Clarion Partners Lands $200M Refi for Mixed-Use Portfolio

HFF worked on behalf of the New York-based company to secure the loan for a nine-property retail, industrial and multifamily portfolio.

By Scott Baltic, Contributing Editor

New York—Clarion Partners of New York has completed $200 million in financing for a nine-property portfolio consisting of multifamily, industrial and retail properties across six states, it was announced late last week by HFF, which had arranged the financing.

HFF worked on behalf of the borrower, a commingled fund managed by Clarion Partners, to secure the fixed-rate loan through one of HFF’s correspondent lenders.

The loan is secured by three multifamily properties totaling 761 units in Plano and Dallas, Texas and Minneapolis; four industrial properties totaling 1,718,768 square feet in Hanover, Md.; Denver; Pompano Beach, Fla.; and Redlands, Calif.; and two retail properties totaling 275,859 square feet in Delray Beach and Celebration, Fla.

The HFF debt placement team representing the borrower was led by Senior Managing Director Riaz Cassum, Director Lauren O’Neil and Senior Real Estate Analyst Robyn King.

HFF was unable to provide additional information, and Clarion did not respond to Commercial Property Executive’s request for further information.

Clarion has been on a tear in just the past 60 days or so, investing in a diverse array of properties in multiple states:

In early October, Clarion acquired 245 First St., a two-building Class A office and life science complex in East Cambridge, Mass., for $311.3 million.

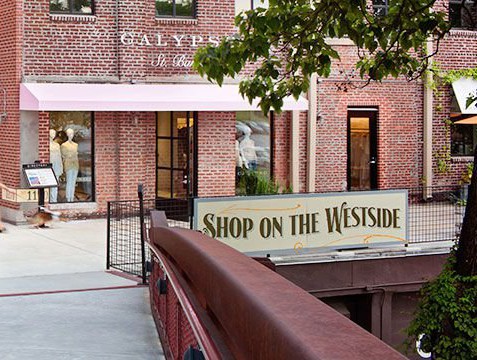

In late October, Clarion, in partnership with Atlanta-based investment and investment company Jamestown LP, bought for about $130 million Westside Provisions District, an “urban destination,” a retail-and-dining property and an adjacent luxury retail and residential project, on Atlanta’s Westside.

Barely 10 days ago, Clarion purchased from Capstone Partners and PCCP LLC, the PDX Logistics Center II in Portland, Ore. The brand-new, Class A, 355,200-square-foot property sold for $36.2 million and is fully leased.

And not even a week ago, Commercial Property Executive reported on Clarion’s purchase, from Loja Real Estate, of a portfolio of 11 grocery-anchored properties in five states. That purchase price was $218 million.

You must be logged in to post a comment.