Brazilian Real Estate Return Highest Since 2019

The index comprised of 20.7 percent office, according to MSCI's Brazil Annual Property Index.

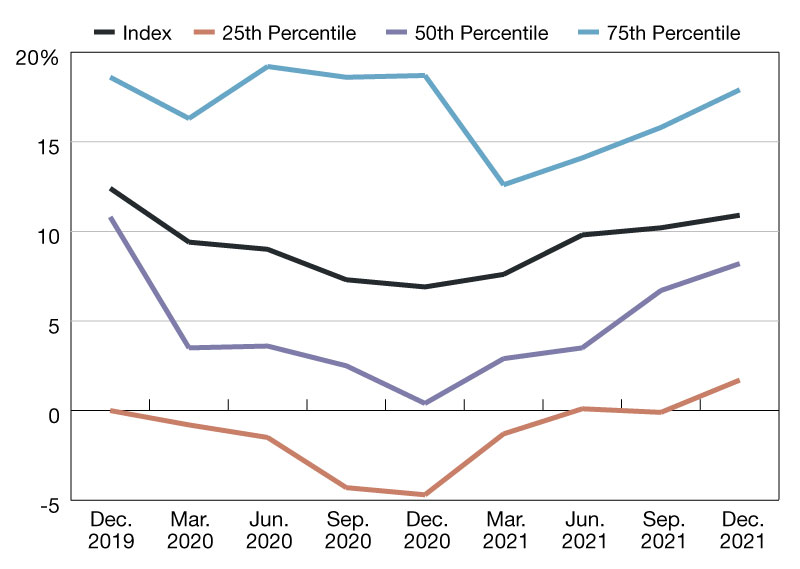

Rolling Annual Total Return

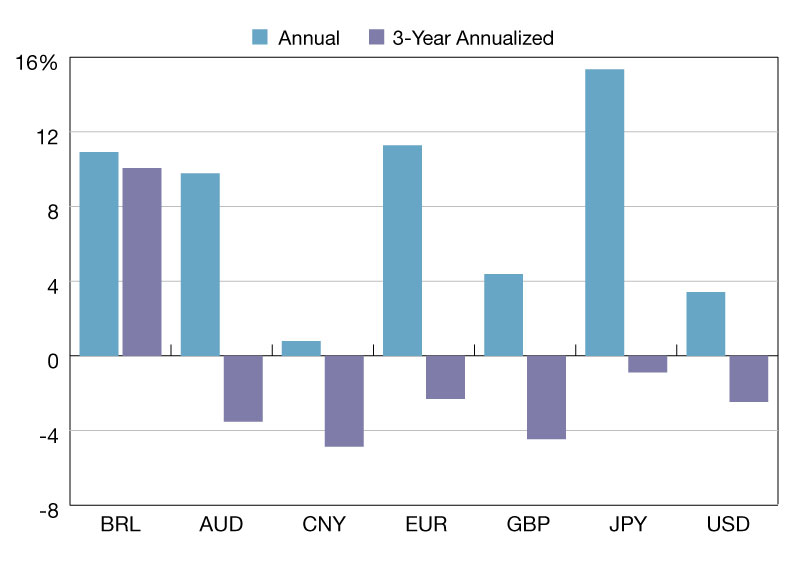

Total Return by Currency; Dec. 2021

The MSCI Brazil Annual Property Index recorded a return of 10.9 percent for 2021, its best result since the start of the COVID-19 pandemic and the highest since the 12.4 percent annual return recorded for the 12 month to the end of December 2019.

The index, published quarterly, tracked the performance of 95 property assets worth BRL 18.9 billion at Q4. At the end of 2021, the index comprised of 20.7 percent office and 39.0 percent industrial when weighted as a percentage of capital employed.

While performance in 2021 was improved throughout the distribution of asset-level returns it was especially an acceleration in the top quartile which underpinned the index return. At the 75th percentile, a total return of 17.9 percent was recorded (7 percent in excess of the index return)–compared to 1.7 percent at the 25th percentile. Since the index return is higher than the 50th percentile we can also deduce that the index return was driven by higher value assets.

Investor’s return on Brazilian investment property remained relatively stable through the pandemic as reflected by its three year annualised, local currency return of 10.1 percent. However, the Real’s depreciation against major currencies meant a less positive outcome for foreign investors.

For US-domiciled investors, a local currency return of 10.9 percent for 2021 meant a dollar-based return of 3.4 percent. Over a three year period, the currency impact was even larger with a 10.1 percent annualised local currency return translating into a negative US dollar return of -2.5 percent.

MSCI is a leading provider of critical decision support tools and services for the global investment community. With over 45 years of expertise in research, data and technology, we power better investment decisions by enabling clients to understand and analyze key drivers of risk and return and confidently build more effective portfolios. We create industry-leading research-enhanced solutions that clients use to gain insight into and improve transparency across the investment process.

You must be logged in to post a comment.