Despite Erratic Markets, Retail REIT Fundamentals Stable

By Merrie S. Frankel, Vice President & Senior Credit Officer, Moody's Investors Service

Moody's has a stable outlook on 17 of its 18 rated retail REITs and does not expect the investment-grade retail REITs to see material changes to their current ratings or rating outlooks over the next year, although there is a bifurcation among retailers.

By Merrie S. Frankel,

Vice President & Senior Credit Officer, Moody’s Investors Service

Real estate fundamentals for retail properties are stabilizing, which bodes well for the ratings of retail REITs. Moody’s has a stable outlook on 17 of its 18 rated retail REITs and does not expect the investment-grade retail REITs to see material changes to their current ratings or rating outlooks over the next year.

Moody’s maintains a stable outlook on U.S. retailers and expects their net operating income to increase by 2 to 3 percent in 2012. Persistent unemployment combined with stock-market swings, a weak housing market, higher gas and food prices along with Washington politics will weigh on consumer confidence and spending. There is a significant bifurcation in performance among retailers. Retailers operating at both ends of the value spectrum – luxury merchants on one side and dollar stores, discounters and warehouse clubs on the other – are outperforming other segments such as apparel and supermarkets.

Retail REITs tend to have properties that are above average in quality, many of which have long-term leases with solid occupancies supporting relatively stable cash flows. “B” and “C” properties, in secondary and tertiary locations with weaker tenants, continue to feel the effects of the weakening economy more acutely than do their “A” counterparts. National retailers, however, are showing increased interest in leasing the “B” space and private investors have low-cost debt capital available to purchase these non-core properties.

Although recent releasing spreads have been trending flat to positive, this trend may be poised to turn negative. Leases signed at the market peak in 2004-2007 may incur roll-downs when retailers sign renewals. Small businesses such as the mom-and-pop stores are still lagging, which impacts in-line store leasing and the ability to increase rents. The vacancy rates for malls rose to 9.4 percent and strip centers were flat at 11 percent during 3Q11, according to REIS Inc. A positive note is that fresh retail concepts are spurring new store openings as retailers exploit the opportunity to capture attractive stores in quality locations previously occupied by failed retailers. Also helpful is the dearth of new retail development, allowing landlords to lease presently vacant space and regain pricing power.

Outlet centers performed well through the recession and are a growth-driver, prompting a number of REITs such as Taubman, Macerich, and CBL to explore this sub-sector. Both Simon (with Calloway REIT) and Tanger (with RioCan REIT) have entered joint ventures to build outlets in Canada, initially in Toronto, on acreage located approximately three miles apart. Although the U.S.-style outlet center has not existed in Canada to date, Canadians frequently cross the border to shop in the U.S. outlets.

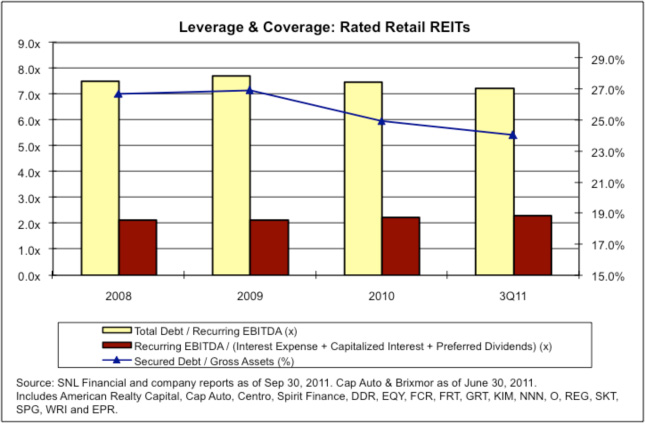

Most retail REITs are managing their balance sheets. Retail REITs rated by Moody’s have maintained relatively stable leverage metrics due to robust equity issuances, cost containment and astute balance sheet management.  For Moody’s rated retail REITs, average secured debt/gross assets (24 percent at YTD 3Q11) and debt/EBITDA (7.3x YTD 3Q11) declined, and fixed charge coverage increased to 2.3x at YTD 3Q11 due to improved earnings and decreased interest from refinancing partly due to unsecured bond issuances in 2011. See adjacent graph.

For Moody’s rated retail REITs, average secured debt/gross assets (24 percent at YTD 3Q11) and debt/EBITDA (7.3x YTD 3Q11) declined, and fixed charge coverage increased to 2.3x at YTD 3Q11 due to improved earnings and decreased interest from refinancing partly due to unsecured bond issuances in 2011. See adjacent graph.

Due to improved leasing, balance sheet management and liquidity, Moody’s does not expect ratings and outlooks, at least for the investment-grade retail REITs, to see a material change in the next 12 to 18 months.

You must be logged in to post a comment.