Economy Watch: Banks Tighten CRE Lending in Q1

Banks cited a less favorable or more uncertain outlook for CRE property prices, vacancy rates or other fundamentals, as well as reduced risk tolerance as important reasons for tightening CRE credit policies in the first few months of 2017, according to the Federal Reserve's latest Senior Loan Office Opinion Survey.

By Dees Stribling, Contributing Editor

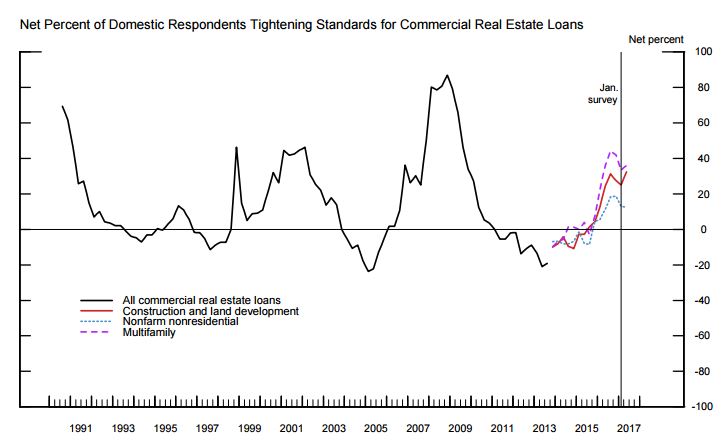

Money’s getting a little tighter for commercial real estate purposes, according to the April 2017 Senior Loan Officer Opinion Survey on Bank Lending Practices, which was released earlier this week. The Federal Reserve noted that banks generally reported tightening their lending standards on all major types of CRE loans in the first quarter.

In particular, a significant number of banks said their lending standards for construction and land development, as well as for multifamily loans, tightened during the first quarter, while a smaller number banks reported tightening standards for loans secured by nonresidential properties. A modest number of banks reported weaker demand for all major types of CRE loans.

The April survey included a set of special questions on banks’ CRE lending policies. Among other things, the survey found that many banks reported lowering loan-to-value ratios on construction and land development, and on multifamily loans. A sizable number of banks raised debt service coverage ratios on multifamily loans, while a more moderate number did so on construction and land development.

Why? Banks cited a less favorable or more uncertain outlook for CRE property prices, vacancy rates or other fundamentals, as well as reduced tolerance for risk. They also reported less aggressive competition from other banks or non-bank financial institutions, and increased concerns about the effects of regulatory changes as important reasons for tightening CRE credit policies.

The survey asked about the standards and terms on, and demand for, bank loans to businesses and households over the past three months, which roughly corresponds to the first quarter of 2017. Some 72 domestic banks and 20 U.S. branches and agencies of foreign banks responded to the survey.

This year’s survey produced similar results as the survey from the same time last year, when banks also reported that they were tightening their lending standards for CRE loans.

You must be logged in to post a comment.