Downtown Renaissance: The World Trade Center Anchors a Thriving Redevelopment Scene

As Manhattan’s biggest redevelopment project in decades, the new World Trade Center towers are the flagships of the Downtown revitalization trend that started in the early years following the terrorist attacks. An update on redevelopment progress in Lower Manhattan.

On Sept. 19, eight days after the 10th anniversary of the Sept. 11, 2001, terrorist attacks, word surfaced that MSCI Inc. had signed a 125,000-square-foot lease at 7 World Trade Center, a 52-story trophy tower in Downtown Manhattan. The news garnered little interest from the general public, which had already turned its attention from Sept. 11 anniversary observations to other matters.

Nevertheless, the lease has intriguing implications. Among the concerns that have arisen about redevelopment of the World Trade Center is whether the 10.4 million square feet of new office space planned for the site will attract sufficient demand. Only two of the four new office towers in progress at the World Trade Center have earned tenant commitments. Skeptics have warned that demand for space will fall short of justifying the construction of so much new product in a relatively concentrated timetable. Those critics have cited uncertain demand, the lethargic recovery and the possible reluctance of prospective tenants and their employees to work at a location that terrorists have already targeted for destruction.

Those favoring the massive redevelopment counter that the large-scale building program is vital to keeping the submarket competitive. “If Lower Manhattan is going to thrive as a major commercial center, it’s going to need Class A office space,” argued Carl Weisbrod, a faculty member at New York University’s Schack Institute of Real Estate, who has held senior positions in the public and private sectors during a nearly 40-year career in real estate. “I think the office space is going to be absorbed.”

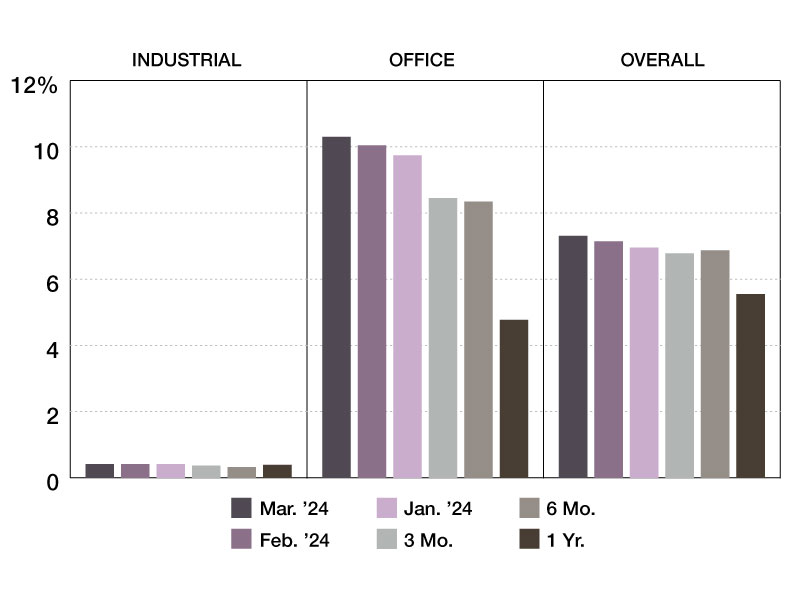

Recent trends appear to support Weisbrod’s contention. At midyear, Downtown Manhattan sported an 8.2 percent vacancy rate—second only to Midtown Manhattan as the tightest in the nation. The MSCI deal also raised confidence that tenants will show continued interest in the new product next door at Ground Zero. Perhaps not so incidentally, the MSCI lease brings 7 WTC to full capacity.

As Manhattan’s biggest redevelopment project in decades, the new World Trade Center towers are the flagships of the Downtown revitalization trend that started in the early years following the terrorist attacks. Observers often point to Downtown’s residential renaissance, which expanded the district’s multi-family inventory by 125 properties and 15,000 units between 2000 and 2011, according to the Alliance for Downtown New York, a local business coalition. Through economic ups and downs, broader redevelopment has grown over the years to include a diverse multibillion-dollar investment in office, retail, hospitality and multi-family projects throughout Downtown Manhattan.

At Ground Zero itself, two of the four planned towers are under construction and due to top out next spring. Progress in the site’s commercial redevelopment is embodied by 1 World Trade Center, which is scheduled to open in two years. The partly complete frame of the 3 million-square-foot, 104-story-tall tower is now clearly visible from a wide swath of the New York City metropolitan area. By the time of the 10th anniversary observations last month, the building’s steel frame had reached the 81st floor and the façade had been installed to the 54th floor. One WTC is being jointly developed by the Port Authority of New York and New Jersey and the Durst Organization, which took a $100 million equity stake in the project last year and will oversee leasing, tenant fit-out and property management. At 1,776 feet tall—including a 408-foot-tall antenna—1 WTC will be the tallest building in the United States.

One WTC attained a leasing landmark in May, when publishing giant Conde Nast signed a 1 million-square-foot, 25-year deal for floors 20 through 41. CB Richard Ellis Inc. represented Conde Nast, and Cushman & Wakefield represented the Port Authority. One of the biggest Manhattan office leases of recent years, the deal was also said to be Downtown Manhattan’s largest office lease in more than a quarter century. Observers say it also represents the gradual diversification of Downtown’s tenant mix beyond financial services to include businesses like technology, media relations and advertising.

Three other towers at the site are being developed under a complex financing agreement hammered out last year by Silverstein Properties Inc., the Port Authority of New York and New Jersey, the states of New York and New Jersey and New York City. Furthest along among the towers is 4 World Trade Center, a 2.3 million-square-foot, 72-story tower designed by Tokyo-based Maki and Associates. Scheduled for completion in 2013, the $1.8 billion project is being financed by $1.36 billion in liberty bonds and $450 million in insurance proceeds. Last month, the steel frame of the 72-story tower reached the 47-story level and glass cladding had been installed to the 22nd story on the building’s north and south sides.

Waiting in the Wings

Market conditions must ripen considerably before Silverstein can start construction on two other planned towers. Designed by British architect Richard Rogers, 3 World Trade Center is a planned 80-story, 2.8 million-square-foot tower on the west side of the memorial. Silverstein is building the tower’s foundation and basement levels so that construction can start promptly when market conditions permit. Under last year’s agreement, Silverstein can start building the tower and receive as much as $600 million in public financing for 3 WTC once $300 million in equity has been raised and pre-leasing reaches 400,000 square feet.

As with 3 WTC, construction is also underway on the basement levels of 2 World Trade Center, the 79-story, 2.3 million-square-foot tower designed by London-based Foster + Partners. Silverstein is committed to building the tower to at least street level so that construction can be jump-started as soon as tenant commitments reach a critical mass. Given the volatility of the economy, a more detailed timetable has yet to be determined. Nevertheless, Silverstein Properties president & CEO Larry Silverstein predicted at a conference last June, “By 2016, this should all be done.”

Far less certain is the future of the parcel at the southern end of Ground Zero, where the 41-story Deutsche Bank building formerly stood. Damaged beyond repair in the terrorist attacks, the tower was dismantled at a cost of $160 million in a painstaking process that ended last winter.

At the moment, a portion of the site is serving as a welcome plaza for visitors to the World Trade Center memorial. There have been a variety of ideas for the site over the years. In 2007, JP Morgan Chase & Co. proposed a 1.3 million-square-foot tower to serve as its headquarters, but it scrapped those plans during the recession. Suggestions for alternative uses include the performing arts space that is part of the master redevelopment plan.

Although the World Trade Center’s office towers may be the main event, the redevelopment is likely to include other market sectors. A dearth of retail is often cited as a weakness of Downtown, especially in light of the residential community’s growth during the past decade. Projects in the pipeline at the WTC and at the neighboring World Financial Center will aim to fill the gap. Except for 1 WTC, each of the new towers will offer at least some retail space, as will the Port Authority transit hub and the underground concourse that links the complex.

A priority for marketing and tenant selection should be “to make sure that it serves as an engine for retail throughout Lower Manhattan,” Weisbrod contended. In July, Westfield Group and the Port Authority reached agreement on a milestone development and management deal for about 550,000 square feet of retail space. Westfield will pay $612.5 million for its 50 percent stake. Westfield and the Port Authority will develop the retail component jointly, and Westfield will manage and lease the property.

Immediately to the west of Ground Zero, the retail component of the World Financial Center office complex will undergo a $250 million makeover that starts this fall. The renovation will encompass two lower levels of the complex and is scheduled for a 2013 completion, reported Ed Hogan, vice president & director of retail for the World Financial Center’s developer and owner, Brookfield Office Properties Inc. Most of the 50 or so retail tenants will be new, and the tenant mix will be designed to tap into the market created by thousands of upscale workers as well as the burgeoning Downtown residential community. Although the World Trade Center’s retail component will also come online in the next few years, Hogan does not see either one as necessarily siphoning off tenants or customers from the another. On the contrary, he said, “The demand is greater than the space, and the two projects will most likely complement one another.”

Though the World Trade Center is the biggest game in town, investment valued in the hundreds of millions is flowing into retail, hotel and mass transit projects within a few blocks of Ground Zero. This year, perhaps the most noteworthy of those new projects came online a few minutes’ walk from Ground Zero: Forest City Ratner Cos.’ 76-story, mixed-use project at 8 Spruce St. Designed by Frank Gehry, the project incorporates an elementary school and retail space, together with 903 residential multi-family units. All told, 10 multi-family projects are under construction. Downtown, further expanding the inventory of 125 properties and 15,000 units that were added between 2000 and 2011.

Developers are eyeing opportunities for other large-scale projects, too. In February, the Wall Street Journal reported that investors Michael Steinhardt and Allan Fried had paid $65 million for a pair of buildings formerly owned by the American Stock Exchange. Steinhardt and Fried plan to convert 86 Trinity Place into a hotel with retail space and demolish 22 Thames St. to make way for a 60-story residential project. On the hospitality side, developers are currently building five new hotels, projects that will bring the inventory to 5,600 keys at 23 properties.

Timetables and other details for such projects may evolve considerably, but it seems clear that the World Trade Center and the surrounding area will keep development humming in Downtown Manhattan for years to come.

For a special report on how 9/11 has impacted development and management practices in the past 10 years, visit CPE’s September 2011 issue, CPE Special Report: The Lessons of 9/11.

You must be logged in to post a comment.