Buyer’s Market

By Allie Putterman In the map shown, the Nielsen Designated Market Areas in dark green have households that are 1.26 times more likely than the average to have a net worth of $1 million or more. On average, 9.6 percent of households in these areas have this high net worth. Together, all DMAs in dark…

By Allie Putterman

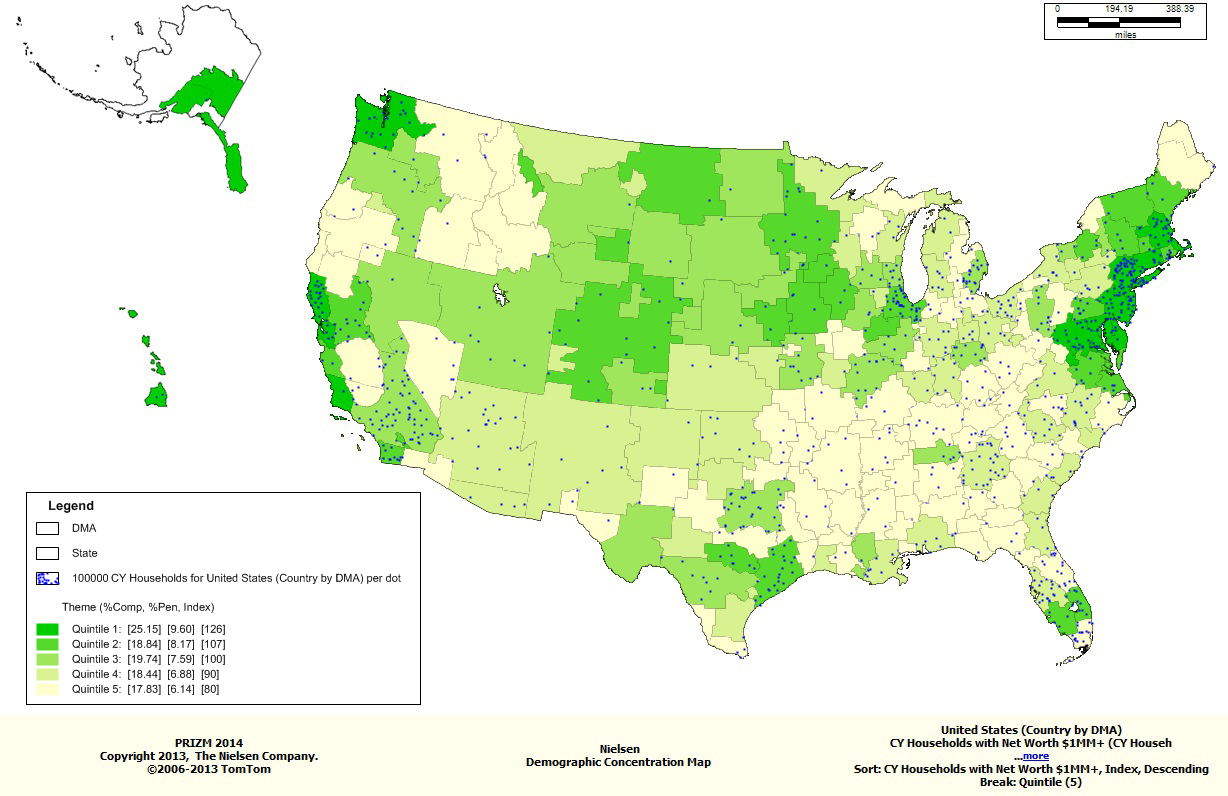

In the map shown, the Nielsen Designated Market Areas in dark green have households that are 1.26 times more likely than the average to have a net worth of $1 million or more. On average, 9.6 percent of households in these areas have this high net worth. Together, all DMAs in dark green comprise more than one-quarter of the high-net-worth households in the U.S. In contrast, areas in light green, or Quintile 5, are 20 percent less concentrated in these high-net-worth households and capture only 6 percent of them, nationwide, even though these same areas make up more than 17 percent of the U.S. population.

At the top of the heap, the Washington, D.C., DMA is 53 percent more concentrated in households with a net worth of $1 million or more. Looking more specifically at the households by type and location, one can further identify behaviors and attitudes of these wealthy households to help understand local consumers–important in securing the correct tenants to serve these elite consumers. Such D.C. consumers are more likely than average to engage in the following behaviors:

- Automotive: If deciding today, they would buy/lease a new Lexus, Mercedes or Toyota Prius.

- Restaurants: In the past month, they have dined at Bertucci’s and Au Bon Pain, while in the past six months, they have dined at Ruth’s Chris Steak House.

- Retailers: In the past three months, they have shopped at Lord & Taylor, Neiman Marcus and Crate & Barrel.

- Sports & Leisure: These consumers are more likely than average to go sailing, while in the past year, they have bought golf clubs and have attended art galleries/shows.

- Psychographics/Attitudes: These consumers trust radio the most, followed by magazines; they will keep their landline phone even if cell service improves, and they follow a regular exercise routine.

While a high net worth may contribute to shaping the behaviors and lifestyles of those in Washington, D.C., the value of net worth varies by region throughout the country. Lafayette, Ind., a city on the opposite end of the spectrum, is 23 percent less concentrated in households with a net worth greater than $1 million. The average net worth of those living in the Lafayette DMA, excluding those in dorms or group quarters, is $235,949–in contrast to Washington, D.C., at $432,423. Of course, assets go further in smaller markets like Lafayette, where, with a still considerable net worth of $150,000 to $249,000, they are more likely to engage in the following behaviors:

- Automotive: They bought/leased a new Chrysler and drive a recreational vehicle. If deciding today, they would buy/lease a new Honda CRV.

- Restaurants: In the past month, they have dined at Cracker Barrel, Bob Evan’s Farm and Ruby Tuesday.

- Retailers: In the past year, they have shopped at Sherwin Williams, while in the past six months they have bought a gift card/prepaid card from a discount store and in the past three months they have shopped at Talbots.

- Sports & Leisure: They are more likely than average to belong to a civic club, own a bowling ball and do outdoor gardening.

- Psychographics/Attitudes: These consumers trust magazines the most, followed by radio; their spouse has an impact on the brands they choose, and buying American products is important to them.

These consumer insights can be extremely valuable to anyone planning their tenant mix or choosing the right location for a retail store. When looking at real estate in Washington, D.C., it may be important to include a sporting goods store that sells golf clubs and club attire or include a tenant that offers frequent exercise classes. In Lafayette, Ind., it may be important to open Chrysler and Honda dealerships or big anchors like home improvement stores for gardening, paint and motoring supplies.

—Allie Putterman is an associate in Nielsen’s Segmentation Leadership Development Program, providing Segmentation & Local Market Solutions.

You must be logged in to post a comment.