Dallas Office Pipeline Ranks 2nd Nationwide

The market placed in the top 10 U.S. metros across all key metrics, according to Yardi Research Data.

Dallas’ office sector continued to hold steady in the first half of 2025. The metro ranked in the top 10 nationally across all metrics, according to Yardi Research Data. However, the Metroplex’s office market followed national trends, with the office supply pipeline continuing to shrink.

Together with Boston, Dallas–Fort Worth stood out nationally for having the most office space under construction. In fact, more than half of the country’s total office pipeline was concentrated in 11 of the top 25 markets as of June, the same source shows.

Dallas’s office pipeline outpaces most markets

Dallas’ office development pipeline at the end of June reached almost 3.3 million square feet, ranking second in the U.S., according to Yardi Research Data. Only Boston (5.9 million square feet) fared better. Among peer metros, Austin (2.7 million square feet), Houston (1.8 million square feet) and Philadelphia (1.2 million square feet) rounded up the top 10 nationally.

When also taking into account projects in the planning stages, the market’s share jumped to 3.7 percent, well above the 2.2 national average. Austin (6.7 percent) took the lead, while peer markets such as Houston (2.1 percent) and Atlanta (2.6 percent) were at the opposite pole.

In June, Kaizen Development Partners broke ground on the $370 million Chalk Hill mixed-use project in Uptown Dallas. The development will consist of more than 400,000 square feet of trophy office space, a hotel and 61 condominiums, as well as retail space.

Office completions remain steady

In terms of completions, Dallas’ office sector saw 934,310 square feet of space coming online across seven properties, ranking fifth among the country’s top markets. This accounted for 0.3 percent of its total stock, slightly above the 0.2 percent national threshold.

Austin (288,349 square feet) and Atlanta (373,340 square feet) are some of the peer markets that fared worse. Additionally, the Metroplex’s completions increased almost 14 percent year-over-year.

Earlier this year, Granite Properties completed 23Springs, a 626,215-square-foot office campus in Dallas. The developer financed the construction of the three-building property with a $265 million loan from Bank OZK, according to Yardi Research Data.

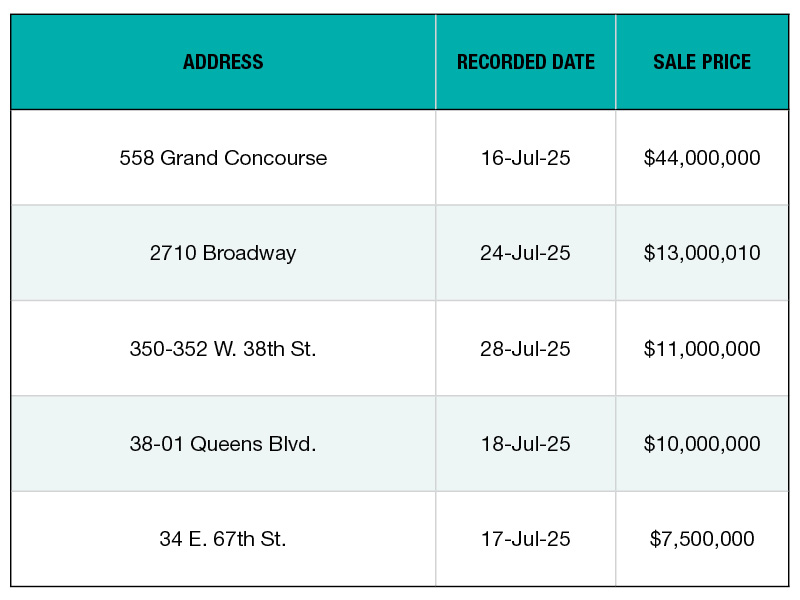

DFW assets trade for less than national average

Dallas’ office investment volume in the first half of the year accounted for $872 million, ranking in the top 10 nationally. Assets in the Metroplex traded for $163 per square foot, slightly below the $189 national average.

Properties in peer markets such as Phoenix ($185 per square foot) and Austin ($221 per square foot) commanded higher prices, while Houston ($109 per square foot) and New Jersey ($106 per square foot) assets changed hands for less.

In May, Skywalker Property Partners purchased The Crossings I, a 232,541-square-foot property in Dallas, through its newest fund. Goddard Investment Group previously owned the 10-story building.

Vacancy rate continues to rise

Dallas’ office sector had a vacancy rate at the end of June of 23.2 percent, considerably above the 19.4 percent national average and 140 basis points higher year-over-year. Peer metros Atlanta (19.5 percent) and New Jersey (18.4 percent) fared better, while Austin (28 percent) had the most available space nationally.

Despite Dallas-Fort Worth’s vacancy rate being high, the market still benefits from positive absorption. In June, Asset Living renewed its 13,168-square-foot lease at Addison Circle One. Franklin Street Properties owns the 293,787-square-foot building.

Law firms continued to drive leasing activity across the U.S. office market, a trend that has also made its mark in Dallas. Reflecting this national momentum, Jackson Walker LLP recently renewed and expanded its presence at KPMG Plaza, growing its footprint to a total of 147,915 square feet.

The Metroplex’s listing rates during the same month clocked in at $31.4, marking an 8.3 percent year-over-year increase. The market’s rate was similar to the national index ($32.9), but below peer metros Atlanta ($35.2) and Austin ($45.3).

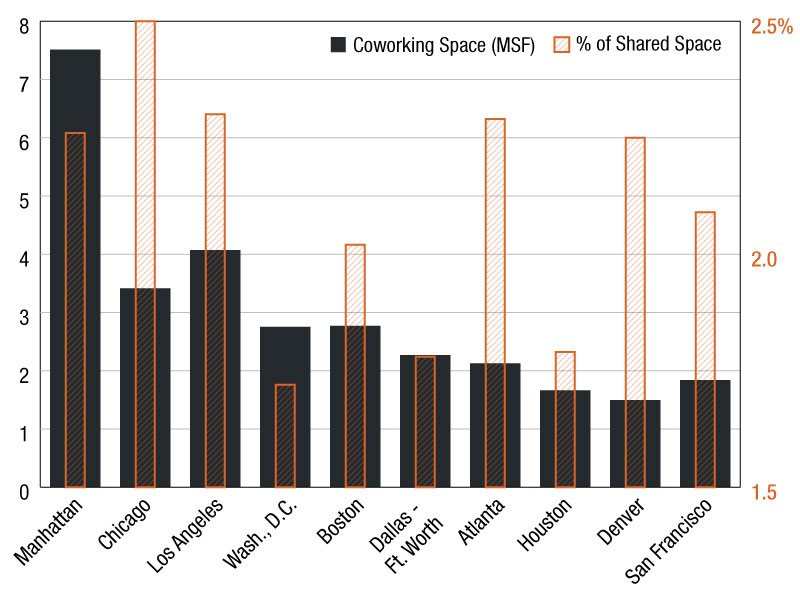

Coworking footprint shrunk in the first half of the year

Dallas’ coworking inventory at the end of June clocked in at roughly 5 million square feet across 275 locations. This marked a slight decline from the end of last year, when the metro had 284 coworking spaces totaling 5.2 million square feet.

The market’s shared space inventory accounted for 1.7 percent of its total office footprint, 30 basis points below the national average. Among peer markets, Atlanta (2.3 percent) and Phoenix (2 percent) had more coworking space, while Philadelphia (1.5 percent) was at the opposite end.

Regus (633,849 square feet) remained the coworking provider with the largest footprint in Dallas, having 37 locations. The company was followed by Lucid Private Offices (417,489 square feet) and HQ (371,133 square feet).

You must be logged in to post a comment.