Commercial Mortgage Delinquency Rates Rise

Every major capital source saw an increase in the third quarter, according to MBA.

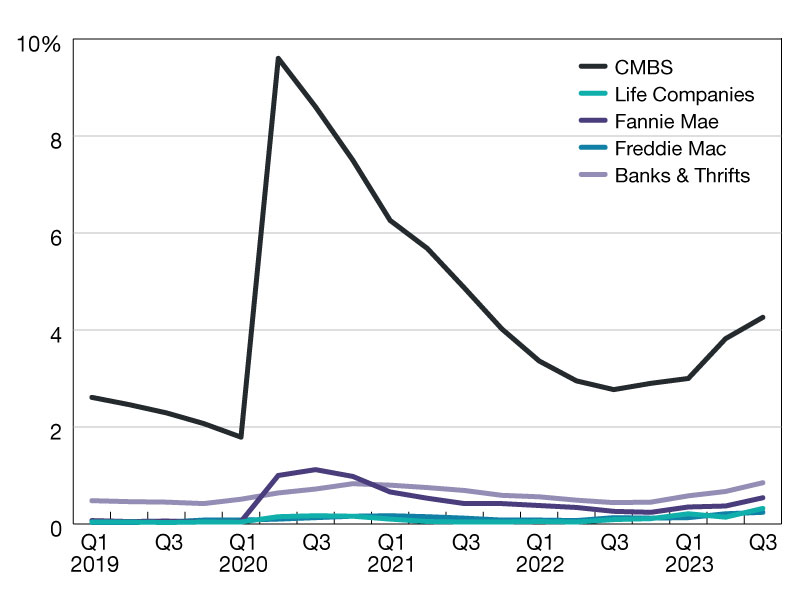

Commercial mortgage delinquencies increased in the third quarter of 2023, according to the Mortgage Bankers Association’s latest Commercial Delinquency Report, released earlier this month.

Not unexpectedly, delinquency rates on commercial mortgages increased for the third consecutive quarter. Every major capital source saw delinquency rates rise, driven by higher interest rates, changes in some property market fundamentals, and uncertainty about property values. CRE market activity remains muted, further complicating the situation.

CRE markets are large and heterogeneous. Data from MBA’s own survey released earlier in the quarter show wide differences in mortgage performance by property type. Deal vintage, term, market, and a host of other factors also play into which loans are facing pressure. These differences are likely to remain important in the year ahead.

Based on the unpaid principal balance (UPB) of loans, delinquency rates for each group at the end of the third quarter of 2023 were as follows:

- Banks and thrifts (90 or more days delinquent or in non-accrual): 0.85 percent, an increase of 0.18 percentage points from the second quarter of 2023;

- Life company portfolios (60 or more days delinquent): 0.32 percent, an increase of 0.18 percentage points from the second quarter of 2023;

- Fannie Mae (60 or more days delinquent): 0.54 percent, an increase of 0.17 percentage points from the second quarter of 2023;

- Freddie Mac (60 or more days delinquent): 0.24 percent, an increase of 0.03 percentage points from the second quarter of 2023; and

- CMBS (30 or more days delinquent or in REO): 4.26 percent, an increase of 0.44 percentage points from the second quarter of 2023.

You must be logged in to post a comment.