What’s in Store for Industrial Real Estate in 2025 and Beyond

Will there be a safe landing after years of barrel rolls?

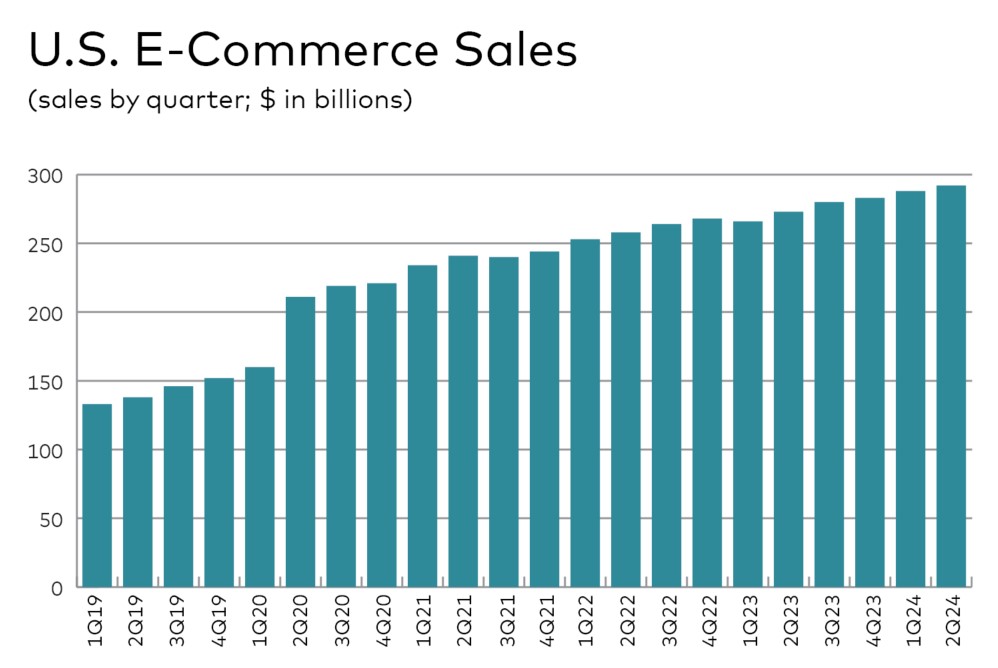

Industrial real estate is reaching a new crossroads. First came the helter-skelter, COVID-induced years of warehouse users gobbling up any space they could find to keep up with e-commerce, supply-chain issues and shifting consumer trends.

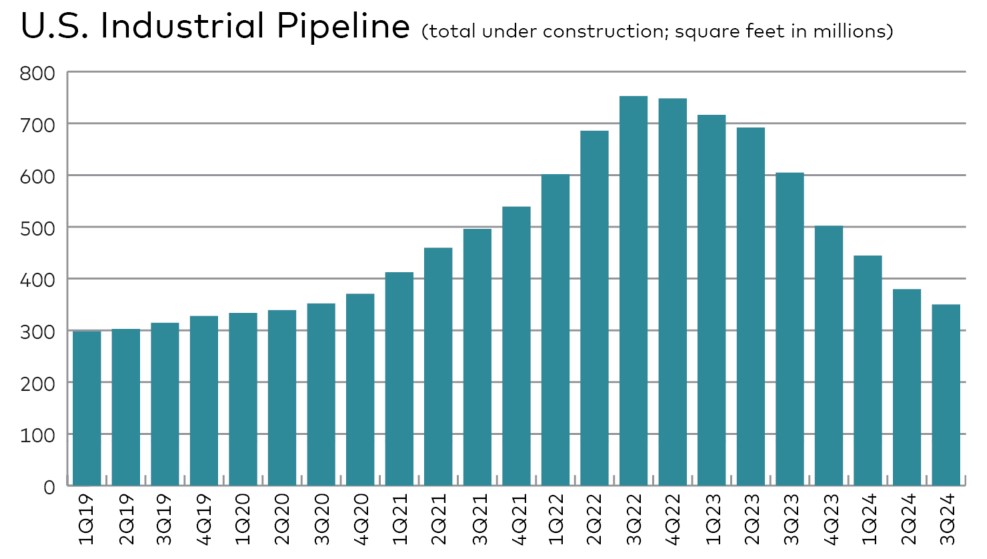

The torrent of leasing activity during COVID-19 drove double-digit rent growth, which in turn fueled a surge of speculative industrial development. Those assets eventually hit the market as consumers not only began venturing out to brick-and-mortar stores with more frequency but also bypassed goods for long-delayed massages, pedicures, trips to the gym and other services that got them out of the house.

As a result, industrial real estate fundamentals softened throughout much of the U.S. Average year-over-year rent growth dropped to roughly 3.6 percent in the second quarter of 2024 from more than 16 percent a year earlier, according to Cushman & Wakefield. The brokerage firm anticipates rent growth bottoming at around 2 percent in 2025 before ticking back up the next year.

“Unlike with other real estate categories, COVID-19 was generally positive for industrial,” observed Victor

Alia, development manager for Dedeaux Properties, a longtime Southern California developer owning some 13.5 million square feet in the region. “And because the market was so hot, every developer and their mother rushed in to build. Some might say a perfect storm was brewing.”

The good news is, at least so far, the storm has not caused severe devastation. The average industrial vacancy rate in 2024’s second quarter rose to 6.1 percent nationwide, an increase of just 210 basis points from a year earlier, according to Cushman & Wakefield, and still well below the double-digit vacancy rate that marked the Great Financial Crisis, noted Jason Hans, a senior managing director & industrial portfolio manager for Affinius Capital, a Texas CRE investment manager spun out of USAA Real Estate. The firm owns 75 million square feet of industrial throughout the U.S.

Because the market was so hot, every developer and their mother rushed in to build.

—Victor Alia, Development Manager, Dedeaux Properties

During the GFC, industrial REITs and other institutional landlords were focused on maintaining occupancy at virtually any cost, he said. Today, institutional owners of industrial real estate assets are maintaining their rental rates, although they may be providing concessions such as free rent or tenant improvement

dollars on new lease deals.

That’s an indication that industrial real estate investors and landlords are maintaining a favorable outlook. The occupancy rate in Affinius’ portfolio is about 98 percent, Hans reported, and the firm is still seeing decent rent bumps with renewing tenants.

Tenants rethink space

The impetus that drove rampant leasing a few years ago—online purchases—has moderated. To be sure, e-commerce sales as a share of all retail purchases continue to grow: After declining to 14.2 percent midway through 2022 from a peak of 16.4 percent in 2020 on a seasonally adjusted basis, online sales as a percentage of all retail sales have been steadily climbing. In the second quarter, e-commerce sales ticked up to 16 percent, according to the U.S. Census Bureau.

But given the more normalized growth of e-commerce, warehouse users today “are trying to figure out what they want to be when they grow up,” said Adam Petrillo, executive managing director in Newmark’s industrial advisory group.

“We’re going on three years of a post-pandemic period, and a lot of those third-party logistics provider contracts are starting to roll off,” he noted.

As part of the process, end-users are also giving more thought to their last-mile delivery locations as they assess their distribution networks, according to Ruben Ramirez, managing director with CBRE.

Despite some economic challenges, industrial real estate professionals remain confident that demand for logistics space will remain steady even as users become more deliberate in their location decisions. They also anticipate that nearshoring and onshoring efforts, along with incentives tied to the CHIPS and Science and Inflation Reduction acts, will create more demand for manufacturing space in secondary and tertiary markets in the Rust Belt and along the U.S. borders.

“I can probably count on one hand the number of true manufacturing deals I’ve done over my 20-year career,” said Tom Griggs, a managing director with Hines & leader of its industrial practice for the Northeast and Mid-Atlantic. “But we’re starting to see an uptick in demand for manufacturing as traditional distribution activity remains a little bit soft.”

SoCal Focus: Big Ports And Industrial Implications

Goods continue to flow into the U.S., especially on the West Coast. Nearly 5.7 million cargo containers moved in and out of the Port of Los Angeles through July of this year, for example, which was a 17.6 percent year-over-year increase. Similarly, some 5.2 million containers that moved through the Port of Long Beach through July represented a 20 percent year-over-year increase.

So far, port business growth hasn’t translated into more robust leasing activity, according to Scott Sowanick, managing director & partner at Stream Realty Partners, in charge of industrial development in the West.

“It’s not like the ports are performing phenomenally well and all a sudden all the excess space is getting absorbed,” he said. “But at the end of the day, if the ports are doing well, it’s a positive. And with demand trending in the right direction, I view that as a tailwind.”

That’s particularly true given that industrial construction starts have come to a standstill, thanks in large part to higher interest rates and construction costs as well as softening fundamentals. In the Los Angeles industrial market, which is about 4.5 percent vacant, some 25 million square feet are under construction, or about 1.4 percent of the 1.8 billion-square-foot market, Sowanick reported. Those metrics feel “pretty comfortable,” he added.

Plus, given that entitlements for new development are only becoming more difficult in California, the industrial market should strengthen over time.

“We’re still very bullish on high-quality, strategically located and port-oriented industrial real estate,” declared Victor Alia, development manager with Dedeaux Properties. “From what we’re seeing, Americans continue to want to order a lot of goods online.”

Gauging peak headwinds

How much demand reaccelerates—and how quickly—remains a question as users rethink their space needs and developers confront power challenges. Leasing tends to slow down in the weeks leading up to a presidential election, and this year has been no different.

The wars in Ukraine and the Middle East have already disrupted the transit of goods, and the ongoing threat of escalation could exacerbate the situation. Labor strikes by port workers and natural disasters are perpetual wild cards.

This time last year, interest rates were moving fairly wildly on a week-to-week basis and construction pricing was going up with no end in sight. But all that has dissipated.

—Tom Griggs, Managing Director, Hines

In discussing its second-quarter earnings, Home Depot executives echoed sentiments voiced by officers with McDonald’s, Starbucks and others that inflation was taking its toll on consumers.

“From a demand perspective, industrial real estate is not immune to the broader business cycle,” said Griggs. “But what is underrated is that during (the early phases of) COVID-19 there was a big shift from purchases of services to goods, and as those have rebalanced, it has led to a slowdown in demand.”

Indeed, the pace at which consumers elect to curb or change spending habits differs from the pace at which manufacturers and distributors of goods can make their decisions, noted Petrillo. “Certainly, the economic environment that we’ve sat in in the last 12 to 18 months, along with unknowns surrounding the consumer, has tempered leasing activity.”

Optimism prevails

Overall, industrial sector trends remain promising enough to spark continued speculative construction. But developers are quick to point out that the supply and demand dynamics for each submarket and location ultimately determine whether they move forward with a project.

Affinius is building or close to starting construction on some 7 million square feet of spec industrial real estate developments in places such as Savannah, Ga.; Chicago; Boston; and Ontario, Calif. Two years ago, that activity would have been closer to 20 million square feet, Hans said.

Lenders such as life insurance companies and debt funds continue to show interest in financing speculative industrial construction, and even some banks are willing to provide debt, though they may require recourse or a developer deposit before making a loan, Sowanick pointed out.

The bad news is that high interest rates continue to create a more challenging funding environment. A construction loan of 3 percent during the days of zero percent interest rates three years ago is now around 8 percent, he added. So the required return on cost for developers has climbed some 200 basis points, depending on the location, construction costs and other variables.

Plus, in some cases, capital providers would rather earn around 5 percent by investing in a Treasury bond or high-yield savings account with no risk, Alia noted.

We were really spoiled for a good period of time.

—Jason Hans, Senior Managing Director, Affinius Capital

Ultimately, for deals to make financial sense today, developers need to secure cheaper land, increased rents or lower construction costs—or some combination of those elements—to overcome the high cost of capital.

“We kept hearing that contractors would get more aggressive when their pipelines of work weren’t as robust, and it literally just happened,” Jans said. “So deals are beginning to pencil, whereas nine to 12 months ago we’d do the exact same exercise and the math didn’t work.”

Power Availability: Top Concern for the Whole Industry

Finding and delivering power to fuel robotics and automation systems in warehouses, as well as the electrified truck fleets that serve them, is one of industrial’s next big challenges.

Given the push to move away from fossil fuels, the issue promises to become ever more important. That’s especially true given rising demand for electricity from other users, especially data centers. And as artificial intelligence becomes more ubiquitous, power consumption is expected to accelerate even more. “What warehouse clear height was for the first 20 years of my career is what power will be for the next 20 years,” said Tom Griggs, a managing director at Hines.

Chasing efficiency

Some of those reasons are related to efficiency and cost savings that automation can provide. Industrial property tenants are having a tough time finding labor, and in some cases, affording it, according to Jason Hans, senior managing director at Affinius Capital.

Another power demand driver is electric trucks. While some carriers may see a market advantage to adopting electric vehicles, California, for example, is requiring truckers to transition to electric power as internal combustion engines in their fleets reach the end of their life.

Tenant requirements will also dictate power needs, and some may elect to minimize automation after doing a cost-benefit analysis, pointed out Ruben Ramirez, a managing director of CBRE. EV truck fleets may also choose to fuel up off site, he added.

Still, there remains the question of where the power is going to come from. That’s the part of the equation policymakers and the market have yet to fully resolve.

“We’re certainly seeing a push for EV adoption around other drayage-oriented port cities in Northern New Jersey, Savannah, South Florida, Houston and Chicago,” said Adam Petrillo, executive managing director in Newmark’s industrial advisory group. “But we have a significant issue, across the board in all markets, about the amount of power that’s available.”

Download the pdf “What’s in Store for Industrial Real Estate in 2025 and Beyond”

You must be logged in to post a comment.