Demand on the Rise in Phoenix

At midyear, Phoenix’s office inventory totaled 108 million square feet. Transaction volume for the 12 months ending in July totaled $1.2 billion, corresponding to the more than 11 million square feet that changed ownership.

By Razvan Cimpean

All in all, the Valley of the Sun’s office market has lately been a shining success. At midyear, Phoenix’s office inventory totaled 108 million square feet of space, split almost evenly between Class A and Class B assets. More than 18 million square feet of office space was listed in the metro as of July, at average asking prices of $27.87 per square foot for Class A properties and $19.80 per square foot for Class B space. The metro’s overall vacancy rate was 17.9%, while urban and suburban locations reached much lower rates, at 12.0% and 14.6% in July.

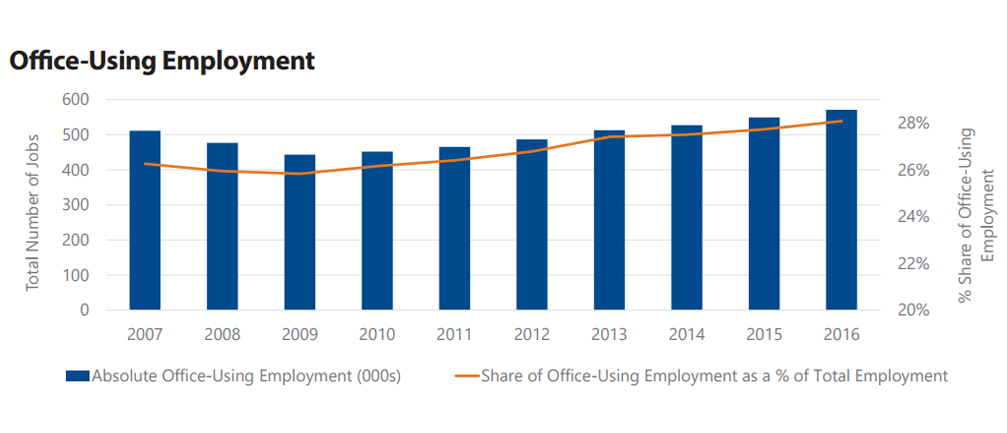

The metro added 21,700 office-using jobs during 2016, accounting for 41.5 percent of the employment pool. Employment in Phoenix improved by 2.6 percent year-over-year overall, well above the 1.5 percent national average. Leisure and hospitality added 13,600 new jobs, gaining 6.3 percent year-over-year through May, followed by education and health services (10,100 new jobs) and professional and business services (8,500 new jobs).

Development remains steady. Nearly 2 million square feet of space is under construction, and by the end of the year, 3 million square feet is scheduled for completion across the metro. The comeback of the Warehouse District in downtown Phoenix is expected to increase the demand for office space there.

Transaction volume for the 12 months ending in July totaled $1.2 billion, corresponding to the more than 11 million square feet that changed ownership. Mesa, Tempe–Mill and Scottsdale–Downtown were among the most expensive submarkets and generated the highest transaction activity.

You must be logged in to post a comment.