CRE Loan Maturities Cushioned by Willing Lenders

With yield-hungry investors and lenders competing for their business, owners of preferred assets will find refi options aplenty.

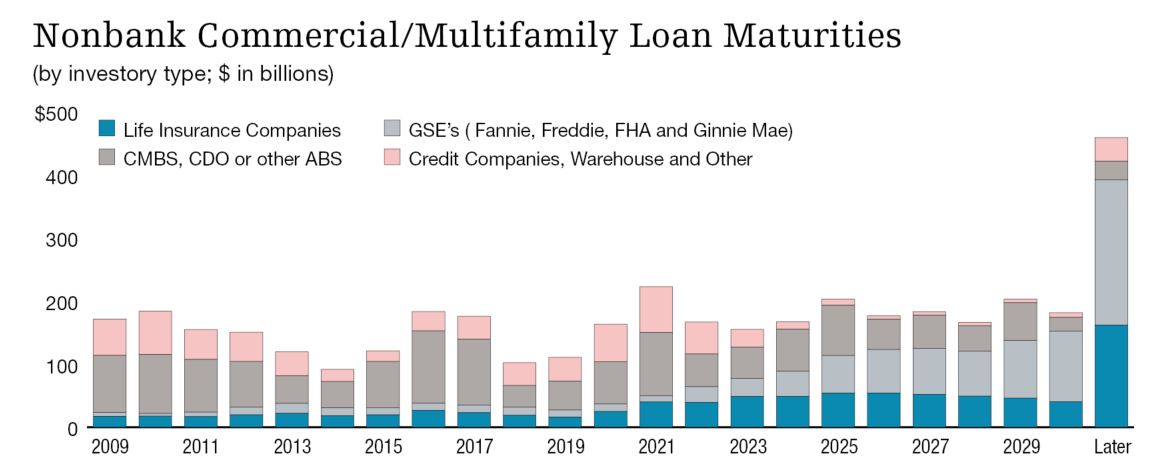

As $430 billion of the $2.3 trillion in outstanding commercial and multifamily mortgage debt matures in 2021, borrowers with cash-flowing properties will find mortgage capital waiting to soften the landing.

“There’s a strong appetite for lenders to make loans right now,” said Jamie Woodwell, vice president of commercial real estate research for the Mortgage Bankers Association. ”That means there’s plenty of capital looking to get invested in mortgages and equity, as well.”

The big challenge in an increasingly vaccinated post-COVID-19 world will be identifying which properties will be able to support debt service. “Lenders are looking at what a property might be facing shortly to get through the pandemic and then what conditions might look like on the other side,” Woodwell added.

As was made abundantly clear in 2020 at the height of the pandemic, generally speaking, industrial and multifamily properties with maturing debt will find refinance options aplenty, with yield-hungry investors and lenders competing for their business.

Bridge financing can help multifamily borrowers with maturing debt and underperforming properties, according to Mark Jarrell, Greystone’s head of portfolio lending.

“As some properties have been thrust into a more ‘transitional’ phase in the last year, due to occupancy challenges and/or lower-than-expected collections, bridge financing can serve as an interim solution for maturing loans while the client prepares for long-term financing with HUD, Fannie Mae, Freddie Mac or CMBS,” he explained.

Economist Victor Calanog, head of commercial real estate economics for Moody’s Analytics, points out that apocalyptic forecasts have not come true to the extent first predicted, noting that prior to 2020, there was likely less “overreach by industry players and market participants.”

In the meantime, the International Monetary Fund, which initially projected that the COVID-19 crisis would cause the U.S. economy to contract by 8 percent is now projecting it will be reduced by just 4.3 percent this year.

In other words, lenders upheld standards, and borrowers exercised self-control at the buffet. Debt service coverage ratios never fell to worrisome levels and there has been little evidence of systemic fire sales so far, though it’s also possible another shoe will drop.

In March, CMBS research firm Trepp reported that hotel and retail CMBS delinquency rates in February saw the largest improvement since the beginning of the pandemic, following eight months of steady improvement—despite the devastation in both travel and hospitality and bricks-and-mortar retail.

In February, lodging-backed CMBS clocked in at 16.38 percent delinquent, down from 22.96 percent 30-plus days past due six months ago. Although the pandemic accelerated e-retail trends by a decade, the delinquency rate for CMBS loans backed by the beleaguered sector fell to 11.83 percent, down from 14.88 percent six months earlier.

What’s more, the overall CMBS delinquency rate fell 78 basis points in February to 6.80 percent, which compares favorably to the height of the Great Recession and the all-time high in July 2012 of 10.34 percent delinquent. The 6.80 percent rate, however, is almost quadruple the 2.04 percent overall CMBS delinquency rate a year ago.

Looking at commercial real estate loan maturities in 2021 by capital source and loan type, Woodwell points out that there’s a relatively low share of longer-term loans coming due or 1 percent of the government-sponsored enterprises and FHA balances. In addition, only 6 percent of life insurance loan balances are coming due in 2021 with 16 percent of CMBS totals coming due and 30 percent of investor-driven lender and other loan balances coming due.

Many of the GSE loans made in 2010 or 2011 were already refinanced or the property was sold or the balance was paid down because of low-interest rates and favorable market conditions. Similarly, life company loans—perhaps 7-year loans made in 2014—have already been refinanced, paid down or the underlying property sold.

That leaves shorter-term, adjustable-rate loans from the CMBS market or loans made by investor-driven lenders that were made more recently, perhaps to reposition a property, or as a bridge from construction to permanent financing, or even just for a shorter hold. In contrast to the long-term, fixed-rate loans that benefited from refinancing at the lower interest rates, the shorter-term adjustable-rate loans naturally gravitated to the lower cost capital.

Signs of distress

Investors have already come up with four major property categories in terms of pandemic impact, according to Woodwell: 1) countercyclical property types like industrial, data centers, single-family rentals and self storage that received a boost from the pandemic; 2) property types like retail that were undergoing systemic changes that were hastened by the pandemic; 3) properties like office that may have been fundamentally changed due to COVID-19; and 4) properties like multifamily, grocery-anchored retail centers or hotel, which will likely pick up again when the virus is in the rearview mirror and the economy has recovered.

That’s not to say there hasn’t been distress across the board and that we won’t see plenty more before this is over. A recent Moody’s report reveals that the distress in the multifamily sector, for example, was concentrated on the rent side, which was hit hard by lockdown policies and eviction moratoriums that slowed new household formation. And those rent declines were felt more harshly in urban than suburban markets. In 2020, San Francisco’s effective rents plummeted 14.9 percent, followed by New York City at a 12.2 percent decline, San Jose at negative percent, Washington, D.C., at 8.1 percent and Oakland-East Bay falling 5.9 percent.

Moody’s also predicts office rents will suffer as remote working eventually impacts space demand. Despite reports of office vacancies as high as 90 percent at the height of the pandemic as workers hunkered down at home, the national office vacancy rate rose by just 90 basis points, from 16.% at the end of 2019 to 17.7 percent at the end of 2020.

But so far, not only have lenders been willing to grant multiple forbearances but they’ve also pushed out loan maturity dates to stave off taking losses. As the economy reopens and transaction volumes rise, however, there will be price discovery for all commercial real estate types—even multifamily and industrial–and greater opportunities for investors to capitalize on unstable loan maturities.

Lender for everyone

Brian Stoffers, global president of Debt & Structured Finance for Capital Markets at CBRE, doesn’t anticipate much distress coming out the $430 billion mountain of debt set to mature in 2021, with a few well-reported exceptions in the hotel and retail sectors.

“There is so much capital available, not only for equity but for debt,” he said. “We closed business last year with over 370 different lenders, including over 170 different banks, and the supply of available debt is not restricted whatsoever.”

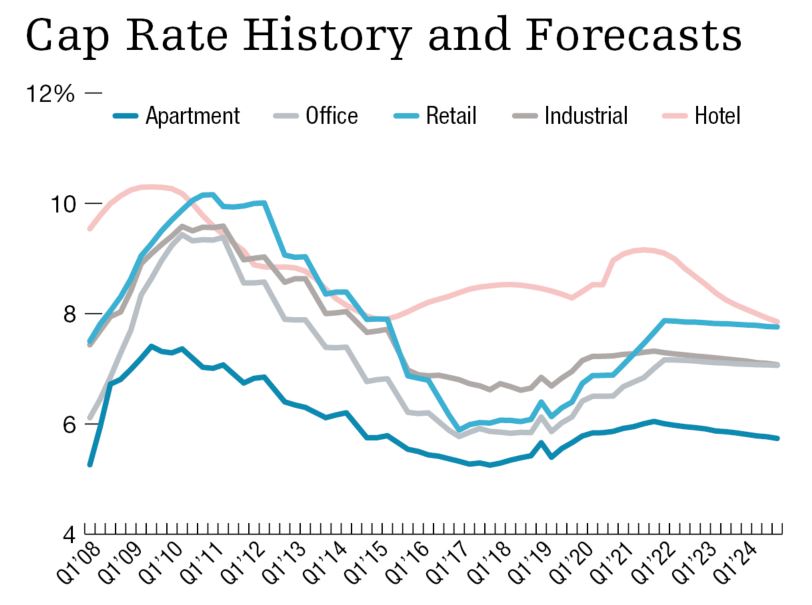

In 2020, cap rates for both industrial and multifamily properties declined, and even office, while more problematic to refinance this year, was buffered by seven- to 10-year leases. If you’ve got maturing debt this year, Stoffers advised not waiting until the last quarter to start looking at alternatives, like debt funds willing to make bridge loans to higher occupancy, for instance.

“There is typically is an outlier—a lender willing to go the extra mile for the transaction, because there is so much competition,” he added.

You must be logged in to post a comment.