Davidson Kempner, AREP Buy Verizon’s Ashburn Campus

CBRE has arranged the $212.5 million sale/leaseback of Verizon's 128.5-acre office campus, former home of MCI, in Ashburn, Va.

By Adriana Pop, Associate Editor

Washington, D.C.–In a $212.5 million deal, Verizon sold the former home of MCI Worldcom (now MCI Inc.) in Ashburn, Va., to Davidson Kempner Capital Management, a global hedge fund with approximately $25 billion of AUM, and American Real Estate Partners (AREP), a Herndon, Va.-based operating company with approximately $2.8 billion in investment activity since 2003.

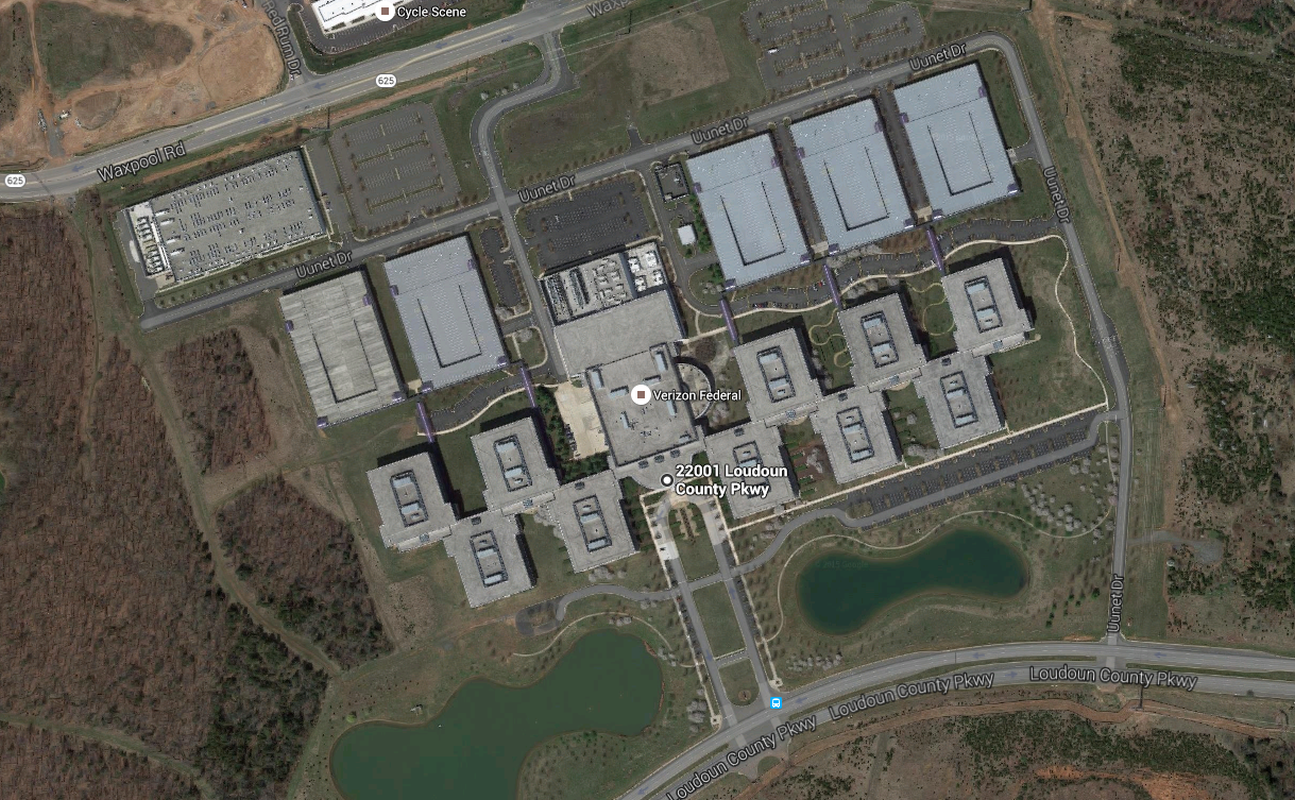

Located at 22001 Loudoun County Pkwy., the campus sits on 128.5 acres of land and offers 1.9 million square feet of office and service uses in 12 buildings. The property also includes five parking structures, a central plant and enough land to construct additional office buildings and a data center.

Verizon also leased-back 1,518,365 rentable square feet for one year, but will retain more than one million square feet for an additional 11 years.

The campus was initially developed as the MCI WorldCom headquarters. Verizon took ownership of the property when acquiring MCI WorldCom for nearly $6.75 billion in 2005, a few years after the communications giant had filed the largest bankruptcy case in U.S. history.

A CBRE team comprising Michael Blunt, Randall Heilig, Olesya Puente, Russell Ingrum, Matt Hargrove and Mike Shellow advised Verizon in the transaction. The Verizon team was led by John Vazquez, senior vice president and head of global real estate, and included James Tousignant, Douglas Dale and Gary Hucka, as well as internal Verizon counsel Diana C. Robinson. Richard D. Eckhard and Curtis Sano led the Holland & Knight team that provided legal representation to Verizon on all aspects of the transaction.

“This transaction had many complex layers, including the sale of a large corporate campus, the structuring of multiple leases, a land condominium and utility separation,” saidd Michael Blunt, CBRE senior vice president, Institutional Properties practice group. “Ultimately the hard work invested by all parties enabled Verizon to successfully monetize a corporate-owned campus, achieving its short- and long-term occupancy objectives while Davidson Kempner and AREP acquired a unique, Class A facility with long-term cash flow and significant upside potential.”

Image via Google Maps

You must be logged in to post a comment.