Capital Shortfall: Is There Sufficient Senior Debt Financing?

Is there enough first-position debt capital to meet the needs of expiring commercial property loans in the next few years?

By Keat Foong

Is there enough first-position debt capital to meet the needs of expiring commercial property loans in the next few years?

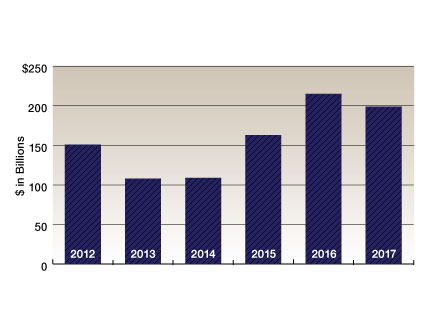

In the larger universe of non-bank lenders, Mortgage Bankers Association data shows mortgage expirations of $151 billion in 2012, dropping to $108 billion in 2013 and and $109 billion in 2014 before hitting $163 billion in 2015, $215 billion in 2016 and $199 billion in 2017.

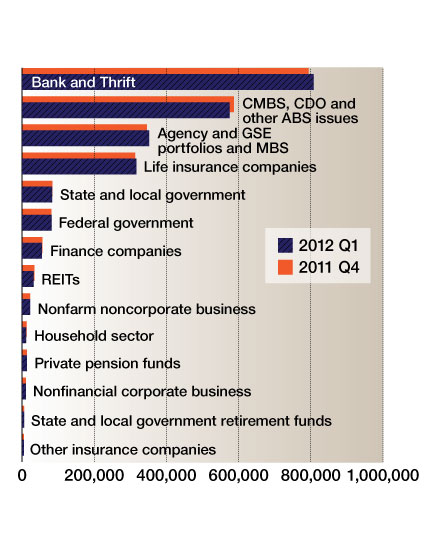

Regarding the supply of debt capital to refinance these loans, Jamie Woodwell, MBA vice president of commercial and multi-family research and economics, noted that lending sources increased their holdings by $8 billion to a total of $2.4 trillion in the first quarter, compared to the fourth quarter of 2011. That means there has been an overall net increase in lending in the market, whereby the amount of originations and refinancing exceed that of loans that are being paid off.

Woodwell noted that banks and thrifts increased their holdings by 1.7 percent; Fannie Mae, Freddie Mac and the FHA by 2 percent; and life companies by 1.2 percent during the quarter. However, the CMBS balance fell by 2 percent. In general, there is an appetite among lenders for commercial and multi-family real estate loans, Woodwell believes.

Is this overall increase in supply enough to meet the demand? The answer may be that when the huge load of expiring CMBS financing is added to the mix, senior debt financing may fall short of the demand over the next few years.

CMBS maturations alone will total $72 billion in 2012, dropping to $41 billion in 2013 and $52 billion in 2014 before rising back up to $100 billion in 2015, $140 billion in 2016 and $137 billion in 2017, according to MBA data. “2015, 2016 and 2017 will be where the real action is, because 2005 to 2007 was the time when people overpaid for assets,” noted Eric Silverman, managing director of Eastham Capital Inc.

Following initial euphoria in early 2011, the CMBS market today is hobbled, especially in light of the European sovereign debt crisis and the resulting instabilities in interest rates. Industry players are projecting this year’s CMBS issuance to be anywhere from about $40 billion to as much as $60 billion on the high end. “My feeling is that (CMBS originations) will be at the lower end of that range,” said Eduardo Padilla, CEO of NorthMarq Capital. “Clearly, the CMBS originations market is stronger than last year, but it is still not large enough to deal with its own maturation requirements.” The hope is that CMBS issuance will be as high as $100 billion by 2015—which may be sufficient to bail out the expiring loans, though not to meet new market demand.

With the exception of CMBS, however, most groups of capital may be able to at least meet their refinancing needs. Banks and thrifts, the largest holders of multi-family and commercial loans, at $808 billion currently, saw the largest drop in their commercial loan portfolios in the history of the banking industry and the largest increase in their Treasury investment, thus converting from one investment to another, according to Padilla. Nevertheless, this group of lenders generally will have the capacity to roll over or extend their loans and make more, he added.

Commercial and Multifamily Mortgage Debt Outstanding as of first quarter 2012. Source: Mortgage Bankers Association

Life companies would also likely be able to meet their refinancing needs head on, at least for now, according to Padilla, whose company also arranges financing on behalf of life insurance companies. Padilla said the volume of life company originations this year is likely to be similar to that of 2011, which was a strong year. Life company originations are likely to be above $50 billion, which is enough to refinance their maturing loans plus accommodate another $20 billion in new financings, he said.

If the commercial property debt and equity capital shortfall is a fact, then the practice of “kick the can down the road” loan extensions on performing loans—in hopes of higher values later on—practiced by CMBS special servicers and banks is likely to continue. In this regard, lenders will probably want to work out loans without defaults as long as the asset quality is pretty sound, conjectured Ryan Severino, senior economist at REIS Inc. “By and large, lenders are not looking to foreclose, as they do not want to be real estate owners,” he said.

The commercial properties that are likely to suffer most in an environment of capital shortage are the distressed or lower-quality collaterals in secondary or tertiary markets, as capital flows to the most attractive and easily financed transactions first. “Where there are likely to be issues are if the assets are so distressed that even those funds are not interested in them. That is where you will find delinquencies and defaults,” said Severino. Alternatively, if borrowers are unable to obtain loan extensions or find the equity or structured financing to bridge the senior debt, they may be forced to sell at a loss, depressing real estate prices—or providing more distressed sales opportunities.

This is a sidebar to “Capital Crisis?” which appears in the September 2012 issue of Commercial Property Executive.

You must be logged in to post a comment.