Building Pressure: How Tariffs, Costs Are Impacting California’s CRE

While investors and developers are grappling with myriad issues, a new Allen Matkins survey finds there are bright spots for the state’s commercial real estate industry.

A new survey of California commercial real estate investors and developers finds accelerating momentum in some sectors despite concerns that have resulted in stalled projects and a more cautious outlook for the industry overall.

The summer 2025 edition of the Allen Matkins/UCLA Anderson Forecast Commercial Real Estate survey found more than a third of developers (36 percent) are delaying or canceling projects, citing increased construction costs and global trade tensions among their key concerns. About 50 percent of total respondents stated they were delaying or canceling projects.

The survey also showed 85 percent of respondents have a more cautious outlook on new developments in the state due to tariffs and supply chain disruptions. Additionally, 44 percent of developers expect distress levels in capital markets to increase over the next year.

Spencer Kallick, partner in the real estate department at the Allen Matkins law firm, said when the winter survey was done, the tariffs were not in effect or were being used as an abatement. Now that the tariffs are being imposed, the summer results are reflecting the uncertainty that CRE developers and investors are grappling with as they plan future investments.

“Folks are realizing that these tariffs, at least in the near term, are here to stay and they are trying to make investment-backed decisions based upon the current economic climate,” he told Commercial Property Executive.

The uncertainty is forcing developers and investors to rethink long-term development plans and shift to sectors with more resilience and opportunities. Kallick said there’s still confidence in sectors like industrial, particularly properties connected to e-commerce, residential and retail. However, the survey also found there are shifting market dynamics across the state’s diverse regions.

Kallick said many of the firm’s real estate development and investment clients are using this time of uncertainty to begin land-use entitlements, particularly for housing projects because of the demand for housing in California. This way they can be the first out of the gates when the capital markets come back and other economic issues are less volatile.

Respondents to the 2025 summer survey spanned 60 firms in Northern California and 80 firms in Southern California. Of those who responded, 46 percent identified themselves as value investors with most of the remaining respondents identifying as developers. The semiannual survey projects a three-year-ahead outlook for California’s commercial real estate industry and forecasts potential opportunities and challenges affecting the industrial, retail, office and multifamily sectors.

Positive sentiments in the industrial sector

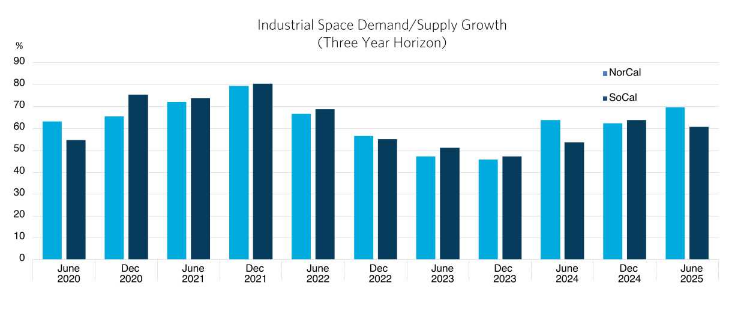

Kallick said the investment sentiment for the industrial sector remains strong in California and the sector is experiencing generally positive momentum. About 60 percent of the respondents in Northern California said they expect industrial demand to outpace supply.

“Vacancy rates are very low in industrial. For a long time, Amazon was the king and everyone wanted to have Amazon in their building. That’s changed. Now it’s not just Amazon. There are lots of other e-commerce businesses that need space. So, there’s absolutely room for more industrial space to be built in California,” he said.

READ ALSO: Industrial Report: Tariff, Construction Uncertainty Reshape Market Dynamics

Rental rates are expected to grow moderately in nearly all major California markets including San Francisco, East Bay, Los Angeles, Inland Empire, Orange County and Silicon Valley. Vacancy rates are projected to remain stable or decline, particularly in East Bay and Silicon Valley.

E-commerce appears to be the major catalyst for development over the next three years, with 41 percent citing it as their top growth driver in Northern California, ahead of demand for data centers, AI and digital infrastructure. However, the picture for new development over the coming year is less optimistic with only 19 percent of respondents expecting more than one new industrial development in the region. That’s a significant decline from 50 percent in the winter survey.

In Southern California, the sentiments were only slightly better, with 31 percent of the respondents expecting more than one project to break ground over the next year, down from 54 percent in the winter survey. Southern California also faces problems with land scarcity, regulatory challenges and buy-sell gaps, but the overall market remains strong, particularly with a focus on non-infill areas.

Mixed-use, luxury driving retail

The retail sector sentiment remains optimistic across most California markets. Vacancy rates are expected to remain steady while rental rate growth is projected across all regions. While Northern California respondents were more cautious, new development plans are moving forward across the state. Fewer developers reported having no new retail plans, suggesting confidence is returning to the sector. The survey also found 38 percent of respondents expect retail to enter a new growth cycle over the next three years, with most of the new retail development to be focused on residential-serving retail stores. Only 7.5 percent pointed to stand-alone big-box retail as a leading driver of growth.

“There’s definitely a flight to luxury and quality and having experiential retail where it’s integrated into a great mixed-use building or near an office building. That’s where we’re seeing most of the growth,” Kallick said.

Mixed office recovery

The office sector sentiment varies by region with the survey showing Northern California seeing more signs of recovery driven by the gradual return-to-office trends and renewed leasing activity in the tech industry. Sixty-one percent of respondents said they believe demand will outpace supply in Northern California and 17 percent of developers expressed interest in new office space versus 5 percent in the summer 2024 forecast. San Francisco and Silicon Valley are seeing improvements in vacancy rates and increased leasing momentum in prime, well-located properties.

The office market continues to be subdued in parts of Southern California, including Los Angeles, Sacramento and the Inland Empire. New development remains limited, even as 45 percent of respondents believe supply will exceed demand. However, 42 percent were optimistic demand will grow faster as return-to-office trends and the tech sector expansion regain momentum.

Asked if California was experiencing an increase in office-to-residential conversions, Kallick said they are seeing it in limited cases, but costly retrofits to meet earthquake requirements can make it prohibitive for conversions at this time.

“That’s going to require some regulatory changes to the California Building Code in order for us to really see that take off,” he said.

Kallick also noted prices for the C and D level office buildings would need to decrease even further to make conversions work financially.

Robust outlook for multifamily

The survey notes multifamily development has slowed but demand remains steady and there are declining vacancies because of the state’s housing crisis. In San Francisco, 86 percent of respondents expect vacancies to decline, up from 58 percent in the last survey. In San Diego, 60 percent of respondents and 53 percent in Los Angeles foresee further tightening in supply driven by several factors, including the tight housing inventory and the Los Angeles wildfires earlier this year.

“A lot of people were displaced as a result of the fires and that has tightened the residential market in Los Angeles even more. So, there is an even greater need for housing at all socioeconomic levels across Los Angeles,” Kallick said.

The office-to-residential trend may play a role with about 30 percent of the respondents expecting to redevelop or repurpose existing office space for multifamily housing.

Kallick expects changes to the California Environmental Quality Act that were signed into law by Gov. Gavin Newsom last month will help spur multifamily development. The reform bills are aimed at streamlining the CEQA process, particularly for infill and transit-oriented housing.

“The CEQA reforms are a very positive step in the right direction of making it easier to entitle and build housing in California. I can tell you that even though they just went into effect about a month ago, we are already utilizing them on multiple projects right now,” Kallick said.

You must be logged in to post a comment.