CMBS Worries: Delinquency Decline May Reverse

While the CMBS delinquency rate continues to improve, the industry is bracing for the impact of an upcoming wave of loan maturities over the next year.

By Paul Fiorilla and Chris Nebenzahl

Although the CMBS delinquency rate continues to steadily improve, the industry is bracing for the impact of the large number of loans originated at the height of the last bubble that will be maturing over the next year.

Roughly $126 billion of CMBS 1.0 loans are still outstanding, and just over $105 billion have a maturity date through 2017, according to Trepp, a New York-based research and analytics firm. These loans have to be refinanced at a time when lenders are adhering to stricter standards that include lower loan-to-value ratios, which will make it difficult for a number of those loans to be refinanced without some sort of recapitalization.

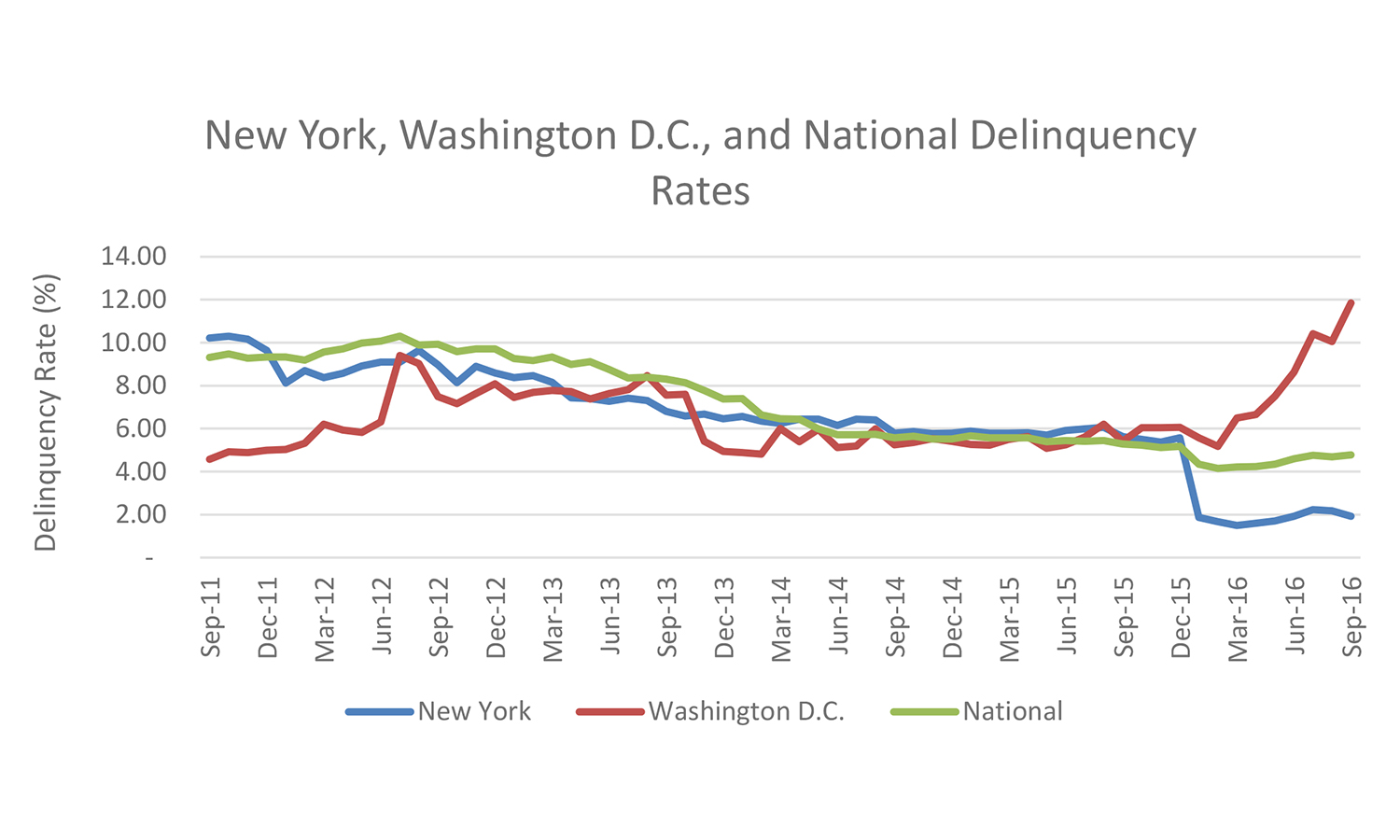

CMBS delinquency rates ballooned in 2010, in the wake of the financial crisis, as property values dipped and net income declined. CMBS delinquencies were less than 1 percent in 2007, but shot up to about 9 percent by 2009. They stayed near that level for several years before beginning a steady decline in 2013, as many loans were gradually worked out. They are now at 5 percent, according to Trepp.

Typically, a loan goes into default when the property’s income drops below the level needed to make debt service payments. The concern for the upcoming wave of CMBS 1.0 maturities, however, is not income but the total proceeds. Many of the loans were written when lenders were routinely originating debt packages of 80 to 90 percent of property value, but today’s lenders are reluctant to go above 60 to 65 percent. If owners are not willing to put in extra equity and can’t refinance, the result is a “maturity default.”

While the market is concerned about a rise in maturity defaults, the CMBS market is also being hit by the new risk retention regulations set to be enacted on Dec. 24. As part of the Dodd-Frank Act, going forward, CMBS lenders will be required to maintain 5 percent of securities in a given loan on their books. The intent is to limit the risk of CMBS deals by ensuring that the lender will hold the securities it creates.

Even though the regulations have not yet taken effect, the CMBS market is already feeling the impact. CMBS origination has slumped since the spring due to rising bond spreads, uncertainty about pricing, new capital requirements that reduced trading and liquidity, and concerns about risk retention, all of which made the market less competitive versus banks and portfolio lenders. Real estate professionals will be closely monitoring the changes to the CMBS market, as the industry has relied heavily on CMBS to fund investment in secondary and tertiary markets and riskier property types.

Trepp’s latest CMBS delinquency data shows mixed results from different metros, with a large increase in the Washington, D.C., metro. Over the past 12 months ending in September, the volume of defaults in the Washington metro increased by 71 percent, and the 11.9 percent delinquency rate is the highest in the country. The increase was largely the result of a reduction in space leased by the U.S. government’s General Services Administration, according to Trepp analyst Scott Barrie. A number of office properties in the Northern Virginia suburbs of Fairfax and Falls Church have recently gone into foreclosure, as well as a $155 million loan on the Portals I property, a mixed-use development in southwest Washington.

Other Mid-Atlantic markets have been hurt by recent CMBS delinquencies, as well. Baltimore, Philadelphia and Norfolk, Va., have all seen their delinquency rates rise over the past 12 months. These markets, combined with Washington, comprise the top three and four of the eight highest delinquency rates nationwide.

New York City, on the other hand, saw an improvement in its delinquency rate, mainly due to the resolution of the $3 billion Stuyvesant Town-Peter Cooper Village loan, which accounted for more than 50 percent of the metro’s delinquencies. While New York maintains the second-largest balance of delinquent CMBS because of its sheer market size, the delinquency rate has fallen to 1.9 percent, the fifth lowest in the nation.

Atlanta’s CMBS delinquency rate has also improved significantly over the past year, falling to 4.6 percent from a nationwide high of 11.2 percent in 2015. The total number of delinquent loans in Atlanta has fallen from 64 to 34 over the same period.

You must be logged in to post a comment.