Deliveries to Test Thriving San Francisco Market

San Francisco’s office market continues to be bolstered by major companies willing to pay a premium to be in the country’s largest tech-driven metro, counteracting smaller players’ shift to less expensive areas.

By Razvan Cimpean

San Francisco’s office market continues to be bolstered by major companies willing to pay a premium to be in the country’s largest tech-driven metro, counteracting smaller players’ shift to less expensive areas. Dropbox and Okta are expected to move into their new corporate headquarters in Fall 2018. The two companies will occupy a combined 1 million square feet in SOMA and South Financial District. Meanwhile, Blue Shield of California joined a growing list of small and medium-size firms priced out of San Francisco. The health plan provider will relocate more than 1,000 employees to its new headquarters in Oakland.

Despite a slowdown in development activity over the last three years, office absorption remained well above the national average. However, more than 4.6 million square feet is scheduled for completion by the end of this year. The spike in deliveries will test the market’s ability to maintain tenant interest, as prices keep going up at a fast pace in most established submarkets.

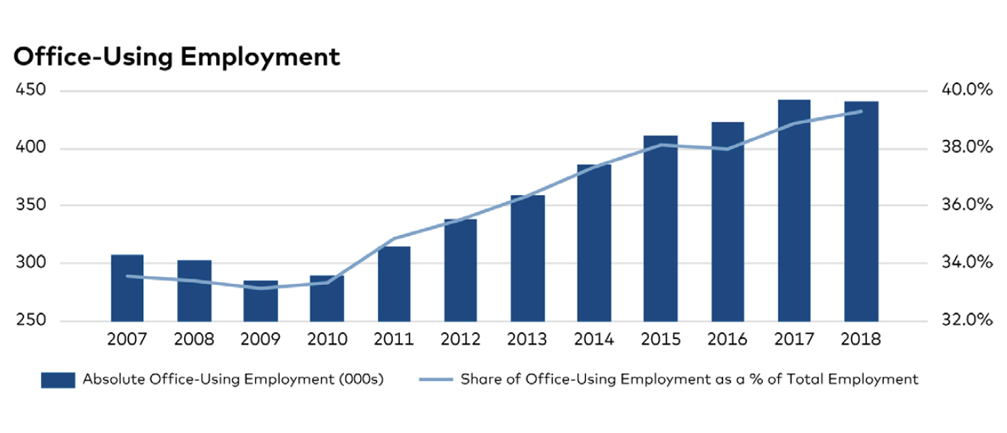

Some 26,000 jobs were added year-to-year through February. Office-using jobs account for 39.3 percent of San Francisco’s total employment pool of 1.1 million jobs. This is the highest level recorded in the metro.

Core urban submarkets continue to attract investors. The South Financial District has emerged as the most expensive submarket, with an average of $1,498 per square foot, surpassing the well-established North Financial District and South San Francisco.

You must be logged in to post a comment.