Charlotte’s Boom

The metro's multifamily market is one of the best-performing in the country, with healthy demand, job increases and strong growth potential.

By Laura Calugar

Charlotte rent evolution, click to enlarge

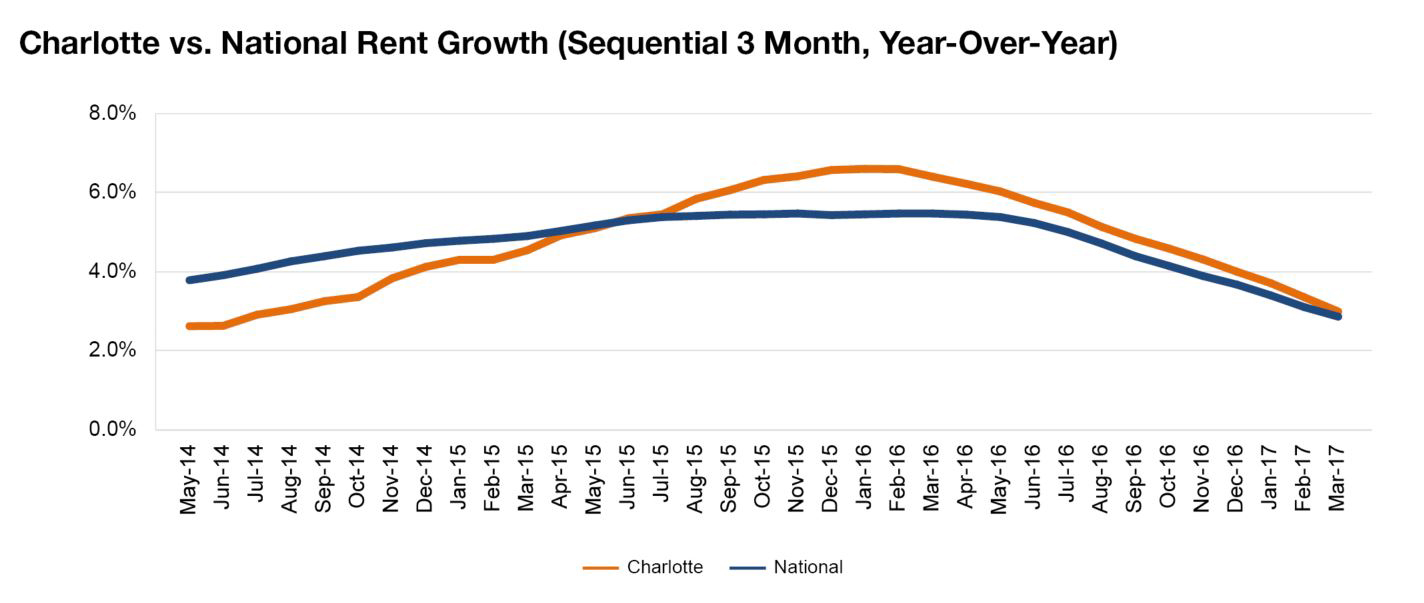

The Charlotte multifamily market is one of the best-performing in the country, with healthy demand, job increases and strong growth potential. Charlotte’s apartment boom has shown no signs of slowing down, though rent growth is decelerating due to an increasing supply and affordability issues.

The metro has established itself as a thriving financial, tech and logistics center for the entire Southeast, with nearly 19,000 new hires last year. Large-scale developments underway include the $600 million Hard Rock Hotel and Casino in King Mountain, the $520 million rail revamp between Charlotte and Raleigh, and the $2.5 billion airport expansion.

Growth in the multifamily market is enormous. Developers are focusing on live-work-play communities, especially in Uptown Charlotte. Though cranes are in full flight in the city’s urban core, development also stretches into the suburbs. High demand in the Renter-by-Necessity segment is pushing up rents. Due to the metro’s favorable demographics and potential for higher yields, investor appetite has not diluted and transaction activity reached $1.9 billion last year, a new cycle high. The significant amount of new units coming online and the 95.2 percent occupancy rate have not scared developers, as most of the upcoming deliveries are aimed at Lifestyle renters. We expect demand and supply to remain high, with rents growing by 3.8 percent in 2017.

Read the full Yardi Matrix report.

You must be logged in to post a comment.