CPE Midyear Outlook: Is It Only About Uncertainty?

There's opportunity in the market for the trained eye, according to our panel of industry experts.

The backdrop for CRE seems to still include many of the usual suspects going into the second half of 2025: interest rates, tariffs, geopolitics, potential recession. There is, however, change in the air.

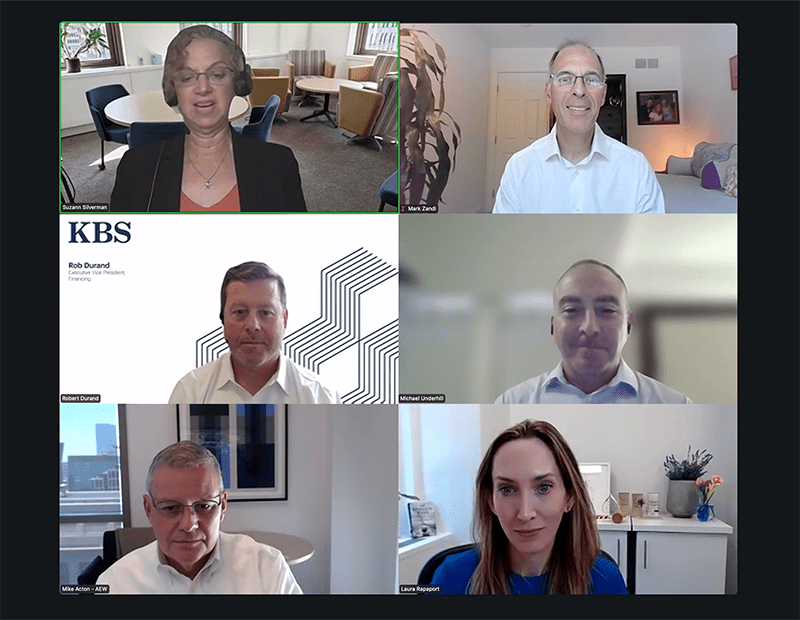

Panelists at Commercial Property Executive’s 2025 Midyear Outlook webinar, moderated by Editorial Director Suzann Silverman, shared a consensus: While times remain uncertain, capital within some sectors is rising. By sticking to the fundamentals and paying attention to asset values, CRE still holds opportunity for the second half of the year.

Mark Zandi, chief economist at Moody’s, started by sharing that, throughout his 35 years as an economist, “There are few times when I have been as unsure about the economic outlook as I am today.” Other instances include the COVID-19 pandemic and the Great Financial Crisis.

Zandi predicts that the next six to 12 months will be “uncomfortable” as unemployment rises and creates a “bumpy road” in the market. With tariff rates coming in around 15 percent, Zandi sees inflation rising to approximately 3 to 4 percent at this time next year, as opposed to the current 2.5 percent ballpark.

“We’re going to go from growth that’s close to 2 percent, that’s roughly where we’ve been, to closer to 1 percent by this time next year. That’s not a recession,” he added. “So, I think we’ll be able to avoid an economic downturn. But that’s going to feel uncomfortable.”

READ ALSO: Forecasting in a Time of Uncertainty

There still are risks with rising oil prices and long-term interest rates as tariffs, immigration policies and Middle East conflicts continue to evolve. “The economy came into this period performing very well and was quite resilient, and I think that’ll continue to shine through,” Zandi said.

Office supply and demand

While return-to-office mandates have led to more in-person work, there is still an imbalance between office supply and demand across the country. Big swings in the space have brought us to a unique point: We are starting to see demand for office space outpace supply for the first time in 25 years, shared North Bridge Founder & CEO Laura Rapaport.

The market has shifted to office conversions, and Rapaport has her doubts. “Not all buildings are created equal,” she said. “The one thing you can’t move about a building is location. So, does it have the right elements to be converted?” These older office buildings were constructed for office use, and not every office building can be converted to multifamily or have additional uses.

Some metros are also struggling as office delinquency rates continue to rise. Michael Underhill, CIO of Capital Innovations, shared that by 2026, the rates could rise to 14 percent, up 11 percent from late 2024. He also shared that Austin and San Francisco show lagging performance.

“It’s a very have/have-not market,” echoed Robert Durand, executive vice president of finance at KBS.

Are foreign investors still interested in U.S. ventures?

With uncertainty being sticky, the panel discussed what this means for foreign investors. While some markets are still performing well, speakers agreed that foreign investors are nervous.

“We’re disengaging from the rest of the world, and that makes the rest of the world nervous about investing in the U.S. and the value of the dollar,” Zandi commented. “Up until recently, we were in a risk-off environment. Capital flows in, interest rates fall, the dollar goes up. We saw the direct opposite happen here: Interest rates went up, the dollar went down and still hasn’t recovered. So that does gives a sense that the U.S. is on watch and investors are nervous about that.”

Over the next six to 12 months, taking into account the changing of Federal Reserve leadership, the independence of the Fed will be more telling about the market and how foreign investors will play into CRE’s future.

Michael Acton, Head of Research and Strategy for North America at AEW Capital Management, has observed a similar mood when it comes to foreign investors. Canada and Australia, for example, have been more inclined to pull back their U.S. allocations. However, entities from Germany, the Netherlands and Japan are still allocating into the market, albeit being involved in less risky transactions.

Stick to the basics

There’s still room for strategizing in the second half of the year, panelists agreed. Public markets are generally doing better than private ones, Durand shared, with CMBS loans going well for the office sector. KBS is looking to move into markets that generate less risk, considering ongoing uncertainty. The firm is doing this by keeping things simple while a clearer image unfolds in the coming months.

“There are some opportunities in the debt space right now, because there are a lot of opportunities on the value-add side,” Durand said when asked about investment. “I think that the challenge is picking them right now, in this environment.”

READ ALSO: Who’s Buying Distressed Office Buildings?

Scaling back and keeping it simple while reevaluating the fundamentals is the way for Laura Rapaport as well.

“It’s about expectations being realistic, both on the business plan and on the amount of leverage that an investor is looking for,” she shared. “You can’t move real estate, you can move the tracks around it, but not the actual real estate itself. And so, for us, we look at the sound fundamentals of real estate.”

One aspect of this is paying attention to location and how the surrounding area is doing. A Class A office building in New York City has the potential, of course, to fare better than a Class C asset that was never fully leased, in a less sought-after area.

“It’s about the perspective of what we’re seeing. But I think there are solutions to that. Coupled with realistic expectations and more of a stabilization as well within the market,” she said. “So I think that’s something we’re also seeing, taking a more refreshed view on what’s realistic here for the particular asset in this market at this point in time.”

You must be logged in to post a comment.