On the whole, the outlook for commercial property is still solid, according to the first-ever U.S. Equity REITs Handbook, which Fitch Ratings released on Monday. The handbook also includes sector-level financial and credit metrics, and summary credit profiles for 49 companies, including credit drivers and ratings sensitivities. All together, Fitch expects continued positive property-level fundamentals across most asset classes during 2017.

Unsurprisingly, multifamily fundamentals should again lead the pack, noted the report, although same-store net operating growth will be below 2016 levels, with some markets likely posting negative results. Office fundamentals are mixed, with technology-focused markets outperforming suburban markets due to strong employment growth, but energy-dependent markets will remain under pressure.

Industrial REITs are benefiting from the growth in e-commerce tenant demand. However, supply chain reconfigurations would be a longer-term concern for the sector if economic growth slows, which could lead to weaker industrial property fundamentals.

Retail fundamentals will vary by format, with grocery-anchored strip centers performing the best, and B-malls the worst, Fitch predicted. Lack of rent growth will prove to be especially problematic for Class B malls and outlying strip centers as they lose tenants. However, Fitch’s outlook for the retail sector is neutral.

“Approximately 70 percent of retail sales will still be made in a physical store in 2020, compared with around 80 percent today,” said Managing Director Steven Marks. “Consumers by and large still enjoy shopping as a leisure activity, plus a significant portion of online sales are connected with a store visit.”

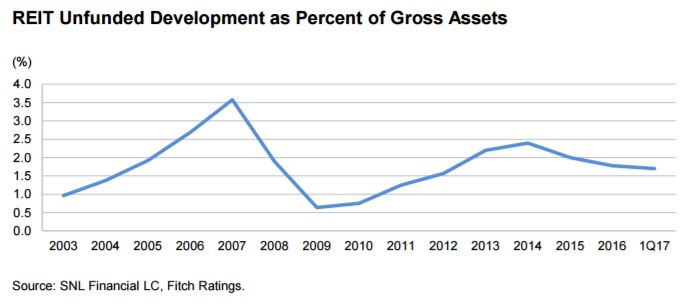

Also, the report said, REITs are increasingly focusing on (re)development to drive earnings in the context of a competitive acquisition market, lower leverage and modest organic growth. Good property fundamentals may cause some companies to moderately increase spec development appetites, particularly industrial REITs. But development exposure across REIT sectors is more manageable today and less than in the peak 2007-2008 period.

You must be logged in to post a comment.