Office Report: CBD Demand Drops

Here’s why many of these markets are struggling compared to their counterparts, according to the latest CommercialEdge report.

Central business districts (CBDs) remain under pressure as high vacancy and falling listing rates persist, while recent federal policy shifts add new challenges to their recovery, the latest CommercialEdge report shows.

CBD office vacancy reached 19.2 percent in April, translating into a 730-basis-point increase since early 2020. While this is slightly lower than urban (20.1 percent) and suburban (19.8 percent) vacancies, listing rates in CBDs have taken the largest hit. As of April, average full-service equivalent asking rents in CBDs were $38 per square foot—down 29.8 percent from pre-pandemic levels. By contrast, urban rates declined 20.7 percent, while suburban rates rose 6.5 percent.

Federal priorities are also changing. A recent executive order signed by President Trump revoked longstanding policies that had favored CBDs for federal office locations, instead encouraging cost-effective site selection, including suburban options. This shift, along with broader trends, has led to a steep drop in CBD office development.

New deliveries fell 42 percent year-over-year to under 4 million square feet—just 8.2 percent of national inventory added in 2024. While steep property discounts have emerged, some well-located assets are still holding steady, proving resilience remains possible.

READ ALSO: Why Retail Belongs in Office Projects

By the end of April, the national office vacancy rate stood at 19.7 percent—down 20 basis points from the previous month but up 140 basis points year-over-year. The highest vacancy rates were recorded in San Francisco (29.0 percent), Austin (28.9 percent), Seattle (27 percent), the Bay Area (25.6 percent), Denver (24.7 percent), Detroit (24.4 percent) and Dallas (23.9 percent).

Nationwide, full-service equivalent listing rates averaged $33.34 per square foot in April, reflecting a slight eight-cent decline from March but a 5.4 percent increase year-over-year. CommercialEdge data shows Manhattan led all markets with an average rate of $68.34 per square foot, followed by San Francisco at $64.19 and Miami at $56.53.

In April, office-using employment grew by 31,000 jobs—the largest monthly gain since December and the third-highest increase over the past year. Despite the uptick, office-using sectors are up just 0.2 percent year-over-year. Professional and business services added 17,000 positions, financial activities gained 14,000 and the information sector saw no change.

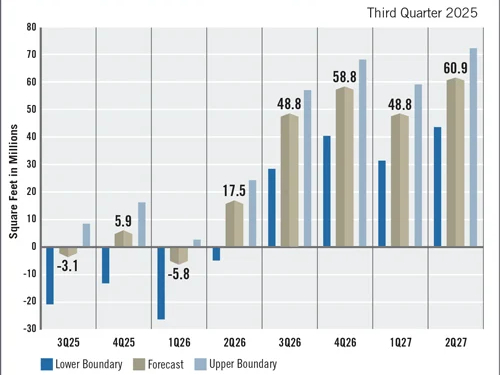

Office pipeline shrinks amid sluggish starts

According to CommercialEdge, the national office construction pipeline stood at 44.6 million square feet in April, accounting for 0.7 percent of total inventory. Between January and April, only 2.8 million square feet of new office projects broke ground. With the sector still in the early stages of a long-term transformation, development activity is expected to stay subdued for the foreseeable future.

Boston led the nation with 5.5 million square feet of office space under construction, amounting to 2.1 percent of its current stock. Both Austin and San Francisco reported 3.2 million square feet underway, equal to 3.4 percent and 2.0 percent of their inventories, respectively. Dallas followed closely with 3.1 million square feet, or 1.1 percent, while San Diego completed the top five with 2.1 million square feet—also 2.1 percent of its office inventory.

From January through April, office sales reached a total of $14.2 billion, with properties changing hands at an average of $191 per square foot. Investment was heavily concentrated in Manhattan, where sales exceeded $2.5 billion, trailed by Washington, D.C., with $1.3 billion and the Bay Area at $1 billion.

Read the full CommercialEdge office report.

You must be logged in to post a comment.