Brokerage Strategies for Older Properties

Well-located vintage assets have a vital role to play—if you have the right game plan.

Sometimes, age does matter. At least, some tenants think so.

When it comes to a broker’s job of getting an older property leased, everyone has a slightly different strategy. Commercial Property Executive asked these three brokers what their game plans entail.

Old dog, new tricks

When it comes to shopping centers, Richard Rizika, partner & co-founder of Beta Agency, thinks getting an older asset leased comes down to its adaptability to trends and tenant needs.

One way to make an older building feel more modern is making sure your processes are as cutting edge as possible. “Incorporating technology in management and marketing streamlines operations and appeals to modern businesses,” Rizika said.

Another way to make an older building more appealing is revitalization. Tenants continue to look for ways to demonstrate their brand identity through a building and its signage. And a building that has gone through some cosmetic or structural upgrades can appeal to this type of client.

Finally, an effective brokerage strategy for Rizika means promoting the building and the owner’s efforts to enliven the asset. “Effective marketing and branding strategies, including the use of social media and community events, help to position a center as a vibrant member of the community,” he told CPE.

Quality matters

In the Washington, D.C., office market, Class AA office buildings are extremely attractive to tenants. Their novelty, paired with elevated amenities, gives these spaces an edge that commands higher rents. Yet, Andrew J. Eichberg, managing director, Stream Realty Partners, noted that there are still tenants looking for value.

“We have found that, in order to attract those tenants to older buildings with amenities that aren’t on par with the newer competitive supply, owners must create great spaces for them,” Eichberg said.

Buildings that have been invested in by ownership, whether it be through the implementation of high-end spec suites or modern layouts and designs, have been able to compete with newer inventory. Therefore, brokers can seek value for their clients in finding these value-driven spaces in the marketplace.

“Differentiate your spaces with quality and the tenants will come,” he added.

Providing the right information

Retail tenants today have high demands for power, parking and HVAC. Matt Hammond, partner, Coreland Cos., told CPE that these needs add an additional layer to retail lease negotiations no matter the age of the property.

For brokers looking to get an older retail building leased, it is key to address these concerns upfront, Hammond noted. Prospective needs to know what is available in the property and the additional steps that the landlord is willing to take.

“It’s important to know if a landlord has the ability to deliver required upgrades and at what cost,” Hammond said. “This practical discussion allows both tenant and landlord quickly determine if there’s an opportunity to do a deal.”

A hierarchy of needs

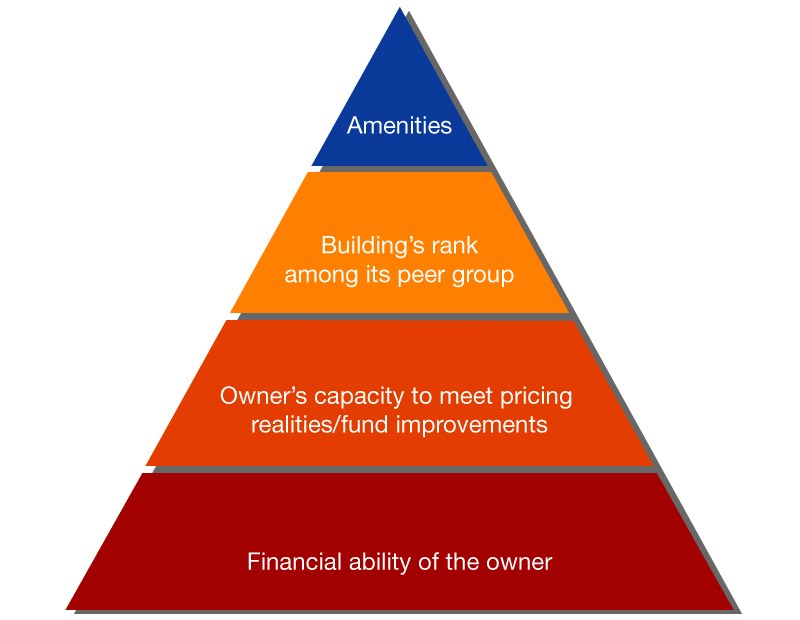

The most effective brokerage strategy when it comes to an older property is matching the right building to the right client. At least, that’s what Michael Cohen, managing principal, Williams Equities, believes. How does he do that? Through something that looks a lot like Maslow’s hierarchy of needs.

Instead of a pyramid that starts with physiological needs and ends in self-actualization, the pyramid Cohen follows is a hierarchy of issues and prerequisites that need to be addressed when a tenant is looking for an office building. The tiers are as follows:

Bottom tier: The financial ability of the owner. “The owner has to be able to show that they have the financial wherewithal to follow through on obligations,” Cohen said. If an owner is in peril of giving back the keys or getting put in default by a lender, no amount of amenity space, tenant improvements or a great location will matter.

Tier 1: The owner’s capacity to meet the pricing realities of today and fund improvements. Cohen says that the next most important thing is an owner’s ability to match lower rental rates in the market, afford to wait for the first rental payments and fund the necessary tenant improvements.

Tier 2: The building’s ranking among its peer group. “It is not uncommon for a tenant that needs 20,000 square feet to have 10, 15 or 20 options to tour,” Cohen noted. And when that is the case, it becomes very apparent which Class B buildings, for example, are at the higher or lower end of the spectrum. Set apart by things like light, air and a nice lobby, the building’s ranking when compared to others in its asset class matters.

Top tier: Amenities. If all of the other tiers have been met, the final consideration is an asset’s amenity space. And the most appealing, Cohen says, is a beautiful outdoor area.

“You have to understand the tenants needs,” Cohen said. And through this pyramid, a broker can match the right company to the right building through ensuring that the right factors are being prioritized.

You must be logged in to post a comment.