Coronavirus Puts Detroit Office Market to the Test

Colliers Senior Vice President Patrich Jett provides a detailed analysis of the metro's recent evolution and discusses how the first month of lockdown impacted the market.

Patrich Jett, Senior Vice President at Colliers International. Image courtesy of Colliers International

Much like every other market in the country, Detroit, too, has entered an economic slowdown as a result of the coronavirus outbreak. After years of growth, which has put the Motor City on many investors’ watch list, the metro is under gloomy skies again. In mid-March, Ford, Fiat Chrysler and General Motors suspended vehicle production indefinitely, with statewide unemployment claims continuing to spike ever since.

When it comes to the impact the pandemic is expected to have on the office market, Colliers International Senior Vice President Patrich Jett estimates the slowdown will be temporary, with more growth to follow. However, he remains cautious, and links a realistic exit from the current economic downturn to the length of the shutdown, its effects and the date a vaccine for COVID-19 becomes available.

READ ALSO: How Coronavirus Is Impacting Office Leasing

Did Detroit’s steady growth in 2019 continue through the start of 2020?

Jett: The Detroit/Ann Arbor MSA continued to be very vibrant in the first quarter, with many new projects announced and strong market activity. One of the largest projects is Volkswagen’s plans to take over 250,000 square feet of office space at Galleria. The company is also building an adjacent 95,000-square-foot R&D technical center that would bring 1,800 new jobs to Southfield, which has long been considered the epicenter of Detroit’s suburban office market.

Dan Gilbert’s Bedrock Detroit is also continuing to push ahead with large projects, including the 190,000-square-foot Detroit Center for Innovation that will be operated by the University of Michigan. There’s also the Monroe Blocks project, an 847,000-square-foot development that will be the first office tower constructed in the city of Detroit in over a generation. We expect the MSA to continue to grow, as companies look to reduce real estate and labor costs and leverage Detroit’s engineering talent and educated workforce.

What trends will shape the market in the coming quarters?

Jett: COVID-19 will, of course, have the largest impact over the next three quarters, as we expect continued shutdowns and layoffs over the next 90 days in almost every industry. The automotive industry will have the most significance in Detroit as we could see a 20 percent reduction in the local workforce. Detroit is also one of 10 international airport hubs in the U.S. for Delta Air Lines, and has two border crossings with Canada. This is one of the reasons why Amazon has invested in over 5 million square feet of existing or planned projects in metro Detroit, and we expect that this will have a large impact on local retail and travel.

We will also continue to see the convergence of technology and the need for engineering talent, which has been making Detroit more relevant as a global player in the technology sector. Amazon has quadrupled its 57,000-square-foot Detroit-based tech hub—one of 18 in the U.S.—while Microsoft has expanded its Technology Center—one of 16 in the U.S.—and opened a new 80,000-square-foot office for LinkedIn, its first new market office in over 10 years. We expect to see more investments from tech giants over the next several years, as they continue to look for human capital and reduce real estate costs.

What are your expectations for the tech sector this year, and how it will impact the office market?

Jett: The state’s ecosystem of universities provides Michigan businesses with a strong pipeline of talent, and offers opportunities for current workers to further their skills in a world of fast-paced technological change. This is apparent by the advanced degrees offered in a range of high-tech innovation disciplines including mobility, artificial intelligence, data science, entrepreneurship, sustainability, cybersecurity, financial technology and more.

Ford Motor Co.’s new Corktown mobility innovation campus is a perfect example of how corporate companies are reinvesting in the metro and its wide array of amenities including the ability to develop, test and prototype this technology. Ford Mobility is now using the American Center for Mobility (ACM), a 500-acre test track at the historic Willow Run Bomber Plant originally built by Henry Ford, to test and validate its autonomous vehicles. ACM also has a 25-acre tech park that is located in an Opportunity Zone and is shovel-ready for R&D built-to-suit projects.

READ ALSO: Construction Costs Continue to Rise in 2020

Over the last several years, we have seen the convergence of Detroit and California/Silicon Valley-based tech giants who have realized that they need the experience and engineering talent of Detroit to be successful. We expect this trend to continue as we see more tech-based companies establishing and expanding in the metro. Another interesting trend in Detroit is the “arsenal of health,” just like the “arsenal of democracy” in World War II, where the automotive industry, including GM, FCA and Ford, is using its unparalleled manufacturing prowess to help America respond to the COVID-19 crisis by making ventilators and face masks under the Defense Production Act.

Automotive supplier Marelli recently signed a 200,000-square-foot lease in Southfield. Do you think this deal is indicative of increased activity in the suburbs this year?

Jett: Yes, it is. There are very few existing properties available over 100,000 square feet that are located in core submarkets, so companies have limited options to combine a large footprint into one facility. The alternative is to look at greenfield/built-to-suit options, which can take up to 24 months to deliver and are considered very expensive due to high construction cost, but sometimes are the best option when looking for a long-term solution. There are over a dozen large projects in the Detroit/Ann Arbor MSA actively looking for large sites over 100,000 square feet.

There is also very limited office product in the Detroit CBD, or Corktown, that is move-in ready or in desirable areas with amenities, regardless of the size. Tenants looking to be in the Detroit CBD, or Corktown, want to be located in the urban core to take advantage of walkability to amazing restaurants and bars, and access to talent.

What are the investment submarkets to watch this year in Detroit?

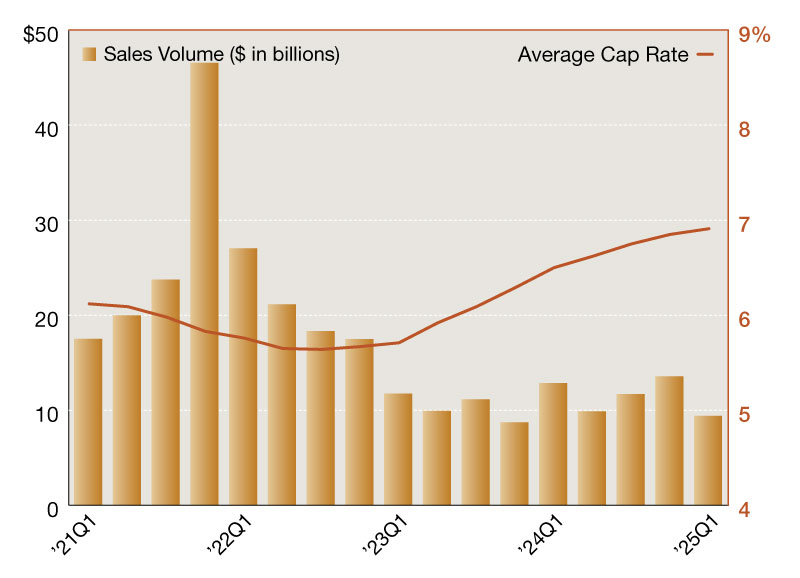

Jett: The metro does not have as many institutional investors as you might see in other institutional markets, but what we do have is much more attractive capitalization rates compared to the core institutional and coastal markets. Cap rates in the office market range from 6.5 percent to 8.5 percent, depending on credit and lease term, and there are deals available. The most active markets for single-tenant investments are Auburn Hills, the 275 Corridor—Novi/Farmington Hills—and Ann Arbor. Detroit is also very active as there is a lack of product and parking, but the entry level has become very expensive and is still speculative.

Do you think the Federal Reserve’s recent rate cuts will affect Detroit’s lending climate for office investment?

Jett: Lenders will be watching their capital to make sure clients are able to survive, but they will also be conservative regarding new investments into the metro. While we believe the lending climate will remain favorable, we do not expect commercial rates to drop much lower than what we have seen over the last several years.

How is the outbreak impacting Detroit’s commercial real estate sector?

Jett: It is hard to determine how COVID-19 will impact the market in the long term, but it is clear that people will be making big decisions and changing the format of how they’re currently running their business operations. We will continue to see people work from home, and technology that will change the way we interact, which, long term, could be negative for the office market sector as we see business adapt to this new model.

How will the $2 trillion stimulus package benefit Detroit’s office market?

Jett: Because its economy relies on the automotive industry, the MSA is among the markets that have been hit the hardest by COVID-19. The stimulus package will give the industry a lifeline to continue to operate, while reducing furloughs and permanent layoffs. It is too soon to understand the impact that this will have on the Detroit office market, but we expect it to reduce the severity of the pandemic’s impact in the region.

Do you think the metro is prone to another downturn similar to the Great Recession?

Jett: We do not expect a long-term recession like what we had in 2008, but rather a 90-day cliff that will take time to recover from, as the economy rebounds and then charges ahead. Very similar to the 1918-1919 Spanish Flu pandemic, we expect the next five years to have tremendous growth. However, this is dependent on the length of the COVID-19 shutdown, if a vaccine will be available before Labor Day and how badly the market gets hit. Brick-and-mortar retail could be devastated, followed by the office market. Revenue is made in Detroit when we are manufacturing, and consumers are spending.

Tell us your goals and strategy for the months ahead.

Jett: First and foremost, we want all of our clients and families to remain safe and healthy. Without them, we do not have a reason to have business goals and strategies. We are preparing to help our clients succeed through this very challenging time by offering additional services at no cost, to help them survive and thrive. We are not taking time off or slowing down, so we expect 2020-2021 to be record business years for the Book-Jett team.

You must be logged in to post a comment.