Construction Starts Continue to Slip in August

Tight lending is hitting institutional projects especially hard, according to the latest Dodge index.

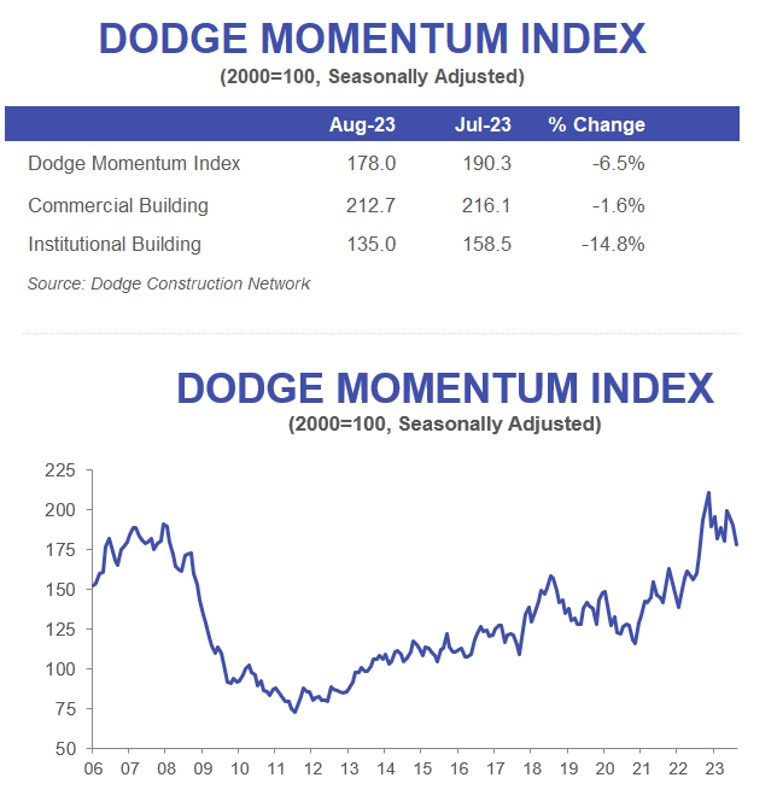

The momentum in the construction sector has continued to dip, according to Dodge Construction Network’s latest report. For August, the Dodge Momentum Index dropped by 6.5 percent to 178, down from July’s revised reading of 190.3.

According to the report, the commercial side of the Dodge Momentum Index dipped 1.6 percent, while the institutional sector saw a far steeper decline of 14.8 percent. The month saw a decline with the education, health-care and amusement sectors, leading to the major decline in the overall institutional sector’s momentum. The commercial side’s relatively smaller drop can be attributed to strong hotel planning making up for the weak activity in the office sector.

READ ALSO: How Cautious Lending Impacts Construction Financing

While May saw a strong spike of activity, planning in the institutional sector has continued to drop since then. However, the Dodge Momentum Index is still 4 percent higher year-over-year in August, with the commercial sector seeing a 3 percent year-over-year improvement while the institutional sector is up 7 percent year-over-year.

Sarah Martin, associate director of forecasting for Dodge Construction Network, said in prepared remarks that a full year of tightening lending standards and high interest rates have begun to affect institutional planning’s momentum, even though the sector is normally resistant to market headwinds.

More of the same for the rest of 2023

For August, Dodge reported that 22 projects valued at $100 million or more entered the planning stages. Despite the decline, the institutional sector saw the $420 million Westborough Life Sciences Park in Westborough, Mass., and the $168 million Freeman Health System Hospital in Pittsburg, Kan., enter planning. In the commercial sector, the fifth phase of the Northern Virginia Gateway Data Center in Fredericksburg, Va., and the Kroger’s Distribution Center in Las Vegas entered the planning stages.

For the remainder of the year, Martin said in prepared remarks that both commercial and institutional planning will likely remain constrained. However, next year is expected to bring a change of pace.

”Continued tight lending standards and elevated interest rates will keep the overall DMI flat to down over the remainder of 2023, but growth should accelerate next year,” Martin told Commercial Property Executive. “The expectation that the economy will be stronger past 2024 will give confidence to owners and developers and support steady planning activity next year, for both the commercial and institutional segments.”

You must be logged in to post a comment.