CRE Equity Investors Pile Into Private Debt

What's driving them to make the shift?

Institutional equity investors are increasing their allocations to private credit funds with the goal of avoiding fundamental risk while still capturing sizable returns.

The approach checks multiple boxes in an environment that’s challenged by high interest rates and volatility, experts say. While an acceleration of investment sales volume in late 2024 and early 2025 suggested that property prices were finally resetting, many equity providers weren’t convinced that distress couldn’t drive them lower. That’s especially true regarding values in the office sector, as well as for certain retail projects and warehouses in oversupplied markets.

Instead, investors are funneling more capital into private debt strategies that stretch the amount of proceeds a borrower receives to 70 or 80 percent of a deal’s cost or value from the senior loan ceiling of around 55 or 60 percent. In return, they are pocketing consistent income rather than depending on rent growth, occupancy gains and appreciation.

More importantly, investors can achieve risk-adjusted returns that are commensurate with equity returns. As of June 2024, when it reached $5 billion in assets under management, for example, Harbor Group International’s two-decade-old credit platform had generated an average internal rate of return of around 12 percent, according to the investment management firm.

I don’t think saying that credit investors can make almost as much money as someone in the equity position in this environment is an opinion—it feels like a fact.

—Matthew Jones, Managing Director & CIO of Credit Investment, Harbor Group International

“I don’t think saying that credit investors can make almost as much money as someone in the equity position in this environment is an opinion–it feels like a fact,” said Matthew Jones, a managing director & CIO of credit investment at Harbor Group, which among other strategies invests equity, mezzanine debt and preferred equity in the multifamily and office sectors. “If you’re underwriting responsibly in equity today, you’re probably hitting low double-digit returns.”

As a result of this shift, private credit providers are flush. Case in point: In February, Heitman closed a high-yield debt fund after raising $806 million, some $206 million more than its goal. The vehicle seeks to “capitalize on dislocations in the capital markets” and will aim for returns between core-plus and value-add equity strategies. Heitman’s overall debt platform provides structured senior debt, mezzanine financing and other products.

“We’ve seen capital sources of all types, regardless of where they’re domiciled, showing more interest in having private credit strategies in their portfolios,” said Jon Lindell, executive vice president in the real estate debt group at Heitman. “Seemingly every day, there’s more uncertainty surrounding property valuations and economic growth prospects, and they see private debt as a way to insulate themselves from risk.”

Long-term trend

As a gauge of the growing interest in private credit strategies more generally, MSCI and Moody’s Corp. are creating a solution to assess the risk of such investments, which are expected to grow to roughly $3 trillion in 2028 from around $2 trillion today. But from the perspective of Walker & Dunlop’s Susan Mello, the move toward private credit strategies began a few years after the Great Financial Crisis.

First, new regulations restricted bank lending, leaving a void in the market, according to Mello, an executive vice president and group head of capital markets for the firm. And second, falling interest rates sent investors searching for higher-yield opportunities. At the time, private debt vehicles were considered a fixed-income alternative vs. an investment in real estate. But over time, investors grew comfortable with the asset class, which focused more attention on properties and helped set the stage for firms like Blackstone to tap into the retail market through non-traded REITs, added Mello.

More recently, high-profile bank failures and the retreat of banks from the market amid the spike in interest rates in 2022 fueled opportunities for private debt funds and further expanded investor intrigue with the vehicles. Private debt sources have seen increasing participation by pension funds, annuity vehicles and insurance companies. Some of that activity is due to Wall Street firms and other investors meeting investor demand as funds flow from retirement accounts, observed Joseph Iacono, CEO of Crescit Capital Strategies.

Private lenders are a little bit spoiled in terms of how much deal flow they’re seeing, and they can select only the best ones.

—Michael Lee, Partner, HKS Real Estate Advisors

“Wall Street banks and other firms are exploring ways to provide products to clients who in the past typically didn’t have access to what were considered alternative investments like private equity,” he reported. “Specific to real estate, debt is becoming more interesting as an investment class.”

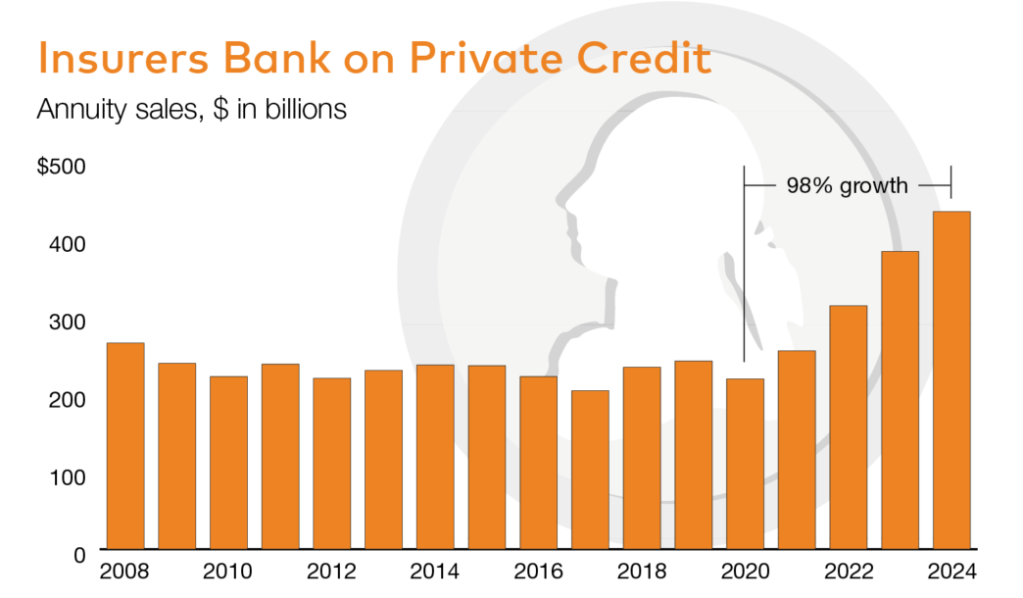

Life insurance companies a few years ago began to more doggedly pursue private debt strategies as one alternative to low-yielding investments when interest rates bottomed during the pandemic. That move was largely catalyzed by consumers snapping up annuities to protect their investments into retirement. Indeed, annuity sales nearly doubled to an estimated $435 billion in 2024 from 2020, according to LIMRA, an insurance trade association.

“We see allocations to real estate debt being made out of equity pools, but just as frequently or possibly more often, they’re made out of fixed-income pools,” pointed out Richard Kleinman, head of research and strategy & co-CIO for the Americas with LaSalle Investment Management. “It’s not that equity is bad, but investors recognize that debt is a complementary strategy.”

Bank leverage

More recently, banks have returned to the real estate lending market, although they are still conservative

due to troubled loans and the consequent rise in regulatory scrutiny. One way they have been participating, however, is by providing private lenders with lines of credit or financing for part of a deal.

That’s a win for both parties, according to Geoff Smith, a senior managing director at Walker & Dunlop Investment Partners, a subsidiary of the brokerage focused on making real estate equity investments and loans. Not only do the bank loans juice the returns of private debt funds but they also allow banks to more efficiently use their capital by taking less risk for bigger returns, added Smith.

As much as 80 percent of private debt funds are layering in additional leverage of some sort, suggested Michael Lee, a partner at HKS Real Estate Advisors, an investment sales and capital advisory firm. Over the 14 years he’s been in the business, the number of private lenders has grown from a half-dozen firms to around 150, he estimated, ranging from one-man shops providing $600,000 loans to big institutions that won’t consider a deal unless it requires at least $100 million in proceeds.

At the moment, the space is bursting with capital, Lee added, but competition between private lenders remains somewhat muted. With banks not yet fully reengaged in the market, the more sophisticated debt funds are being particularly selective about which transactions they’ll pursue.

“Private lenders are a little bit spoiled in terms of how much deal flow they’re seeing, and they can select only the best ones,” noted Lee. “We may bid a transaction to 40 or 50 different groups, but if it’s impaired or a little challenging in some regard, we’re typically coming up with only a handful of offers.”

To a certain degree, the environment is akin to that of 2009 when private lender Parkview Financial was launched, said Paul Rahimian, founder & CEO of the firm, which specializes in commercial and residential construction and bridge loans. While interest rates and the market cycle of the two periods differ, the pullback by banks today, just like back then, has provided Parkview and other lenders with new opportunities.

“The environment we’re in is very attractive for us as a private lender because it gives us a chance to deploy capital when banks aren’t,” he pointed out. “On the flip side, given the volatility in the markets, investors in equities who have done well are now thinking that it’s time to look at fixed-income alternatives, like a private debt fund that invests in real estate.”

You must be logged in to post a comment.