Class B Office Properties Face Fewer Financing Options

Remote work and a tighter financing environment point toward conversion—but into what?

Shortly after the initial shock of COVID-19 and the lockdown subsided, it was apparent the virus boded well for apartments while signaling disaster for hotels and shopping centers. Offices were the wild card. And two years later, as hospitality and retail recalibrate amid the return of travelers and shoppers, offices remain a question.

As of late July, an average of 44.7 percent of office workers in 10 large cities were occupying buildings on a weekly basis, according to building management firm Kastle Systems, which monitors keycard swipes across the country. While that marked a slight improvement over the prior week, no substantial gains have emerged over the past few months.

That is disconcerting enough for owners of Class A office properties. But the environment is proving extra difficult for owners of Class B office assets that may want to upgrade their buildings to Class A standards and better compete for tenants.

Nuveen, a global investment manager, recently completed just such a conversion of its headquarters on Third Avenue near Grand Central Station in New York. Among other improvements made in the $120 million project, the 665,000-square-foot building now boasts energy-saving smart windows and lighting, a food hall, luxury gym, and a tenant-only lounge featuring Topgolf simulators.

Nuveen and its parent company, TIAA, occupy about half the building. Nuveen financed the project with cash, except for $28 million in C-PACE funding provided by Nuveen Green Capital (formerly Greenworks Lending). C-PACE funds pay for energy efficiency upgrades and are recorded as a tax assessment.

“We wanted to create a sense of place and a sense of pride given the fact that it is our headquarters, and we think the conversion will create some traction to lease some space that we have to fill,” said Nadir Settles, global head of impact investing and New York regional head of office for Nuveen Real Estate. “We have a lot of tailwinds with our location.”

Challenging Environment

Nuveen is likely an outlier, however. The current leasing, investment sales and financing climate is making similar Class B-to-Class A office conversions unfeasible, Settles and other observers say.

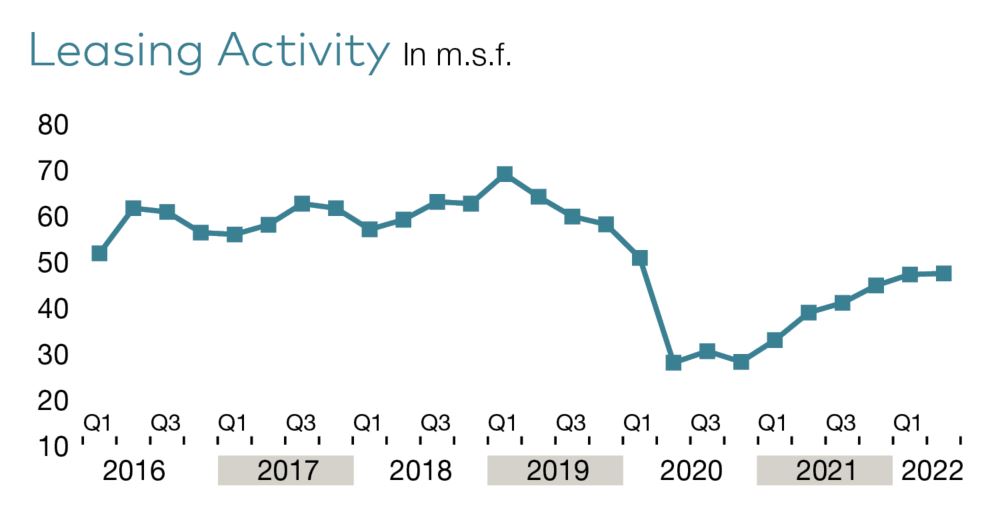

NAIOP, the Commercial Real Estate Development Association, forecast office absorption of 46.9 million square feet over the last three quarters of 2022. But it noted that Class A offices were driving the activity. Indeed, occupancy losses across Class B and C space contributed to the lion’s share of the 7.8 million square feet in negative office absorption in the second quarter, according to JLL.

“I have seen quite a few instances throughout my career of converting B office into an A office, but they were all pre-COVID,” said Kelly Layne, a senior managing director with JLL’s capital markets group who is based in Houston. “We aren’t necessarily in an environment where lenders are jumping up and down saying, ‘We want to make more office loans,’”

Additionally, because of higher interest rates and the prevalence of remote working, few Class B sales are taking place outside of desperation or distress. Opportunistic investors who would typically pursue such conversions don’t know what Class B buildings are truly worth and are waiting for a price reset, observers add.

“When you have a combination of challenging occupancies for commodity space and a deterioration of liquidity that is needed to support renovation business plans, it’s a double whammy that has put significant pressure on valuations for Class B offices,” said John Alascio, an executive managing director in Cushman & Wakefield’s equity, debt and structured finance practice in New York.

Heavy CapEx

Converting a Class B space into Class A is also complex and expensive. In addition to making power and technology upgrades and adding larger conference rooms, gyms, outdoor terraces and other necessities in order to compete, today’s germ-sensitive environment requires an overhaul of air handling systems as part of a broader biophilic design effort, said Charles Krawitz, chief capital markets officer and head of commercial lending at Chicago-based Alliant Credit Union.

“Even if you could convince yourself that you had the right basis in a property and could stomach all the cost overruns stemming from inflation,” he said, “I’m not sure you could do a true B-to-A conversion based on energy demands and the perceived amenities that are necessary to attract tenants.”

New Use

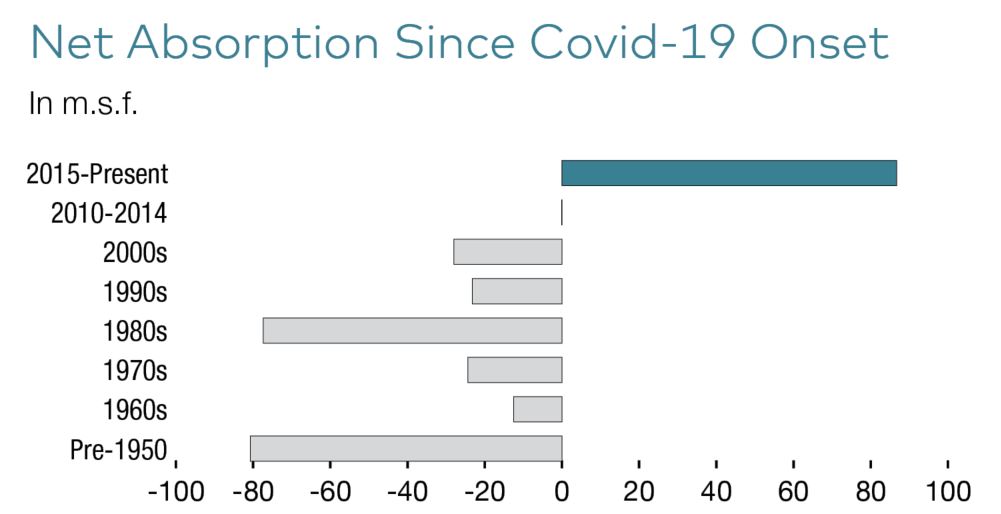

Alternatively, Class B buildings could make suitable candidates for life science, medical office or apartment building conversions. All are viable solutions to the oversupply of obsolete office space and have advantages over new construction, according to NAIOP, which issued a research paper on the topic in March.

Still, securing financing depends on the dynamics of individual markets and the building’s location. Core life science markets of Boston, San Diego and San Francisco have strong demand and a limited supply of buildings and vacant sites, NAIOP reported. It also identified Austin, Denver, Houston, Philadelphia and a handful of other markets as growth markets that could support life science conversions.

Demand for housing is creating apartment conversion opportunities on a broader scale, and since 2010, developers have turned 222 office buildings into multifamily, NAIOP said. But complexities that create challenges include the addition of kitchens and bathrooms as well as market limitations.

In Houston, for example, downtown office vacancy remains high as a consequence of the last oil bust about seven years ago, Layne reported. But the city’s lack of walkability and the region’s sweltering summers may work against attempts to convert buildings into apartments, he said.

Meanwhile, in New York City, building codes dictating where windows need to be placed, setbacks and other technicalities can make conversions difficult, said Jay Neveloff, a partner and chair of the real estate practice at the Kramer Levin law firm.

“All of the zoning rules go into an architectural analysis to determine whether a Class B building is suitable and marketable as residential,” he said. “That’s a major limiting factor to conversions.”

You must be logged in to post a comment.