CRE Investors Find Bright Spots Amid Headwinds: Deloitte

Taking a closer look at the firm’s 2026 outlook and what it means for the industry.

Deloitte’s 2026 commercial real estate outlook cites global macroeconomic volatility and policy uncertainty for dimming commercial real estate executives’ optimism for the industry slightly compared to last year but notes the recovery is only pausing, not stopping.

“The sentiment is a net positive even while this uncertainty exists,” Sally Ann Flood, vice chair & U.S. real estate sector leader, told Commercial Property Executive.

Deloitte surveyed more than 850 commercial real estate executives in firms in North America, Europe and Asia Pacific in June and July about investment priorities, growth, workforce, operations, technology plans and anticipated changes for commercial real estate fundamentals over the next 12 to 18 months.

The overall sentiment index was 65, well above the lowest point in 2023 of 44, but slightly down from last year’s high of 68.

While trade and regulatory uncertainties, like the tariffs implemented by the U.S. federal government over the past several months, have complicated decision-making, Deloitte states growth opportunities in the CRE industry exist for those who remain agile and forward-thinking. The report also noted there are bright spots, including a recovering U.S. investment market, growing demand for data centers and other commercial real estate assets, and emerging forms of capital to refinance existing properties or buy new ones.

Nearly 75 percent of respondents plan to increase investment levels over the next 12 to18 months. The report also showed 83 percent of respondents expect their revenues to improve by the end of the year.

Top 5 concerns

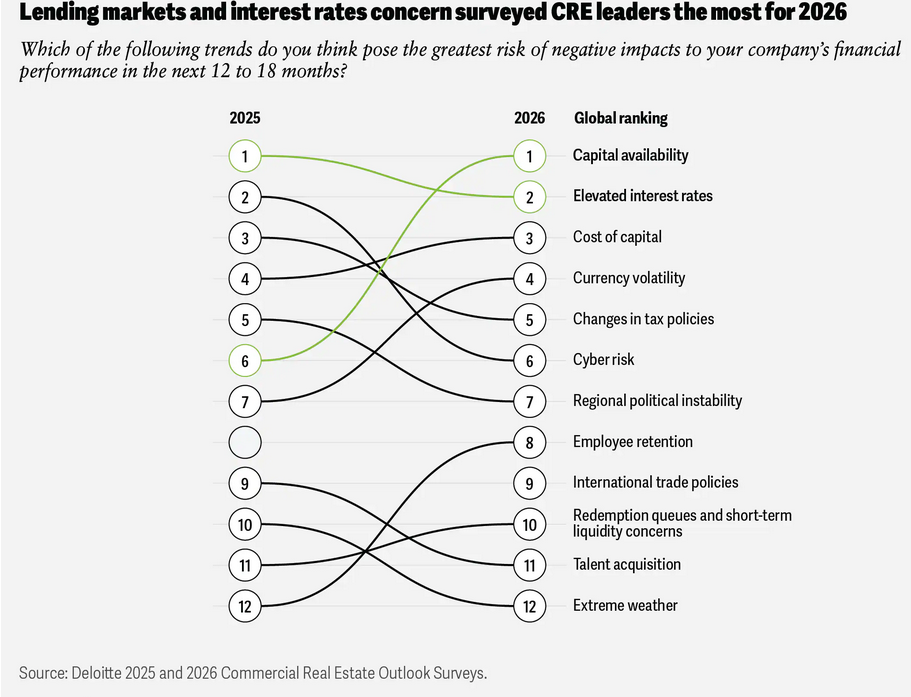

Respondents cited the top five concerns that could pose the greatest negative impact to their firms as capital availability, elevated interest rates, cost of capital, currency volatility and changes in tax policy. Cybersecurity fell from number two last year to number six, indicating that macroeconomic risks were taking precedence.

“It’s just outside the top five,” Flood noted. “I think for all of our clients and board-level conversations, cyber risk is still always on the agenda. But for these executives, it did drop out of the top five.”

Deloitte states more than 50 percent of respondents reported their companies are facing property loan maturities in the coming year. In the U.S. alone, there are more than $1.7 trillion in commercial mortgages, and many have delayed maturity through “extend-and-pretend” deals that just push out the due dates.

READ ALSO: The Case for CRE in Today’s Pricing Environment

Flood said there is a “tale of two debt markets.” She was referring to new debt origination versus existing loans facing maturity that are often stressed by refinancing and defaults. Of those responding to the survey, 21 percent said they expected to pay off their loans in full at maturity; 34 percent planned to extend or modify their loans and 15 percent expect their loans to reach foreclosure or to begin the process of handing the assets back.

“For those legacy loans, there’s still those refinancing difficulties and challenges,” Flood said.

However, she said they are seeing “a brighter story on new debt origination.”

The report noted new loans often come with better terms and valuations and

success will depend on how well they mitigate loan risk within their existing portfolios while also taking advantage of improved new-loan conditions.

New loan volume increased by 13 percent from the end of 2024 through the beginning of 2025 and by more than 90 percent year-over-year, according to Deloitte.

Despite concerns from the respondents about availability of capital, access to debt capital has improved and Deloitte noted it could even become more robust. As property values have reset, there is more liquidity as some lenders and borrowers begin to reengage.

The report noted all sectors have seen an increase in active lenders with alternative debt sources such as private credit funds and high net-worth individuals leading the way. These sources accounted for 24 percent of U.S. commercial real estate lending volume in 2024, exceeding the 10-year average of 14 percent. Deloitte stated there was $585 billion in commercial real estate dry power ready for deployment as of August.

The report noted CMBS lenders and banks are also slowly coming back to an “evolved commercial real estate debt market.” CMBS lending jumped 110 percent year-over-year in single-borrower deals through early 2025, Flood added.

Sector spotlights

Asked which asset classes they believe will present the greatest opportunity for investors over the next 12 to 18 months, the digital economy, which includes data centers and cell towers, moved one spot to top the list this year. Logistics and warehousing placed second, followed by industrial and manufacturing, multifamily, office suburban, life science/biotech, office downtown, hotel/lodging, senior care and single-family rentals to round out the top 10.

Flood said Deloitte research showed in nine major markets, 100 percent of new data center construction is preleased.

“That is really clear as to where the money is going,” she told CPE, adding the growth of artificial intelligence is part of the driving factor in the data center demand.

Deloitte noted the continued trend of onshoring and nearshoring of high-value manufacturing is likely to continue over the next 12 to 18 months and increase demand for specialized manufacturing facilities and advanced logistics. While the pace of leasing activity has slowed slightly in the industrial sector, Deloitte expects long-term growth and users with specific needs contributing to a solid build-to-suit development pipeline.

“When you listen to some of our large public REITs, they have such a robust development pipeline. It doesn’t surprise me that industrial is up there,” Flood remarked.

She noted that both suburban and downtown office moved up two spots on the list, to 5th and 7th, respectively.

“I must say, it was a surprise to me but also welcome in that there is a shift to office re-entry programs. I think there is a real look at the quality of the assets, which is leading to high competition for some of those lease deals,” Flood said.

Lack of new construction in the office sector is also contributing to demand for the high-quality assets in both downtown and suburban markets.

AI challenges

The survey asked respondents about their experiences integrating AI into their organizational workflow. The responses indicated there’s growing pains with 19 percent saying they believe their organizations are still in the early stages of their AI journey. Twenty-seven percent cited challenges with implementation, including technical issues, lack of expertise or resistance to change.

Flood said the use of AI in commercial real estate will be transformative once the practical applications that offer clear, measurable returns are attained.

“When they’re doing a more targeted deployment, there’s a lot more potential for impact,” she shared. “We’re seeing some success, and it came through in the survey, like tenant relationship management, drafting news leases and portfolio management.”

You must be logged in to post a comment.