CRE Deal Volume Drops in Q4

Deal activity slowed in the last quarter of 2017, as investors waited to see if tax reform would pass in 2018. According to the most recent Ten-X Commercial report, they may also have been worried about whether the U.S. economic expansion, which is approaching the second longest expansion period in the nation’s history, would continue.

By Gail Kalinoski

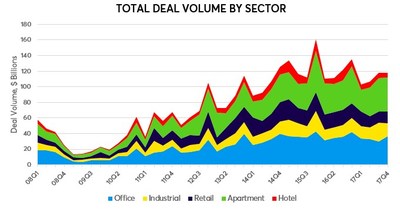

Commercial real estate transaction volume dropped slightly in the fourth quarter of 2017, down 0.5 percent from the third quarter, to $117.4 billion. The decline was sparked by a pricing gap between buyers and sellers over lingering uncertainty about the U.S. economy, according to Ten-X Commercial’s latest Commercial Real Estate Volume & Pricing Trends report.

The minor drop in the fourth quarter, which came after two quarters of growth, is attributable to a $6.7 billion drop in deal volume in the industrial sector. The report also noted that compared to the fourth quarter of 2016, the drop was 13.2 percent and the annual drop was 6.9 percent, to $445.2 billion.

While industrial volume was down in the fourth quarter, the report noted there were gains in the office and multifamily sectors, with deal volumes growing by $6.2 billion and $1.4 billion, respectively. The multifamily sector’s volume increased for the third consecutive quarter, reaching 37.1 percent—its highest level on record and more than 800 bps above its 10-year average, according to Ten-X Commercial.

Deal activity may have slowed in the last quarter of 2017 as investors waited to see if tax reform would pass in 2018. They may also have been worried about whether the economic expansion in the United States, which is approaching the second longest expansion period in U.S. history, would continue, according to Ten-X. Those concerns created a pricing gap between sellers and the buyers who were wary about buying assets at tight cap rates so late in the real estate cycle.

Deal activity may have slowed in the last quarter of 2017 as investors waited to see if tax reform would pass in 2018. They may also have been worried about whether the economic expansion in the United States, which is approaching the second longest expansion period in U.S. history, would continue, according to Ten-X. Those concerns created a pricing gap between sellers and the buyers who were wary about buying assets at tight cap rates so late in the real estate cycle.

“Uncertainty around tax reform-related policy undeniably weighed on deal volume late last year, but the legislation that eventually passed is expected to be beneficial to the real estate industry. The main question on everyone’s mind now is whether the delayed closings and optimism about the new tax regime will be enough to offset other headwinds and fuel deal volume growth in the first quarter of 2018 and beyond,” Peter Muoio, Ten-X chief economist, said in a prepared statement. “The run up in interest rates since the start of the year is a potential downdraft on deal closings as financing costs increase and cap rate expectations change.”

Muoio said those concerns may have shifted investors to more conservative strategies.

“The new wrinkle is whether the jump in interest rates suppresses deals in the first quarter,” he said.

The Ten-X report noted that cap rates increased minimally in all five sectors.

“Cap rates are currently holding below their 10-year averages in each property segment, ranging from hotel’s 10 bps gap to industrial’s gap of 100 bps,” the report stated. “Retail, apartment and office cap rates are all in the ballpark of 60-70 bps below their historical averages.”

CRE Property Valuations

Meanwhile, property valuations are only up 0.4 percent year-over-year as of February, according to the Ten-X All Property Nowcast, which gauges national pricing through a combination of proprietary and third-party data. That marked the weakest year-over-year gain for the index in its seven-year history. Month-to-month, it did edge up slightly in February by 0.1 percent, the first increase in 10 months. The report noted pricing increased in three of the five major property segments with only office and hotel declining. While the industrial pricing was up by 1 percent in February, concerns about tariffs and other trade barriers—which have been in the news this past week, with President Donald Trump proposing steel and aluminum tariffs—remain a risk for this segment.

In January, Ten-X Commercial reported U.S. CRE prices had dropped 0.3 percent in December from November, at that time the eighth consecutive month of contraction for its CRE Nowcast index. Prices in December were just 1 percent higher than the previous December, marking the weakest appreciation of the cycle to that point.

Images courtesy of Ten-X Commercial

You must be logged in to post a comment.