Coworking Offerings Multiply in San Diego

Cushman & Wakefield’s latest study for the San Diego market finds that there are 1.5 million square feet of coworking spaces across 107 locations and more facilities are underway.

San Diego’s coworking spaces have grown consistently over the past eight years and are expected to increase again this year, according to the latest report from Cushman & Wakefield on coworking and flexible workplaces. Existing companies like Regus are expanding their offerings and new companies like Industrious are planning their first locations in the metro.

“San Diego has more than 1.5 million square feet of coworking space across 107 locations as of June 2019, which marks a significant increase of 1.2 million square feet over the last eight years, having averaged 25 percent year-over-year growth during that time,” Jolanta Campion, Cushman & Wakefield’s director of research in San Diego, told Commercial Property Executive. “Continuing to gain in popularity, we fully anticipate for coworking inventory growth to continue ahead, with more openings on the horizon.”

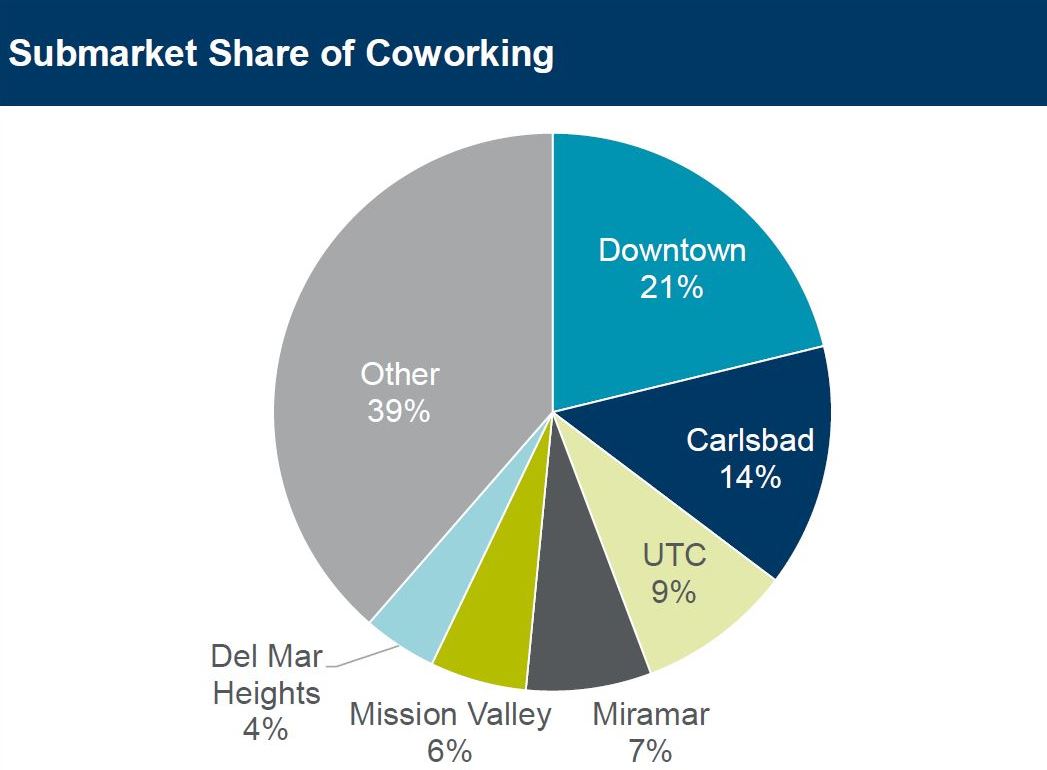

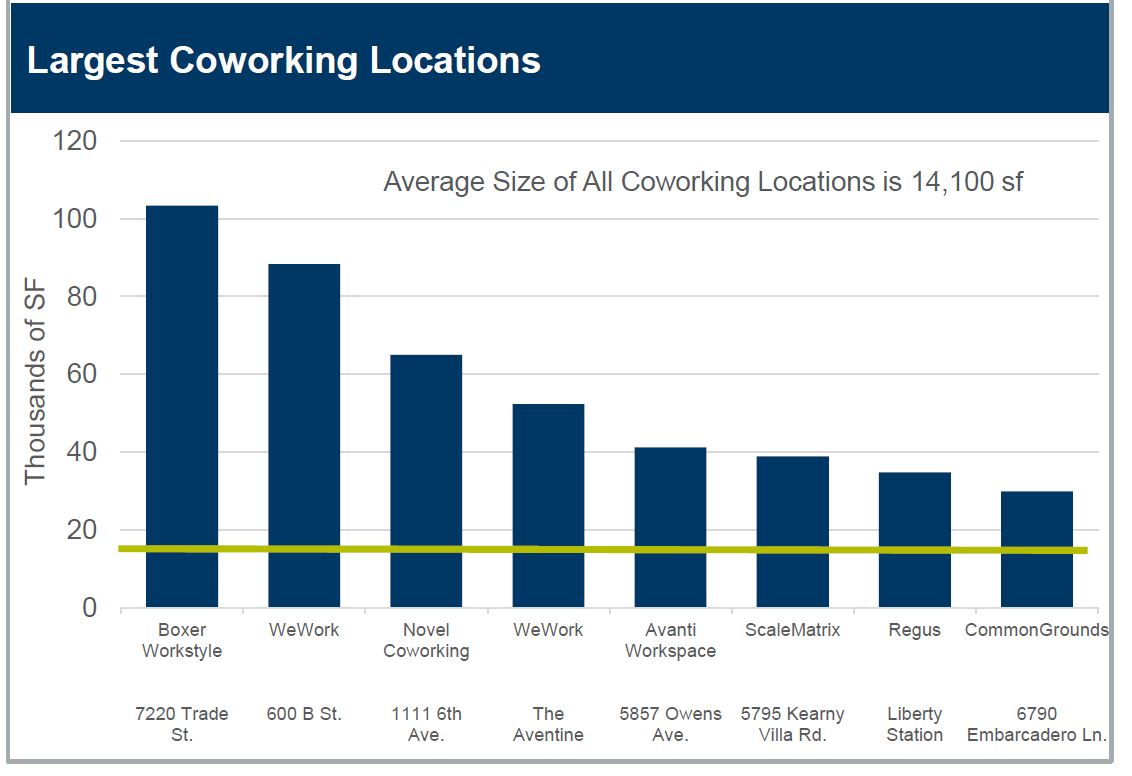

Downtown San Diego has the largest share of inventory—21 percent—followed by Carlsbad, Calif., with 14 percent. Moreover, Carlsbad has the second largest share and the highest number of locations—16—ranging from 3,500 square feet to 41,300 square feet. Regus has the most space in downtown—19 percent—with 288,300 square feet across 18 locations, followed by Premier Workspaces—10 percent, 152,100 square feet—across nine locations. WeWork has nine percent of the coworking inventory in the metro, which encompasses 140,600 square feet across two locations, including an 88,000-square-foot space at 600 B. St.

The downtown inventory is expected to grow this year as Regus opens Spaces locations at Makers Quarter and at Kettner & Ash. Furthermore, Industrious is planning its first location at 1 Columbia Place.

San Diego’s coworking spaces represent 1.9 percent of the 80 million square feet of total office inventory countywide, compared to 1.2 million square feet across 90 locations a year ago. And all this compared to a 1.1 percent average of coworking inventory nationwide and 2.5 percent average in gateway markets, according to Cushman & Wakefield.

Specialized coworking spaces

Coworking continues to gain popularity among tech startups and creatives such as marketing and web design companies, along with freelancers and independent contractors representing various employment sectors. The report notes physical and financial flexibility are becoming the new normal for the 21st century workforce and coworking supports those needs.

Specialized coworking locations focusing on major industries like life sciences, technology, film production, legal services, nonprofits, medical and supporting female entrepreneurs have taken root in San Diego. Some of the specialized locations include Film Hub for the film production and entertainment sector, Enrich and Bar Center at 401 for the legal services sector and BioLabs, Incubate Ventures, ScaleMatrix Launch Center, JLABS and LabFellows for the life sciences industry.

Hera Hub, a female-focused business center and accelerator with more than 400 members, was founded in the San Diego area. The company has locations in Sorrento Valley, Mission Valley and Carlsbad in the San Diego region as well as Phoenix and Atlanta and also Sweden. WeShare MD serves the medical community and Collective Impact Center focuses on nonprofits. The technology sector has brands like EvoNexus, Incubate Ventures, NEST CoWork and ScaleMatrix Launch Center.

“This trend is consistent across the markets as coworking providers are designing spaces that foster culture building, collaboration, networking by offering educational classes, meet ups and a motivating atmosphere tailored to bring the community together,” Campion added.

You must be logged in to post a comment.