CRE Regulatory Review: Tariffs, Taxes, Immigration and More

Financiers and advisors weigh in on governmental actions poised to disrupt today’s mature, robust and increasingly competitive market.

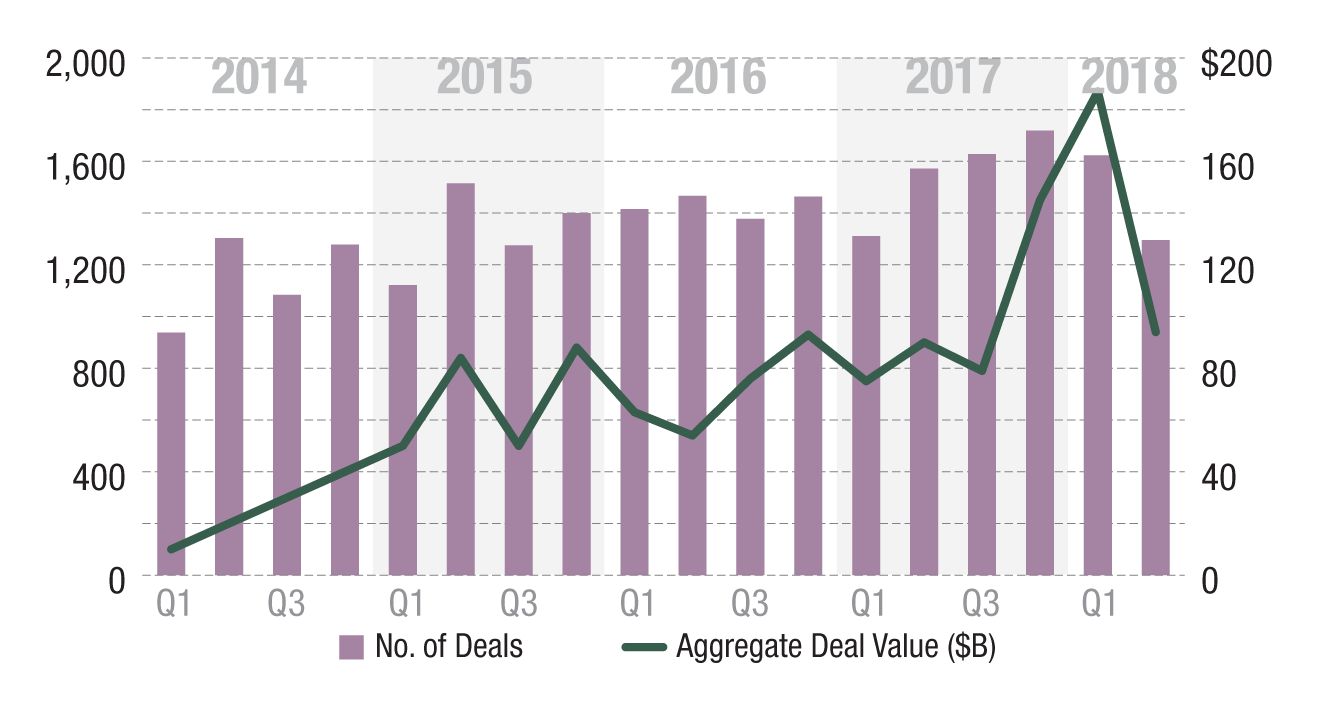

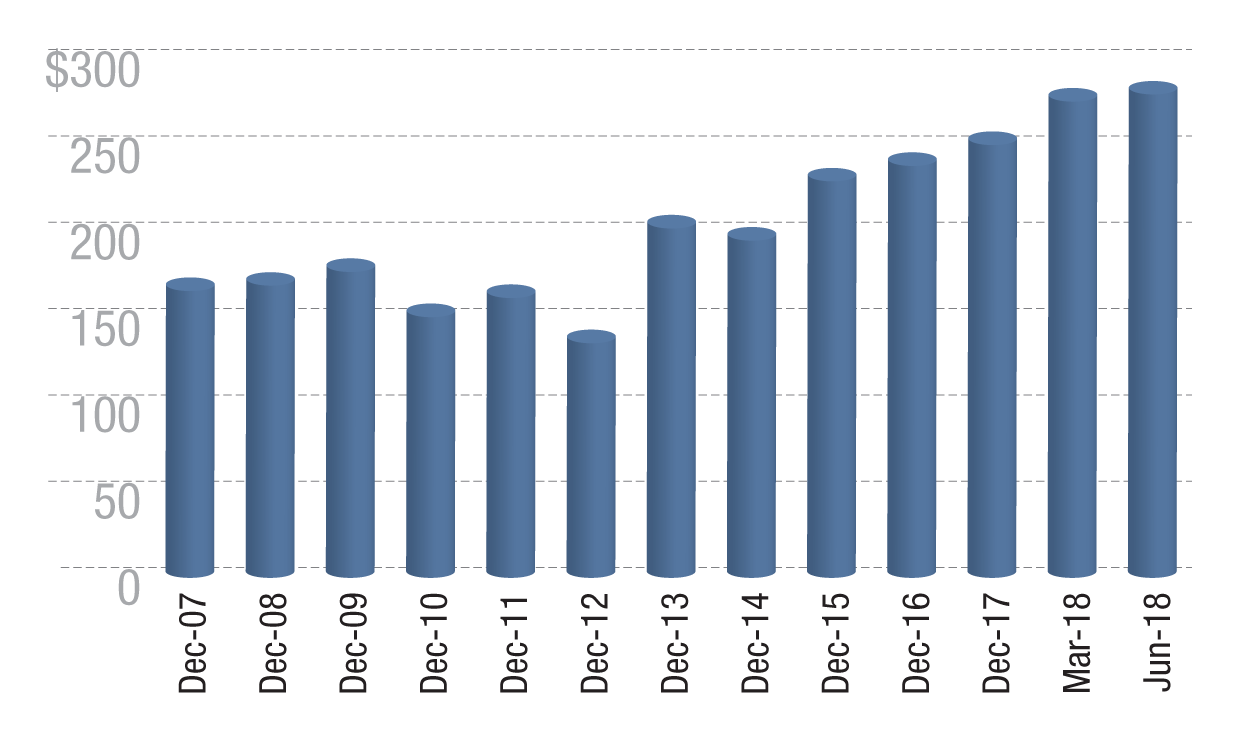

Nearly a decade into the economic recovery, the U.S. commercial real estate market is enjoying its longest bull run yet in terms of valuations and rents. But while first quarter 2018 was one of the busiest of recent record for transactions, the heated market created a wait-and-see attitude as the year went on. Private real estate funds, for example, are currently sitting on more capital than they can expediently deploy.

“Whether current market valuations are inflated is probably the key issue in terms of real estate transactions,” suggested BDO Partner & National Leader Stuart Eisenberg. “The key questions are: ‘Have we hit the precipice, is there some sort of cleanup going on right now and are prices going to crest and fall back down?’”

Meanwhile, as the cycle matures, there are changes in trade, fiscal and immigration policies that could have widespread implications—some positive and some negative—for commercial real estate next year. CPE examines some of the weightier ones here.

Interest Rates & Inflation

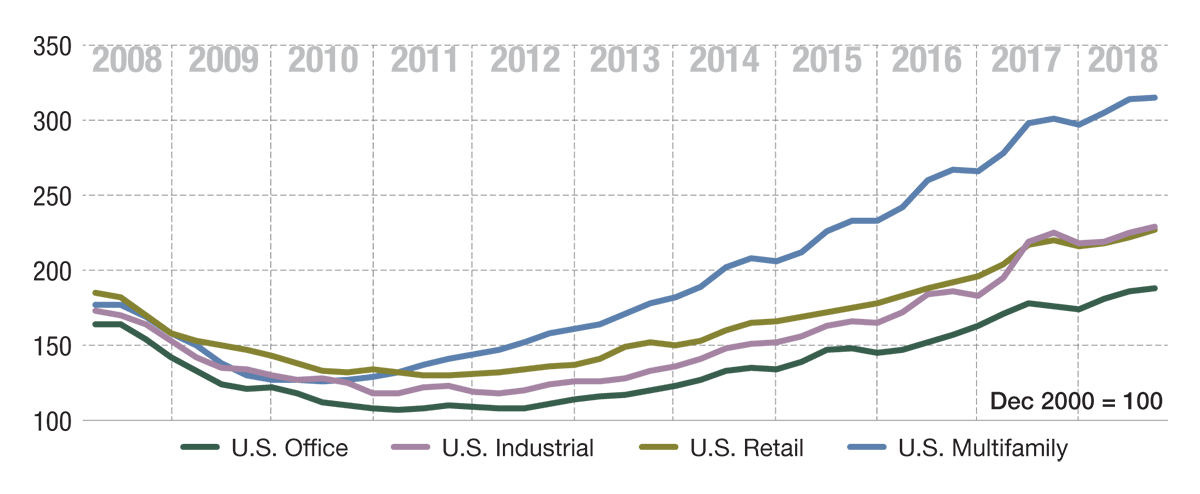

While rent growth has begun to slow across property sectors, rents are still growing in line with a booming economy and favorable job market. For this reason, the Fed’s signaled interest rate hikes have had a nominal effect on the commercial real estate financing environment.

Peaking Prices

The rising inflation that precipitated the interest rate hikes, however, has affected the cost of developing new properties. “There’s no question that inflation has shown up in construction inputs,” said Gabriel Silverstein, managing director of SVN | Angelic. “But technology continues to (improve) construction techniques, which could balance things out as we find ways to build differently.”

Trade tension

Geopolitical risk, however, is by far the most important issue for the real estate industry, argued Silverstein. “There doesn’t seem to be a real risk of recession in the next two years, unless there’s a trade war or other major geopolitical event,” he said.

Adam Ruggiero, head of real estate research for MetLife Investment Management, agreed: “The potential for an escalation in the ongoing trade dispute with China remains a concern, particularly for West Coast industrial markets, but, for now at least, the impact of the trade restriction has been relatively positive for commercial real estate.”

Despite these headwinds, the industrial market continues to thrive. Cap rates have been declining for most of this cycle, while asset prices have soared to record levels. But for how long?

In September, the Trump administration announced that a 25 percent tariff on $200 billion worth of Chinese imports will go into effect next year, and already the market has shown what could result from punitive trade policies. Since January, domestic steel prices have trended sharply upward, far outpacing rates in Europe and Asia, reported IHS Markit. And, from August to September, steel imports fell nearly 26 percent, according to data from the American Iron and Steel Institute.

According to Paige Hood, chief investment officer and senior portfolio manager of PGIM Real Estate Finance, the tariffs could potentially increase the costs of goods and trigger a reduction in retail sales.

Meanwhile, development profits continue to decline as a result of rising material costs, which have increased over the past three years due to steel and lumber tariffs and global demand for these commodities. Compressing profits further, land and labor costs are significantly higher, too. These changes, Ruggiero noted, have “restrained the pace of supply growth despite healthy demand and a positive financing environment.” On the bright side, a slowdown in new deliveries could help to alleviate pricing pressures.

Tax Law Changes

Intended to stimulate the economy, the new tax law passed at the end of 2017 bestowed a number of benefits on the commercial real estate industry, though none have been market-making.

Moderating Marketplace

“As it was passed, tax reform doesn’t structurally (affect) financing in a positive or negative way,” explained Silverstein. “But generally speaking, what’s positive for the economy is going to be good for financing.”

And because mortgage rates have not risen as much as 10-year Treasury rates have, the increase in cost of capital to borrowers has been negligible.

For the industry at large, however, the tax cuts introduced by the new legislation have provided a welcome boost to consumer spending. This trend has sustained growth in brick-and-mortar and online retail sales, in turn, fueling demand for warehouse space.

And there are other perks of tax reform for real estate finance companies. “New mortgage REIT dividend rates have made some of our strategies much more tax-efficient than they used to be,” said Thorofare Capital CEO Kevin Miller.

Opportunity zones, a key provision of tax reform, represent a boon for investors with pent-up capital—and a $6 trillion untapped market, according to the Economic Innovation Group. In addition to making economically distressed communities more attractive to developers, the economic development tool incentivizes investors to deploy significant funds into disadvantaged communities in what Miller described as “a tax-advantaged way that will produce a win-win result.” The opportunity zone vehicle promotes long-term investment, with the aim of delivering sustainable community benefits, such as growth in jobs and local businesses.

“We think that the tax reform that was bilaterally passed this past year is potentially a great tool (for investing in) secondary and tertiary markets,” Miller continued. “Pending further guidance from the Treasury and, if it makes sense, we intend to participate in this strategy and deploy meaningful funds into a well-diversified portfolio of opportunity zone properties across the nation and across several different asset classes.”

Pent-Up Capital

Opportunity zones will likely increase liquidity in the commercial real estate industry and positively impact developers. “Now we’re going to see capital from other asset classes wanting to go into real estate to defer taxes,” suggested Shlomi Ronen, managing principal & founder of Dekel Capital.

Although recent guidance has sparked new interest by investors in opportunity zones, there are still some unknowns regarding the new program. For one, the opportunity funds are not subject to SEC or FINRA regulation. “Investors need to (scrutinize) the track record of the developer,” cautioned BDO Tax Managing Director Marla Miller. “What’s exciting to investors is that appreciation won’t be taxed, but that benefit alone is not the driving force—just the icing on the cake.”

Border concerns

Immigration is another issue that could exacerbate an already severe labor shortage, continuing to lengthen construction timelines and increase project costs. In the long term, immigration might become less of a problem thanks to automation, suggested Silverstein, since advancements in artificial intelligence could reduce the need for labor.

“Higher levels of immigration, particularly of skilled immigrants, mean more workers, more residential demand, and higher consumer spending, supporting demand growth across all property types,” said Ruggiero. On the other hand, he added: “A restrictive immigration policy, by contrast, will ultimately limit job growth, slowing demand for the office and apartment sectors in particular.”

You must be logged in to post a comment.